*This is the fifth article in our 2024 Southwest Economic Outlook series. Hear from Oklahoma State University and OSU Extension Service, and Texas A&M University and TAMU AgriLife Extension Service economists about the 2024 outlook.

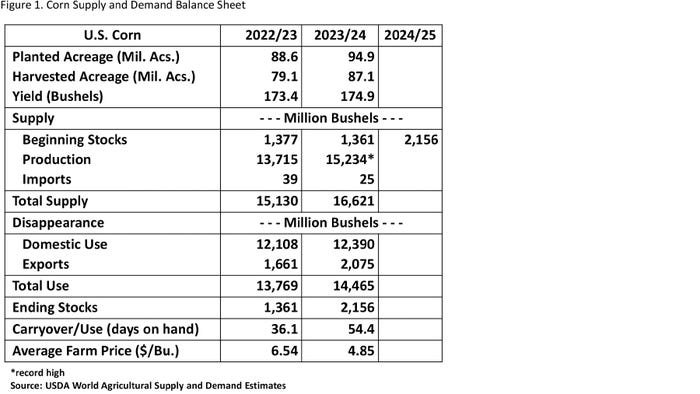

Despite a growing season that saw some extremely dry conditions in key production areas, the 2023 U.S. corn crop set a record at 15.234 billion bushels, just topping the previous record of 15.148 billion bushels in 2016. The total U.S. corn supply for the 2023/24 marketing year is up 10% compared to the previous year.

Total corn use, on the other hand, was up only 5% compared to the previous marketing year, resulting in an increase in ending stocks and lower prices. The stocks-to-use ratio, as measured by the number of days of use on hand at the end of the marketing year, increased from a 36.1-day supply at the close of 2022/23 to 54.4 days estimated for 2023/24. The national season average farm price fell from $6.54 per bushel to a current estimate of $4.85, a 25% decline.

How do we expect the factors of supply and demand to shape the price outlook for corn in 2024? Are there indicators to watch that may provide insight into how balance sheet components may change in the new growing season compared to last year?

Corn supply

We are set to begin the marketing year with over two billion bushels of beginning stocks. That level of carry-in provides a considerable supply cushion for any production problems in the upcoming growing season. With a relatively strong soybean-to-corn price ratio this winter, we may see a decrease in corn acres. But a trendline yield estimate for 2024 would be around 180 bushels per acre, significantly higher than the actual yield in 2023 -- 90 million acres planted and a 180-bushel yield results in a total corn supply of 17 billion bushels in 2024, a record high.

Corn demand

Livestock and poultry inventory reports will be an important gauge of feed use, the largest corn use category. In 2023, USDA’s calculation of grain consuming animal units showed fewer cattle and hogs but a slight increase in poultry. Gasoline and ethanol consumption levels have not returned to pre-COVID levels. Gasoline engines are increasingly efficient and a growing number of vehicles on the road do not use any gasoline at all. But fuel use would benefit from an improving economy and higher ethanol blending rates. Exports are the most likely category to boost overall corn use in 2024. Brazil, our major corn export competitor, is expected to see a smaller corn crop and lower exports in the upcoming season competing with U.S. grain.

Corn carryover, price

Many factors will combine to determine whether the pile of grain left over at the end of the marketing year gets larger or smaller and whether prices are ultimately higher or lower. In 2023, the increase in the corn supply outpaced the use increase. But there was uncertainty and price volatility along the way that provided profitable pricing opportunities.

With above-average U.S. (2.1 billion bushels vs. 1.7-billion-bushel average) and world corn stocks (12.4 billion bushels vs. 11.9-billion-bushel average), 2024 corn prices are expected to remain below average.

The key in any season is to know how your cost of production compares to prices, and not letting those opportunities get away.

About the Author(s)

You May Also Like