November 22, 2013

Futures prices on December 2014 corn and November 2014 soybean contracts are considerably below 2013 projected prices. This suggests that crop insurance guarantees will be considerably lower in 2014 as compared to 2013. As a result, most farmers will face considerable losses before crop insurance makes payments in 2014.

Likely 2014 Projected Prices

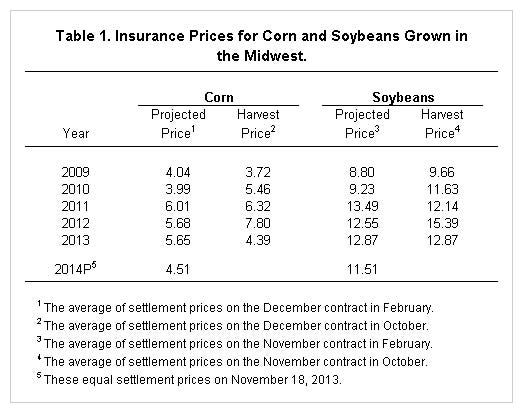

In the Midwest, projected prices for corn and soybean crop insurance contracts are set based on settlement prices of Chicago Mercantile Exchange (CME) futures contracts during the month of February. The December contract is used for corn and the November contract is used for soybeans.

In recent years, projected corn prices have been above $5.50 (see Table 1). The projected price was $6.01 per bushel in 2011, $5.68 in 2012, and $5.65 in 2013. Current futures contract levels serve as a good indicator of futures prices during the month of February. The settlement price of the December 2014 contract was $4.51 per bushel on Monday, November 18th. A $4.51 projected price for 2014 would be $1.14 lower than the $5.65 projected price for 2013.

Like what you're reading? Subscribe to CSD Extra and get the latest news right to your inbox!

In the three most recent years, projected soybean prices have been above $12.50 (see Table 1). The projected price was $13.49 per bushel in 2011, $12.55 in 2012, and $12.87 in 2013. The settlement price of the November 2014 soybean contract was $11.51 per bushel on Monday, Nov. 18. An $11.51 projected price would be $1.36 below the $12.87 projected price for 2013.

Lower Per Acre Guarantees

Lower projected prices translate into lower per acre crop insurance guarantees. Take, for instance, a 190-bushel guarantee yield on an 80% Revenue Projection (RP) policy, a typical guarantee yield and coverage level in northern and central Illinois. Given these parameters, the 2013 guarantee is $859 per acre (80% coverage level x 190-bushel per acre guarantee yield x $5.65 projected price). A 2014 projected price of $4.51 would result in a $173 per acre lower guarantee of $686 per acre (80% coverage level x 190-bushel per acre guarantee yield x $4.51 projected price).

In 2014, non-land costs of producing corn are projected near $540 per acre and cash rent for farmland with a 190-bushel guarantee yield averages near $290 per acre, giving $830 per acre in costs. An 80% coverage level has a guarantee of $686, considerably below the $835 cost level. An 85% coverage level has a $728 per acre guarantee, still below $830 of costs. In most cases, farmers will be in a loss situation before crop insurance makes payments on corn.

For soybeans, a 52-bushel per acre guarantee yield and an 80% RP policy is typical in northern and central Illinois. Given these parameters, the 2013 per acre guarantee is $535 per acre (80% coverage level x 52-bushel per acre guarantee yield x $12.87 projected price). An $11.51 projected price in 2014 would result in a $56 lower guarantee of $479 per acre (80% coverage level x 52-bushel per acre guarantee yield x $11.51 projected price).

Non-land costs on soybeans for 2014 are projected at $340 per acre. Adding a $290 per acre cash rent results in total costs of $630 per acre. Insurance guarantees, even at an 85% coverage level, will not exceed the $630 in total per acre costs.

Summary and Commentary

Downside revenue risks likely will be greater in 2014 as compared to 2013. Crop insurance products will provide much lower guarantee levels and, in most cases, farmers will face substantial loss situations before crop insurance makes payments.

These lower guarantees point to one issue concerning relying only on crop insurance to provide the farm safety net. Crop insurance works well when projected prices are relatively high. When projected prices are lower, safety nets also are lower. The limits of within year protection offered by crop insurance points to the need for across year protection offered by revenue programs in the commodity title of the farm bill, such as ACRE under the 2008 Farm Bill and the various revenue options under consideration for the next Farm Bill.

In reality, the situation projected for 2014 is much nearer the norm than the situation is recent years. The safety net provided by crop insurance in 2013 will be similar to that provided by crop insurance in the years between 2000 and 2005.

Read the article at farmdocDaily.

You might also like:

You May Also Like