May 10, 2021

The value of any product is ultimately decided by the amount that consumers are willing to pay. While attempting to sort through and understand factors that affect consumer purchasing behavior for a product is a daunting task, it is vitally important for any industry. The beef industry is no exception.

The past few quarters have been filled with twists and turns regarding severe supply disruptions, major swings in finances for many households, and ever-changing restrictions and regulations affecting how food purchases and consumption take place.

Expect to see a litany of research become available in the next few years that will seek to explain and quantify the effects of the COVID-19 pandemic on consumer behavior. Some of these studies will likely provide crucial insights on how the U.S. cattle and beef industry can continue to provide products that consumers want and are willing to pay for.

Dive into consumer data

One data source that likely will be used for such research is the consumer expenditure surveys from the U.S. Bureau of Labor Statistics. Not only is annual expenditure data available back to 1984 for various food categories and other household expenditures, but the data also can be sorted by income level, age, race and other demographic identifiers.

This makes it possible to understand what consumer characteristics are most closely related to higher levels of beef consumption, allowing for more targeted marketing efforts.

In recent years, expenditures for selected states have been added as well. This not only allows differences in consumer expenditures to be analyzed by geography, but in time it will also provide a valuable resource in studying how different state and local policies regarding pandemic-related restrictions affected consumer purchasing behavior.

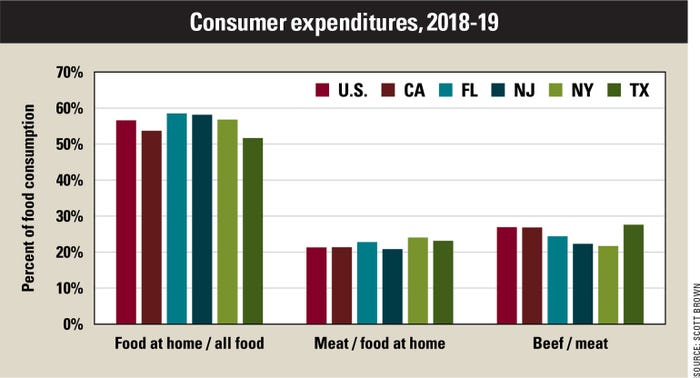

For now, the most recent available data covers the two-year period of 2018-19 and includes the states of California, Florida, New Jersey, New York and Texas.

Food consumption stats

Comparing the national data to the state-level surveys yields some interesting insights.

While all areas show larger expenditures for food at home than food consumed away from home, Florida, New Jersey and New York consumers had a higher percentage of expenditures for food at home than the national average, while Texas was well below the national average.

Although not displayed on the graphic, there is a wide disparity in the percentage of food consumed away from home by income level, with the highest 20% in terms of income spending 49% of food dollars for food away from home, compared to only 35% for households in the lowest 20th percentile of income.

Among food-at-home expenditures, New York showed the largest portion spent on meat, followed by Texas and Florida. New Jersey spent a smaller portion of at-home food expenditures on meat than the national average. Texas directed the largest share of total meat at home spending to beef, followed by California, Florida, New Jersey and New York.

It is vital for an industry to understand its consumers as thoroughly as possible, and with the increased uncertainty of how behavior changed as a result of the pandemic, the stakes are even higher. Much research is likely forthcoming regarding potential changes in consumer demand that the industry will need to adapt to. Stay tuned.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like