Dairy product sales should grow in 2024, led by natural cheese, butter and yogurt, says Corey Geiger, lead dairy economist for CoBank. However, that growth will be at a slightly slower pace than in 2023.

“U.S. consumers will be pressured by reduced household savings, growing credit card debt, the return to making monthly student loan payments and higher interest rates,” Geiger says. While growth in dairy sales could be lukewarm, the dairy aisle remains the largest sales category in U.S. grocery stores at over $78 billion in annual sales, based on Circana sales data.

Per-capita consumption of all dairy products in the U.S. reached 653 pounds per person in 2022.

“That’s 114 pounds, or 21%, above the historical average dating back to 1975,” Geiger notes. According to USDA data, overall dairy consumption in 2022 was the second-highest total on record.

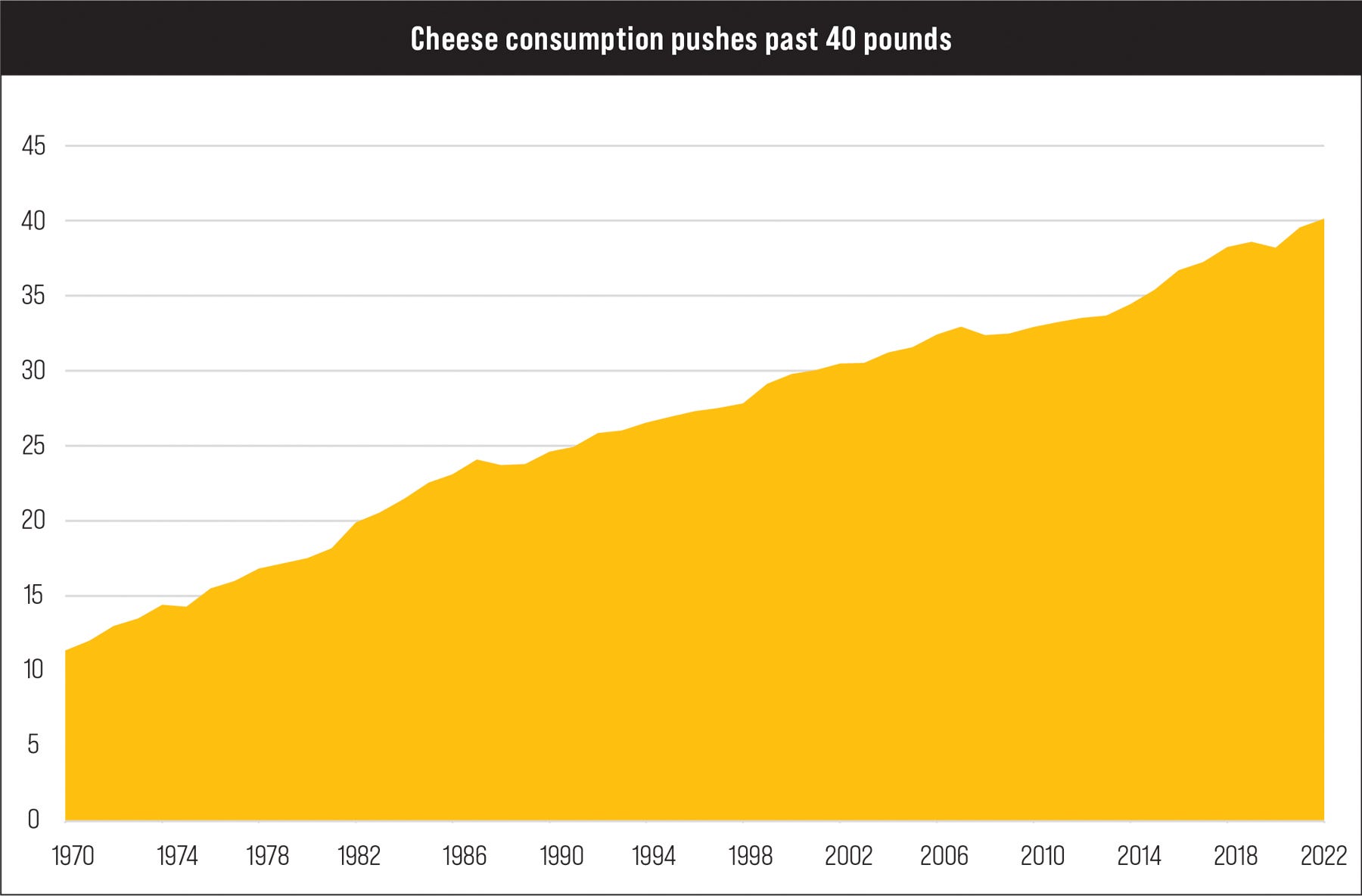

In 2022, U.S. per-capita cheese consumption pushed past 40 pounds per person for the first time. Mozzarella, the pizza cheese, ranks first at 16 pounds per person, followed by cheddar at 11.4 pounds. Hispanic-style cheese is the fastest-growing category, surpassing 1 pound per capita. The category has more than tripled since 2000 (see chart below).

“America has doubled per-capita cheese consumption every other decade,” Geiger says. In 1967, the average person ate 10 pounds. By 1983, the total climbed to 20 pounds. In 2001, cheese consumption surpassed 30 pounds and then eclipsed 40 pounds in 2022.

Geiger believes U.S. cheese consumption can continue to grow. “Danish and French citizens all eat more than 60 pounds annually, and those in Austria, Finland, Germany, Greece, the Netherlands and Switzerland each average more than 50 pounds of cheese every year,” he says.

More cheese sales are a must as more processing comes online. Projections say U.S. cheese production could grow by 520,000 metric tons from 2023 to 2026, he says.

