November 29, 2017

By Liz Morrison

Despite low crop prices and weak farm income, agricultural land values in Minnesota and the Dakotas appear to be holding steady after a multiple-year pullback.

The halt in the downward slide is triggered by robust demand for good-quality land, along with fewer farms for sale. Other forces shoring up land values include good yields the past two years and cheap interest rates.

“The decline in land values has stopped, at least temporarily,” says broker Charles Wingert, Wingert Realty and Land Services, Mankato, Minn.

“It’s a status quo market,” agrees farm credit bank appraiser Gerry Dee, Compeer Financial, Rochester, Minn. “We’re not seeing huge swings like before. The market has retained its value, despite low crop prices. That has surprised a lot of people.”

Farmland values across the three-state region began dropping in 2013 and 2014, following an unprecedented run-up fueled by soaring crop prices. As commodity prices sank, land values dipped 20% to 30%.

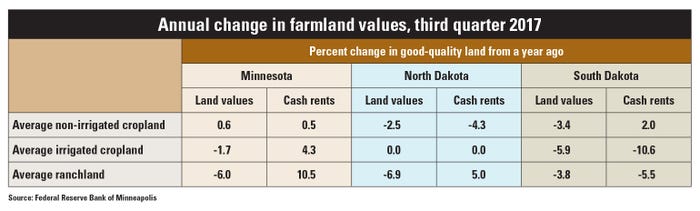

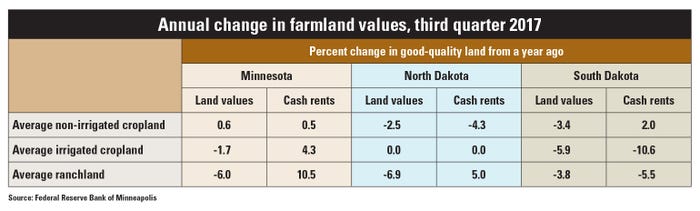

An October survey of agricultural bankers by the Federal Reserve Bank of Minneapolis found that average cropland values in the 9th District had retreated about 1% from a year earlier. The district includes Minnesota, the Dakotas, Montana and Wisconsin. Grassland fell about 3%, perhaps reflecting the impact of drought in the western parts of the region, says Joe Mahon, regional outreach director.

Year-over-year values of nonirrigated cropland — the largest class of land in the three-state area — stayed fairly steady in most areas in the third quarter of 2017, according to an October survey of agricultural bankers by the Federal Reserve Bank of Minneapolis. The quarterly survey is not a scientific sample, but does provide a snapshot of market conditions by knowledgeable local experts, says Joe Mahon, regional outreach director.

Year-over-year values of nonirrigated cropland — the largest class of land in the three-state area — stayed fairly steady in most areas in the third quarter of 2017, according to an October survey of agricultural bankers by the Federal Reserve Bank of Minneapolis. The quarterly survey is not a scientific sample, but does provide a snapshot of market conditions by knowledgeable local experts, says Joe Mahon, regional outreach director.

It appears that farmland values hit bottom this year and are now settling in, says Kevin Pifer, president of Pifer’s Auction and Realty in Moorhead, Minn. Pifer’s, which sells farmland in Minnesota and North and South Dakota, has seen prices for good-quality cropland and grassland edge up 2% to 3% from the first quarter of 2017. “That sends a signal of more strength in the market,” he says.

At the same time, buyers are wary of poor-quality land because of low crop prices and the high cost of inputs, Pifer says. That resulted in more no-sale auctions in 2017.

“Still, we feel that good cropland is going to be competitive. We haven’t seen much land offered for sale in the last 18 months,” he says.

In the Red River Valley and Dakotas

Cropland values on both sides of the Red River are fairly steady, agrees John Botsford, a farm manager and broker at Red River Land Co. in Grand Forks, N.D. Although the pool of prospective land buyers shrank with the downturn in the farm economy, there are still plenty of strong, able buyers.

“We’ve been bailed out up here by strong yields,” Botsford says.

Farmland prices are also being supported by attractive federal financing programs for beginning farmers. “Maybe half of our recent sales have gone to beginning farmers,” he adds.

Likewise, in the southern Red River Valley, land prices are stabilizing, says Guy Miller, an appraiser and broker at Miller Realty in Breckenridge, Minn.

“But it has been a very slow year for land sales in our area,” Miller says. Volume is off more than 50% as prospective sellers hang on to land, waiting for prices to rise. Profitable sugarbeet production has helped support demand for both land purchases and rentals, he says.

Miller looks for positive things to come from dairy expansion in Wilkin and Traverse counties on the Minnesota side of the river.

In southeastern South Dakota, cropland and pastureland prices are solid, says Chuck Sutton, a broker and farm manager at Chuck Sutton Auction in Sioux Falls, S.D.

“We’ve seen remarkable strength in the market this fall,” Sutton says. “It comes down to supply and demand. There’s less available inventory and a pent-up demand.” Buyers are more discriminating now, he adds, but when a prime farm comes up, growers really go out and compete for it.

In western North Dakota, cropland and ranchland prices in Williams, Divide, Mountrail, McKenzie and Dunn counties are running strong, says Roger Cymbaluk, a broker and farm manager at Basin Brokers in Williston, N.D. Well-capitalized farmers with outside oil money are the primary buyers, seeking to expand their land holdings as a permanent place to park money, he says. The buyer pool has dwindled. However, there has been no downturn in his area.

“Operators don’t get many opportunities to buy land,” he adds, and many are paying cash.

