June 21, 2013

Soybean planting has been delayed in many areas of the Midwest. Since final planting dates for corn have passed, farmers who have purchased the COMBO insurance policy are eligible to take prevented planting payments for corn. Soon all final planting dates for soybeans will have passed and all Midwestern farmers will be eligible for soybean prevented planting payments. Here we'll compare returns from prevented planting payments are compared to planting soybeans. For corn, prevented planting payments almost always will be larger than expected returns from planting soybeans in late June. Prevented planting payments for soybeans are less than prevented planting payments for corn. Taking the prevented planting payments for soybeans will become more economically attractive if soybean plantings are further delayed.

The Current Situation

In most cases, planting soybeans will have higher expected returns than planting corn when the planting takes place in middle to late June. Therefore, the alternatives compared in this post are planting soybeans versus taking prevented planting payments.

Like what you're reading? Subscribe to CSD Extra and get the latest news right to your inbox!

A previous post summarized the implications of taking corn prevented planting payments. Ramifications for taking soybean prevented planting payments are similar to those for corn. Some details include:

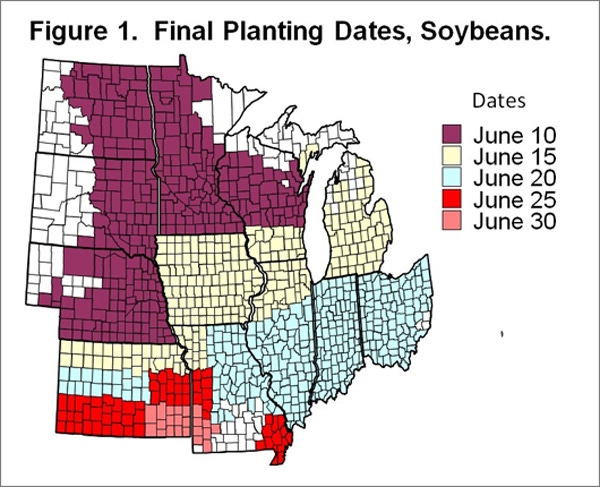

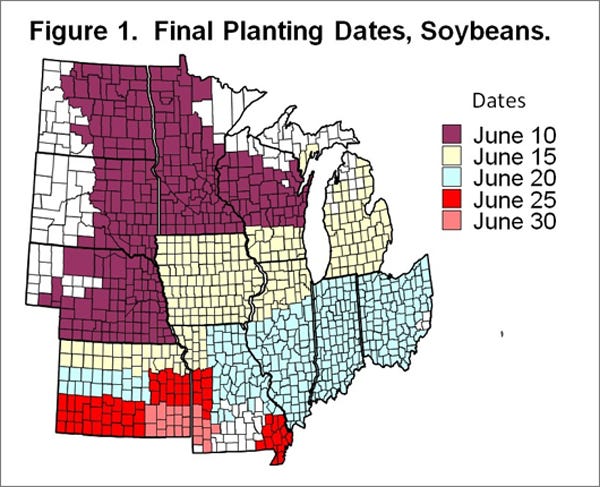

Final planting dates across the Midwest range from June 10 in the Upper Midwest and western Corn Belt to June 30 in southeastern Kansas and southwest Missouri (see Table 1).

Once final planting dates have passed, farmers are eligible to take prevented planting payments on soybeans.

Farmers can still plant soybeans. If they do, prevented planting payments will not be received and crop insurance guarantees will decrease 1%/day during the 25-day late-planting period. After the late-planting period is over, guarantees will be 60% of original guarantees.

If prevented planting payments are taken, farmers cannot plant harvestable crops during the 25-day late planting period that begins on the final planting date.

Farmers can plant a crop after the 25-day late planting period, but this will usually result in a 70% reduction in the prevented planting payment and the use of low yields in calculating future Actual Production History (APH) yields. In most cases, it will not be economical to plant another crop after the late planting period for soybeans.

Farm Scenarios

Returns from taking prevented planting payments versus planting soybeans are examined for two cases. The first is when the farmer is eligible for a corn prevented planting payment. The second is when a soybean prevented planting payment is available.

Examples:

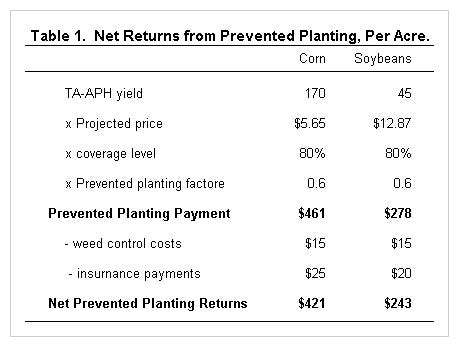

The farm has purchased a COMBO crop insurance product (i.e., Yield Protection, Revenue Protection, and Revenue Protection with Harvest Price Exclusion) for both corn and soybeans at 80% coverage levels. The Trend Adjusted Actual Production History (TA-APH) yields are 170 bu./acre for corn and 45 bu./acre for soybeans. The standard prevented planting factor of 0.60 has been selected at crop insurance sign up.

