By Alfred Cang and Saket Sundria

Commodity investors are taking flight as fears deepen that the spread of coronavirus could curtail China’s demand of everything from crude oil to soybeans.

Prices are slumping as the death toll rises, prompting China to extend its Lunar New Year holiday to contain the infection whose spread is accelerating around the world. Fears over the economic impact sent most energy, base metals and grains futures down more than 1%, while pushing havens like gold higher.

The traders who keep commodities flowing in and out of the world’s biggest consumer would typically be expecting an up-tick in demand after a lull during the Lunar New Year holidays that officially started last week. But the rapid spread of coronavirus has upended the outlook.

“We should short everything,” said Jia Zheng, a portfolio manager at hedge fund Shanghai Minghong Investment Management Co. “With the spread of the epidemic, the domestic consumer market will shrink sharply, and construction will be delayed after the holiday.”

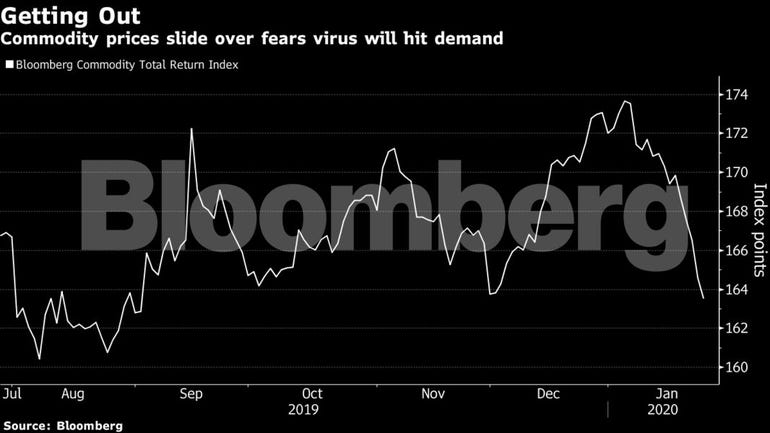

The Bloomberg Commodity Total Return Index slipped 1.5% on Monday, heading for the lowest close since August. Here’s how commodity markets are faring:

Energy

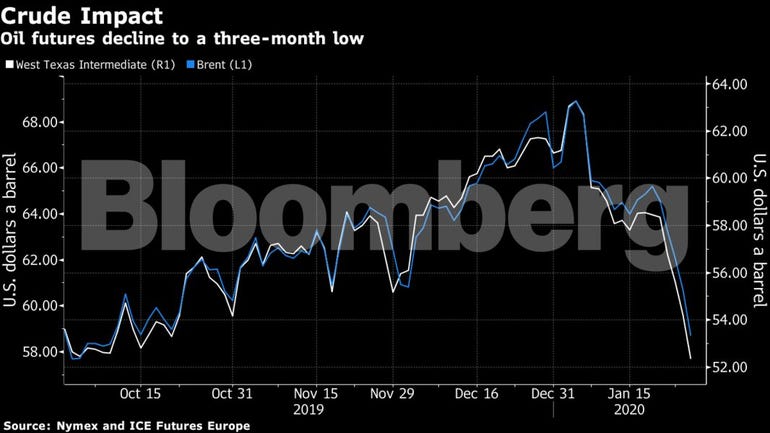

Oil slumped on speculation that curtailed travel and industrial activity will hit fuel demand. Brent crude slid 3% to $58.86 a barrel after capping its longest run of weekly losses since June. While Goldman Sachs Group Inc. predicted that global oil demand may take a hit, the sell-off has prompted OPEC behemoth Saudi Arabia to say it is seeing very little impact on consumption so far.

“For now it is primarily a matter of confidence getting hit but a prolonged outbreak, combined with a continued spreading, will alter the way people travel and commute,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “A supply glut of fuel in China would filter through to the rest of the world through exports, and on that basis the market is reacting in this defensive manner.”

Metals

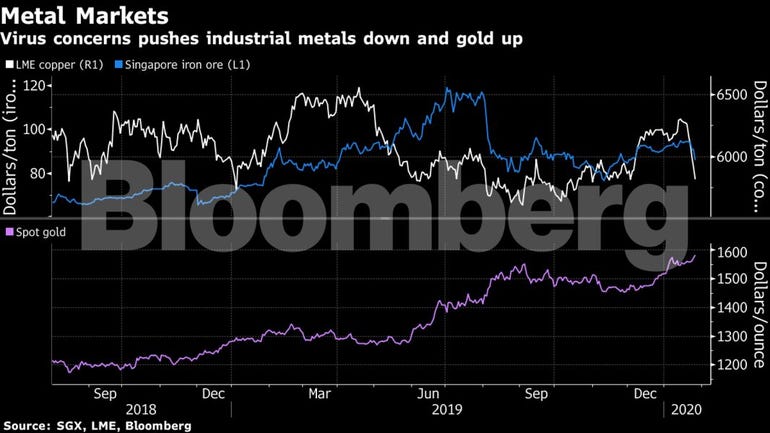

It’s no surprise that base metals and bulk commodities -- which are closely aligned to China’s industrial activity -- are getting hurt. Copper fell 3.1% in London, heading for its longest slump since 2014, while iron ore plunged more than 6% in Singapore. Still, the risk-off mood benefited havens, with gold heading for the highest close in more than six years.

“I always own gold, especially when risks are high and interest rates are low and I will up those allocations,” said Stephen Innes, chief market strategist at AxiCorp., adding that he doesn’t yet see an opportunity to buy into the dip in other commodities. “Until I get something that hits me in the face telling me to buy this stuff, I will not. The fear factor is manifesting.”

The timing of the virus could hardly be worse for copper bulls. Net-long wagers on the LME contract reached the highest in at least two years just before the outbreak, in part on bets that the recent U.S.-China trade deal would trigger a rebound in manufacturing and consumer spending.

“Demand concerns linked to the virus spreading continue to weigh on economic activity,” pushing base and ferrous metal prices lower, ING commodity strategists Warren Patterson and Wenyu Yao wrote in a note Monday. That could limit industrial activity in China in the first quarter, particularly amid an extended New Year holiday and if restrictions on movement remain in place, the analysts said.

Agriculture

Travel restrictions and a reluctance by China’s people to visit restaurants while the outbreak rages may hurt demand in a nation already ravaged by a hog virus that slashed pig herds and cut consumption of livestock feed. The coronavirus is also another blow to crop markets hoping for more Chinese purchases of U.S. farm products in the wake of the trade agreement.

Soybeans, corn and wheat dropped in Chicago with the oilseed touching the lowest in more than a month. Rubber slid in Tokyo, while sugar and coffee retreated in New York.

“Commodities are being hit across the board and grains are no exception,” said Michael McDougall, managing director at Paragon Global Markets in New York. “The virus problem in China is going to get worse. The timing after we finally signed on a truce couldn’t have been worse.”

--With assistance from Krystal Chia, Rakteem Katakey, Mark Burton and Justina Vasquez.

To contact the reporters on this story:

Alfred Cang in Singapore at [email protected];

Saket Sundria in Singapore at [email protected]

To contact the editors responsible for this story:

Will Kennedy at [email protected]

Nicholas Larkin, Dylan Griffiths

© 2020 Bloomberg L.P.

About the Author(s)

You May Also Like