In Minnesota

In southeast Minnesota, land prices were still trending down last summer, says Dee, the Rochester appraiser. However, several good sales this fall would seem to indicate a reversal, he adds. He estimates values may be up as much as 5% from last fall. It’s a supply-driven market, Dee says, echoing other experts.

“Because so few farms are for sale, when one does come up, there’s strong demand,” Dee says. Adding to enthusiasm, yields the past two years have been above five-year averages.

Southern Minnesota is showing pockets of strength, agrees Wingert, the Mankato broker. Prime cropland values have edged up about 3.5% this year, he says, driven mainly by investors, who have returned to the market after a four-year absence. Of the 50-plus farms the company sold in the first three quarters of 2017, 63% were to investors, he says.

Likewise, in central and west-central Minnesota, cropland is holding steady or inching up, says Leon Carlson, an appraiser and farm manager for Upper Midwest Management in Olivia, Minn.

The amount of land for sale is down sharply, he notes. In Yellow Medicine County, for example, there have been only a dozen sales in 2017 — less than half the usual volume. In some areas, sugarbeets are exerting upward pressure on land values, as farmers who are switching from three-year to five-year beet rotations seek more acres, Carlson says.

Values are firm in southwest Minnesota, too, says Eldon Krull, an appraiser and farm manager for Northwestern Farm Management in Marshall, Minn.

“Even though grain prices haven’t rallied, we’ve seen a steady land market in 2017,” he says. However, it’s a thinner market now, with fewer yet very strong buyers. The livestock sector drives land markets in many parts of the region, he adds.

“Many livestock producers have made good profits in the last two years,” Krull says.

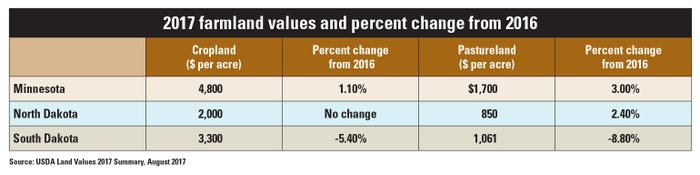

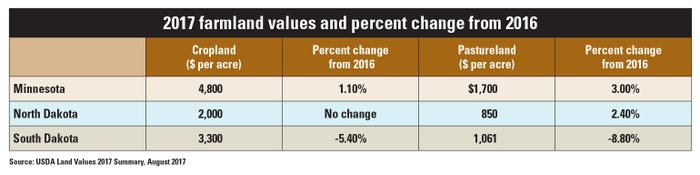

USDA’s August report of farm real estate showed average Minnesota and North Dakota farmland values holding steady in 2017, while South Dakota values fell about 5%. Pastureland values ticked up in Minnesota and North Dakota, and fell almost 9% in South Dakota, according to the survey.

USDA’s August report of farm real estate showed average Minnesota and North Dakota farmland values holding steady in 2017, while South Dakota values fell about 5%. Pastureland values ticked up in Minnesota and North Dakota, and fell almost 9% in South Dakota, according to the survey.

In general, market watchers agree that prices for good farms — those with top soil ratings, good drainage, desirable field configurations and easy access — were firm in 2017, says Jack Davis, a South Dakota State University Extension farm business management specialist who oversees an annual land values survey.

“We’re not at the peaks of a few years ago, but the feeling is that good land is holding value,” he says.

Morrison writes from Morris, Minn.

What farmland market watchers are saying

• “There is still a shortage of land for sale, and the desire of expansion farmers and investors to purchase is strong.” — Charles Wingert, Wingert Realty and Land Services Inc., Mankato, Minn.

• “Values are steady currently. But we can’t take too many more years of these low crop prices. If commodity prices continue without relief, current land values probably won’t be sustainable.” — John Botsford, farm manager and broker, Red River Land Co. LLC, Grand Forks, N.D.

• “We’ve seen remarkable strength in the market this fall. It comes down to supply and demand. There’s less available inventory and a pent-up demand.” — Chuck Sutton, broker and farm manager, Chuck Sutton Auction, Sioux Falls, S.D.

• “We feel that good cropland is going to be competitive. We haven’t seen much land offered for sale in the last 18 months.” — Kevin Pifer, Pifer’s Auction and Realty, Moorhead, Minn.

• “Farmland values are now holding steady. I don’t think they are going down. But there are not nearly as many potential buyers now as at the peak in 2013 and 2014.” — Bob Hansen, Bob Hansen Land and Auction, Salem, S.D.

• “Even though grain prices haven’t rallied, we’ve seen a steady land market in 2017. Buyers are seeking high-quality land and avoiding lower-quality land.” — Eldon Krull, Northwestern Farm Management, Marshall, Minn.

• “I look for positive things to come from dairy expansion in Wilkin and Traverse counties. This gives farmers more options for crops and additional markets for their commodities.” — Guy Miller, Miller Realty, Breckenridge, Minn.

• “Pastures are dry and ranchers are culling hard. Ranchers will be looking very carefully at pasture rents.” — Roger Cymbaluk, broker and farm manager, Basin Brokers, Williston, N.D.

• “The market has retained its value, despite low crop prices. That has surprised a lot of people.” — Gerry Dee, Compeer Financial, Rochester, Minn.

• “A concern is ag producers whittling away at equity. Credit risk is increasing, and net income is down.” — Brian Gatzke, farmer and appraiser, Northern Plains Appraisal, Brookings, S.D.

• “The big question is, where do we go from here? I still have a downward bias because of farm economics.” — Andrew Swenson, North Dakota State University Extension economist

• “The returns from farming aren’t there to support these values.” — Jack Davis, South Dakota State University Extension business management specialist

You May Also Like