Given the above crop insurance information, prevented planting payments for both corn and soybeans can be calculated. For corn, the prevented planting payment is $461/acre (170 bu. TA-APH yield x $5.65 projected price x 80% coverage level x 0.60 prevented payment factor). The prevented planting payment for soybeans is $278/acre (see Table 1).

The prevented planting payment scenarios here do not consider costs associated with prevented planting. Most farmers will undertake weed control. Weed control costs used here are $15/acre. In addition, crop insurance will have to be paid on acres in which prevented planting is taken. Crop insurance premiums are assumed to be $25/acre for corn and $20/acre for soybeans. Given these costs, the net prevented planting payment is $421/acre for corn and $243/acre for soybeans. Table 1 shows the calculation of net prevented planting payments.

The alternative to taking prevented planting payments is planting soybeans. Only costs that can be avoided by not planting soybeans are included in the analysis. Herein, direct costs of $160/acre are used. Direct costs are included for fertilizer ($50/acre), pesticides ($30/acre), seed ($55/acre), storage ($5/acre) and crop insurance ($20/acre). Machinery costs are included for field cultivating ($10/acre), planting ($12/acre), combining ($30/acre) and trucking ($3). This gives a total of $55/acre in machinery costs. Soybean costs then total $215/acre ($160 direct costs + $55 machinery costs).

Corn Prevented Planting Payments versus Planting Soybeans

For those cases in which corn was originally going to be planted, farmers may be able to take prevented planting payments on corn. In these cases, the relevant comparison is between the return from taking a corn prevented planting payment and returns from planting soybeans.

For planting soybeans to have higher returns than prevented planting, soybean revenues must exceed the net prevented planting payment ($421/acre, see above) plus soybeans costs ($215/acre, see above). In other words, soybean revenue must exceed $636/acre ($421 prevented planting payment + $215 soybean costs). A number of yield and price combinations can result in revenue more than $636. Currently, harvest-time bids are at $12.70/bu. for soybeans. At a $12.70 soybean price, soybean yields have to exceed 50 bu./acre for planting soybeans to be more profitable than taking the soybean prevent planting payment (50 bu./acre breakeven equals $636 revenue / $12.70 soybean price). Lower soybean prices result in higher soybean yields to have higher returns than prevented planting.

While yields above 50 bu./acre are possible, soybean yields lower than 50 bu./acre are more likely. At this point in time, taking the prevented planting payment has higher returns than planting soybeans in most case.

The returns in the above example change with different insurance coverages. Prevented planting is more favorable the higher the coverage level. Some farmers purchased higher prevented planting factors (0.65 and 0.70) which will make prevented planting returns higher, thereby increasing the desirability of taking the prevented planting payment.

Soybean Prevented Planting Payments versus Planting Soybeans

In some cases, all corn acres have been planted, but soybean acres are not planted. After the final planting date, the relevant comparison is between the returns from taking a soybean prevented planting payment and returns from planting soybeans.

For planting soybeans to have higher returns than taking the prevented planting payment, soybean revenues must exceed the net prevented planting payment ($243/acre) plus soybean costs ($215/acre), for total revenue of $458/acre ($243 prevented planting payment + $215 soybean costs). At a $12.70 soybean price, soybean yields would have to exceed 38 bushels per acre for planting soybeans to be more profitable than taking the soybean prevented planting payment.

Achieving 38 bu./acre of soybeans may be possible, but lower yields are more likely. As planting is further delayed, expected yields decline, thereby increasing the desirability of taking the prevented planting payment.

The above example is for a particular situation. While the particulars vary across scenarios, the example illustrates the tradeoffs fairly common across a range of situations. Of course, farmers should look at their own case in particular. The prevented planting module in the Planting Decision Model will be useful in making these calculations. This spreadsheet can be downloaded from the FAST section of the farmdoc website.

Farmers need to consult with crop insurance agents on prevented planting. Crop insurance agents can aid in determining the number of acres on which prevented planting can be taken. There are also deadlines for signing up to take the prevented planting payment. Contacting a crop insurance agent sooner rather than later is advisable.

Read the article at farmdocDaily.

You might also like:

You May Also Like