April 5, 2019

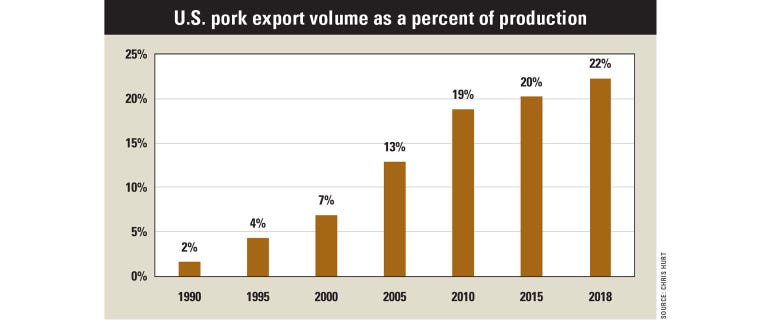

U.S. pork has gone global. In 1990, pork producers only exported about 2% of their production. That began changing in the early 1990s, as industry leaders saw the opportunity to enter the fast-growing market for global pork.

Leaders recognized the need to adapt our pork products to the demands and desires of foreign customers. They also realized the U.S. industry must promote its products to foreign buyers and assure them of the health and sanitation of our products.

Furthermore, they had to remind foreign buyers that the U.S. followed the “rule of law.” To foreign buyers, that meant that pork purchase contracts with the U.S. industry would be delivered, and that if problems arose, the laws of the U.S. would protect their legal rights in the contracts, as well.

Today the U.S. pork industry exports 22% of our production. In contrast, the U.S. corn industry will export only 16% of 2018 production, and the U.S. beef industry is exporting only 11% of current production.

Curve in the road

Unfortunately, the pork industry’s great success in developing foreign customers had a downside when tariffs, which are basically taxes, were imposed on our exports during trade disputes with China and Mexico beginning in April 2018. These trade restrictions had more impact on the pork industry than the beef industry because trade is so much more important to pork than beef or even corn.

Now for the good news! As trade disputes are resolved, the opportunity for price recovery is greater in pork than in some other commodities noted here.

Prospects of better hog and pork prices really began to show up this spring. Price improvement has shifted the outlook from losses for 2019 to potentially small profits for the year.

In addition to the reduction of trade disputes, China has decided to buy more U.S. pork to help cover shortfalls in its production losses due to African swine fever.

Exports stimulate growth

Pork exports have really helped the U.S. industry grow. Since 2000, the U.S. pork industry has grown at a compound annual rate of 1.9%. There are two components to that growth: the domestic market and the foreign market.

The domestic market has grown at a compound annual rate of just 0.8% per year. This means the larger contribution of 1.1% annually to our growth has come from the foreign market.

Our industry has been able to grow about 1.1% more per year due to our success in reaching foreign consumers. While that doesn’t sound like a lot in a single year, the U.S. pork industry is about 20% larger today than it was in 2000 because of the growth in exports.

That’s clearly good news, as about 1 out of every 5 people working in the U.S. pork industry would not be needed without the growth in exports.

Hurt is a Purdue University agricultural economist and Extension marketing specialist. He writes from West Lafayette, Ind.

About the Author(s)

You May Also Like