May 4, 2022

Cow-calf producers have not faced this confluence of competing factors in the past 40 years. Some factors indicate that producers should continue herd liquidation, while other factors indicate there should be greater retention.

What we do know from USDA’s National Agricultural Statistics Service January cattle inventory report is that beef cows are down 2%, heifers held back for beef cow replacements are down 3%, and heifers expected to calve this year are down 3% year over year.

All of this indicates smaller feeder cattle supplies in 2022 and 2023. That is what we know. What we don’t know is what decisions should be made to further liquidate the cow herd or begin rebuilding efforts given current and expected market conditions.

Here are three factors indicating that herd liquidation should continue:

1. Ongoing drought. The drought in parts of Nebraska, and more broadly throughout the U.S. over the past several years, has reduced total hay inventory. 2022 could be the third year of the most recent drought. If the drought materializes, it could further limit both forage production and quality.

2. High feed costs. Prospective corn plantings are down with more grain producers choosing to plant soybeans. This indicates that, barring a large South American crop, producers should expect higher corn prices. Likewise, higher corn tends to correlate with higher distillers grain prices — both of which increase ration costs and reduce a feedlot's willingness to buy feeder cattle.

3. High cull cow prices. Cull cow prices have begun to rise dramatically in 2022 because of seemingly insatiable consumer demand for ground beef and lower beef imports from Australia and Brazil. Low prices over the past several years have incentivized some producers to turn their herd over now when there are profits to be made.

Here are three factors indicating herd rebuilding should begin:

1. Strong export demand. Demand is strong in the export market. In 2021, the U.S. set a record for beef exports. Demand has remained strong in the first part of 2022, and beef has seen more than a 50% increase in export demand since 2010.

2. Strong consumer demand. Even with higher levels of inflation, particularly in the red meat market, consumers have shown that they are willing to buy beef at elevated prices. This has led to retail and food service beef demand at levels not seen since the 1980s.

3. Higher fed and feeder cattle futures prices. Both the fed and feeder CME price indicate strong demand in the current and deferred months. Using futures plus historical basis as a forecast for fall delivery of feeder cattle, indications are that current prices would be some of the highest producers have received in the past five to seven years.

Why is this year so unique?

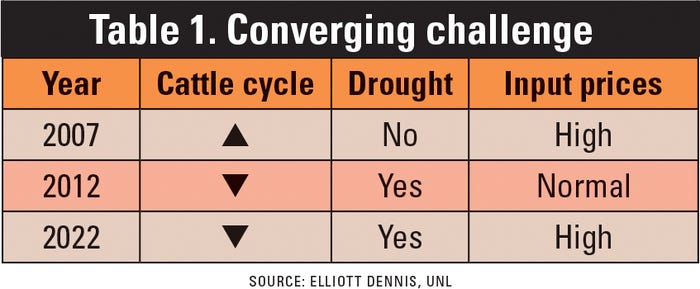

This year is unique because the cattle market has not simultaneously faced higher input prices and drought conditions while in a downturn of the cattle cycle.

In 2004, the cattle market began to expand before being limited by higher feed prices in 2007-08. The cattle market was still contracting when the drought occurred in 2010-12. Now in 2022, the market is contracting, experiencing a drought and facing high input prices. (See Table 1.)

We have a situation where there is a drought, high input prices, and the cattle market is in a downturn. Agricultural economists have examined how two common drought mitigation strategies (partial herd liquidation or buying additional feed) affect an operation's net present value given the cattle cycle and the length of the drought. Ideally, we want high returns with little variation.

What they found was that partial liquidation of livestock tended to provide better returns than buying feed to overcome constrained forage supplies. Moreover, partial liquidation tended to be less risky and created potentially less financial stress than buying feed. High feed input prices would further increase the value of partial liquidation.

These results were estimated using historical weather and price data. In other words, while this is what the results show, on average, using historical data, each producer must engage in some level of forecasting on market conditions and what they believe is best for their operation.

Other considerations

Regardless of the choice you make (i.e. retain cows and buy hay, or partially liquidate cows and no hay) there are three points to consider:

1. Recognize payoffs will be made over an entire cattle cycle. Decisions on buying additional feed or liquidating part of the herd are paid out over an entire cycle because of the biological lag in production. For example, the effect of a breeding decision is not known for about three years. The tendency with finances is to evaluate whether a decision gained or lost our operation money over one year.

2. Communicate the plan to your lender. Regardless of the decision made, clearly communicating this plan to your lender is important. This helps set expectations for you and the lender about the need for and possibility of extending additional financing. It's better to have a clear understanding of these expectations before making a management decision.

3. Don’t forget about price risk management. Price risk management continues to be a tool to help manage the variation and level of profits. The market has a significant amount of price volatility. Some of this has come because of the integration of the U.S. beef market into the global beef supply chain increasing the total value of the beef carcass. However, as COVID-19 has demonstrated, it can have unpredictable, damaging effects. In most years, there are opportunities to offset some of the total cash price risk. But this requires effort and time dedicated to watching markets, having a plan and then being willing to act.

Dennis is a livestock marketing economist at the University of Nebraska-Lincoln.

You May Also Like