“That growth in cheddar-style cheese will more than double production growth from 2019 to 2022,” Geiger notes. “The equally, if not more, valuable offshoot of cheese production is whey. With the dryer technologies at the modern cheese plants, owners and managers are poised to capture high-end whey protein sales.”

Dairy exports

On the international market, U.S. dairy exports in 2023 fell back to 16.5% after posting back-to-back record years in 2021 and 2022, when exports represented 18% to 19% of total U.S. milk production. “Exports remain much stronger than the 15% static figure posted from 2013 to 2020,” Geiger says.

“Ultimately, the wild card is international demand as the world’s growing middle class craves more high-quality proteins,” he explains. “While countries with growing middle-class economies could step up dairy purchases, a strong U.S. dollar also could dampen sales.”

Additionally, China — the world’s largest dairy product importer, accounting for roughly 20% of all purchases — remains mired in an economic slump. “In 2021, China’s gross domestic product had grown to 75% of the U.S. total. By the third quarter of 2023, China’s GDP had slipped back to 64% of the U.S. total, the same as 2017,” Geiger says.

If global dairy demand picks up, the U.S. is poised to fill orders as the other major dairy export regions — Oceania, the European Union and Argentina — all show signs of static milk production growth. Lower feed costs and improved cow productivity should spur some additional U.S. milk production, he notes. However, production costs have moved higher.

Less milk

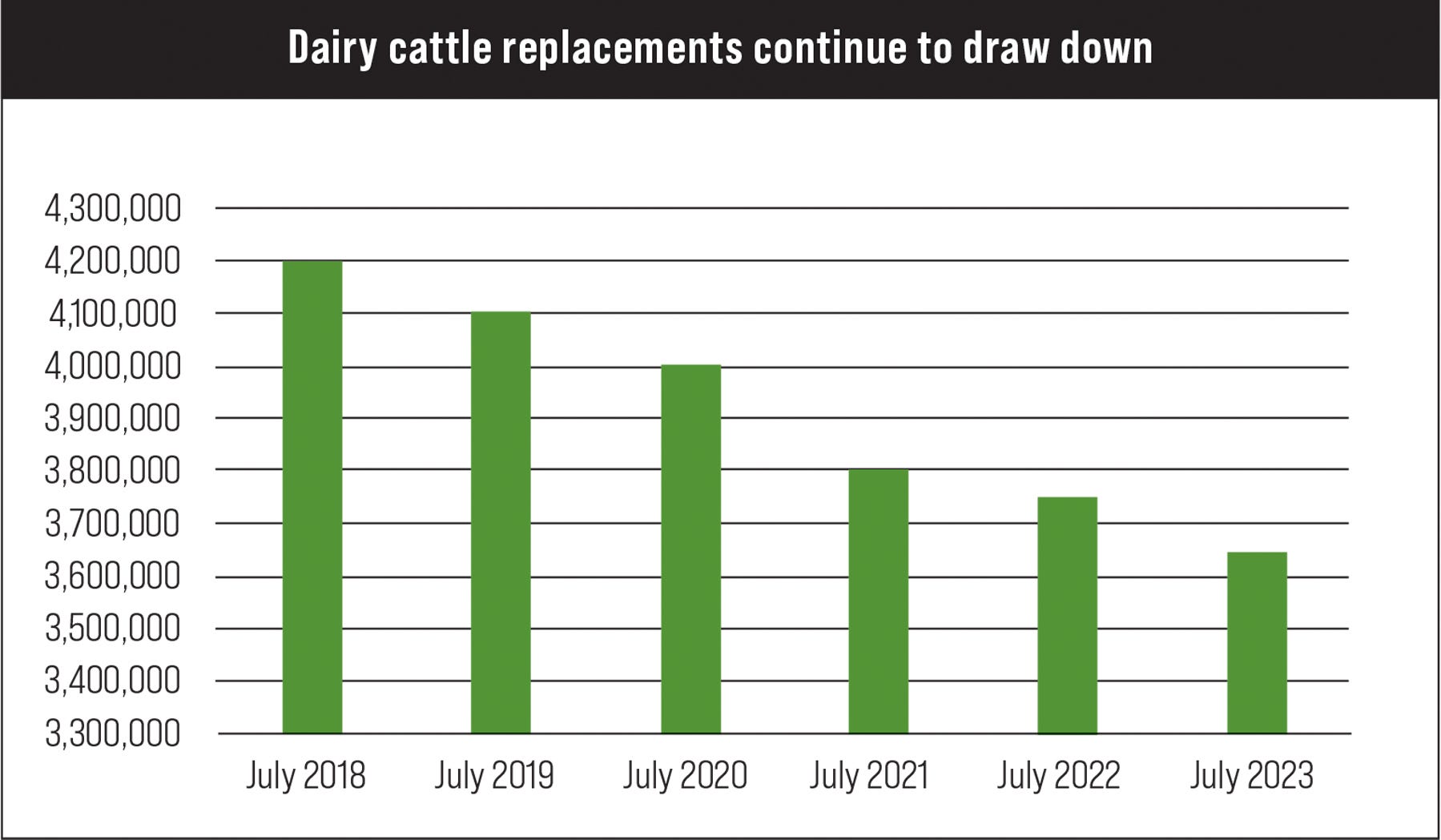

“Modest margins, along with a declining supply of replacement heifers, will limit a major upward movement in milk production,” Geiger explains. Strong use of beef semen on dairy cows has shrunk dairy replacement numbers by 550,000 head in the last six years (see chart below).

As for 2024 milk production, USDA shifted its forecast down by 1 billion pounds to 229 billion pounds total. Those lower milk production totals have come about as farmers shift feeding strategies and genetics to favor higher-component, more nutrient-dense milk with higher butterfat and protein levels.

“That delivers more value to farmers, processors and consumers,” Geiger says.

About the Author(s)

You May Also Like