August 2, 2019

What a year 2019 has been for U.S. agriculture! The pork outlook has had three big drivers: large pork supplies, trade disputes and adverse weather. Each of these factors remains uncertain, and the final outcomes will impact the outlook for the rest of this year and next year, as well.

Pork supplies have been larger this year than originally anticipated. They rose by 4% in the first half, and are expected to grow another 5% in the second half. Producers have slowed sow expansion to just 1%, and are keeping their summer and fall farrowings about the same as last year. If this continues, it means production growth would slow to 2% to 3% next year.

Demand has remained strong for both domestic and export markets. Pork export volume was up 9% in the first half of the year, and sales for the rest of the year look strong as well. China has been a large buyer this year, but much of that pork is still unshipped. The trade dispute with China does raise the question of whether those purchases will turn into actual shipments.

Continued trade concerns with Mexico and Canada could also cloud the export picture. The USDA export forecast is optimistic. The agency thinks the U.S. will export a record 24% of pork production in 2019 and nearly 25% in 2020.

Feed cost uncertainty

What will be the final size of the 2019 U.S. corn and soybean crops? We’re learning more about acreage as USDA resurveys corn and soybean farmers. However, prevented planting acres and failed acres may take some more time to come into focus. Markets are now concentrating on yield potential, frost dates and any damage that may result.

The industry has already begun adjusting to higher feed prices and will do more as needed. There will be additional feeding of substitutes such as wheat. If corn prices remain high relative to protein, then more soybean meal will be included in diets.

High corn prices relative to protein will cause some shifting toward more corn production relative to soybeans, starting with South America. Higher feed prices will cut into profitability. In turn, reduced profit prospects will slow, or reverse, the expansion path the industry has been on since 2014. This slowing of expansion will eventually result in higher pork prices and profitable production.

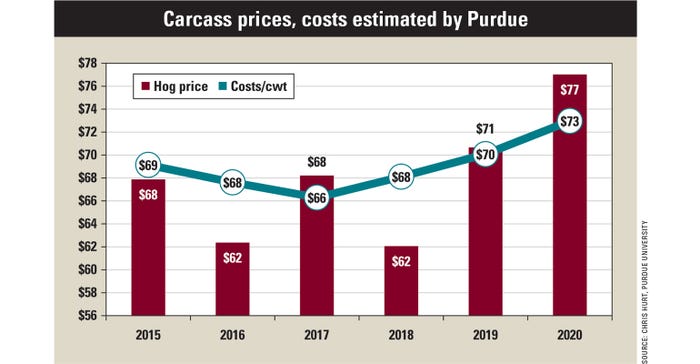

Right now, my outlook remains favorable. Pork production margins are expected to decrease this fall but remain slightly positive. Stronger hog prices in 2020 are expected to increase margins, with estimated profits above all costs of $8 to $10 per head. However, the major uncertainties we’ve talked about could cause much different outcomes.

As we have all said this year, “Only time will tell!”

Hurt is a Purdue University Extension agricultural economist and market specialist. He writes from West Lafayette, Ind.

About the Author(s)

You May Also Like