Big speculators continued to cover short positions into the first week of October, as forecasts for very wet conditions threatened harvest, according to the latest data from the Commodity Futures Trading Commission on Friday.

Here’s what funds were up to through Tuesday, Oct. 2, when the CFTC collected data for its latest Commitment of Traders.

![]()

In tune with Ag

Big speculators trimmed 90,627 contracts off their bearish bet in Ag, buying cotton and meats in addition to most crops. Investors using index funds to gain exposure to commodities were also light buyers.

Short stuff

Big speculators liquidated 51,215 contracts of their net short position in corn, covering bearish bets for the second straight week. They’re still short 95,286 contracts according to the Commitments tally as of Tuesday.

Short shorts

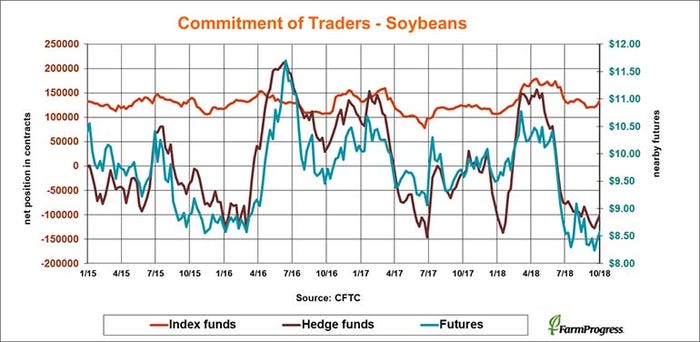

Big speculators bought back bearish bets in soybeans, but not enthusiastically. They liquidated 14,215 contracts but are still short 100,281.

Big oil

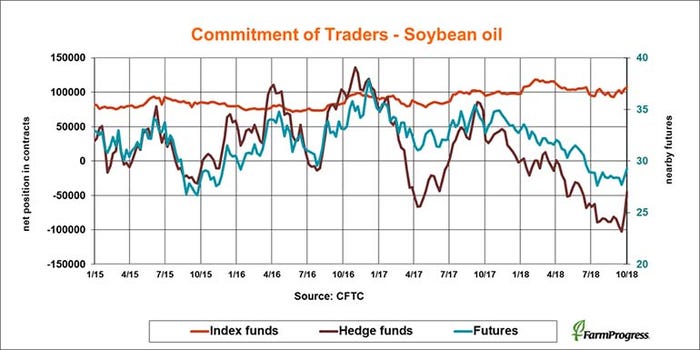

Big speculators aggressively trimmed bearish bets in soybean oil for the second straight week, buying back 33,118 contracts according to the CFTC report.

Light stuff

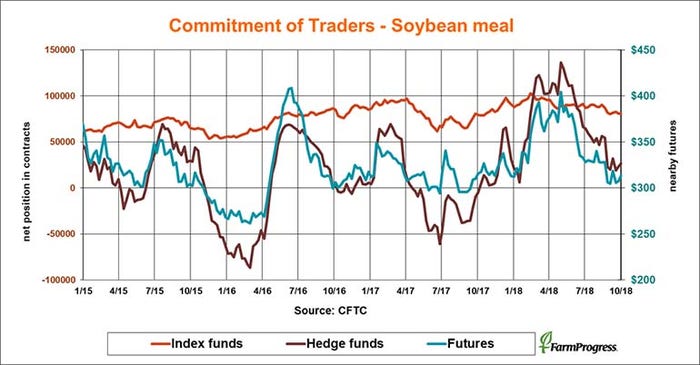

Big speculators remain long soybean meal, but not by a lot. They increased bullish bets in the product by 3,211 contracts to 26,785.

Seventh heaven

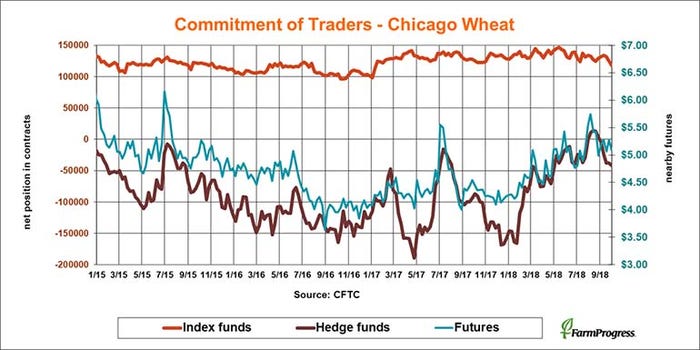

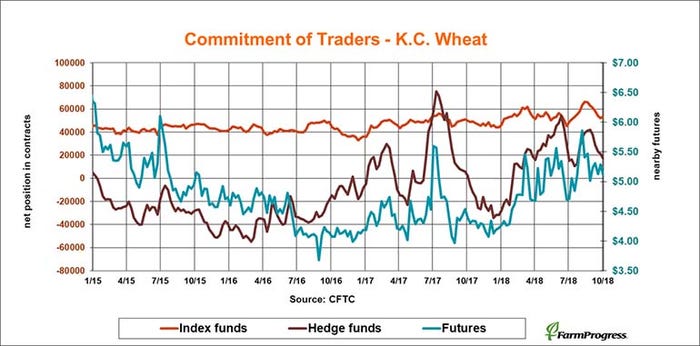

Big speculators sold soft red winter wheat for the seventh straight week, though only by a modest amount. They added 3,886 contracts to their modest net short position. Index traders sold even more, cutting 6,936 contracts off their net long position.

Going down

Big speculators sold hard red winter wheat for the fifth straight week but are still long 17,330 lots after cutting 3,762 contracts.

Little cubs

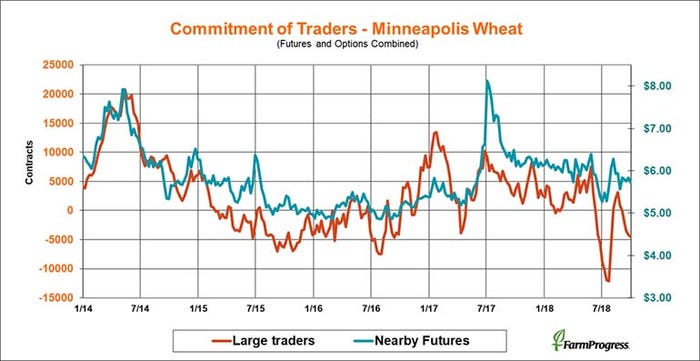

Large spring wheat traders were small sellers last week, adding 277 contracts to their net short position.

Selling the rally

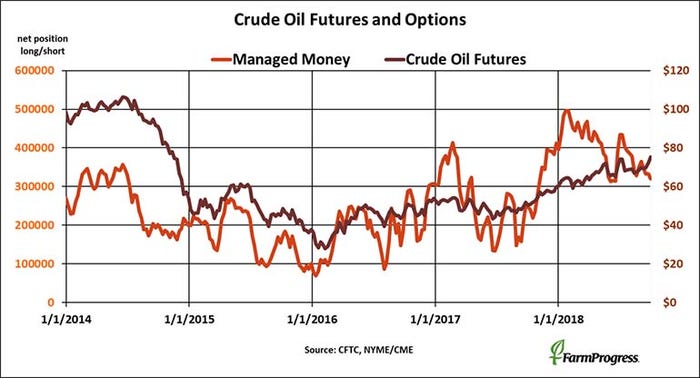

Money managers sold crude oil for the fourth straight week as prices rose to new near-four-year highs, cutting $938 million off their net long position.

About the Author(s)

You May Also Like