On November 16, 2023, President Biden signed H.R. 6363 – the Further Continuing Appropriations and Other Extensions Act of 2024 – into law. The bill extended the Agriculture Improvement Act of 2018 (2018 Farm Bill), reauthorizing programs like the Agriculture Risk (ARC) and Price Loss Coverage (PLC) programs through September 30, 2024. Producers will have an opportunity to make a one-time election between ARC and PLC for the 2024 crop year. USDA opened the election and enrollment period on December 18, 2023, and it runs through March 15, 2024.

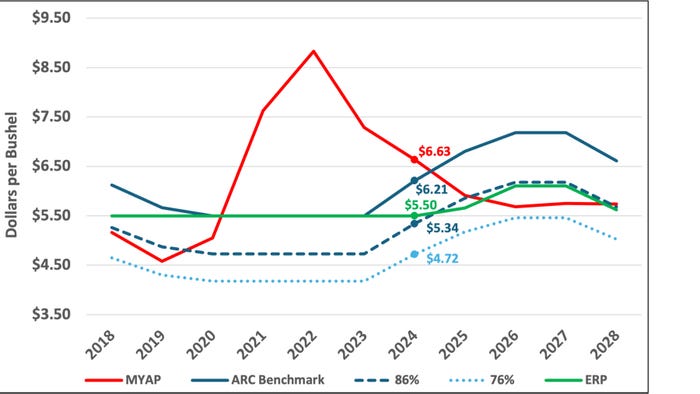

The ARC/PLC decision for 2024 is against the backdrop of a general softening in prices, but the implications vary by crop. For some crops, the decision may be clear-cut. In this article, we illustrate the case of wheat (Figure 1). While Effective Reference Prices are projected to climb starting next year for wheat, it is important to remember that you are making a one-year decision for crop year 2024, where the Statutory Reference Price remains at $5.50/bu. With a projected Marketing Year Average Price (MYAP) of $6.63/bu, it is unlikely (though not impossible, as we are very early in the growing season) that PLC will trigger. While some may be tempted to elect ARC as a result, note that the 86% trigger threshold is at a price of $5.34/bu, largely indicating that any hope of receiving an ARC payment would rest on very low yields. In other words, in the case of wheat, it’s unlikely that either ARC or PLC will trigger (unless there is a disaster that results in low yields).

Figure 1. Historical and Projected Wheat Prices and What They Mean for the ARC/PLC Decision.

As we have noted in the past, we highly encourage you to also look at tools like the Supplemental Coverage Option (SCO) or the Enhanced Coverage Option (ECO), both of which provide area-wide coverage for part of the deductible not covered by your underlying policy. Importantly, if you elect ARC, you cannot purchase SCO. In other words, you are essentially evaluating ARC versus PLC + SCO. Even if PLC is not expected to trigger, you may still choose to elect it and purchase SCO, particularly if the value of SCO is expected to exceed that of ARC.

Considering STAX

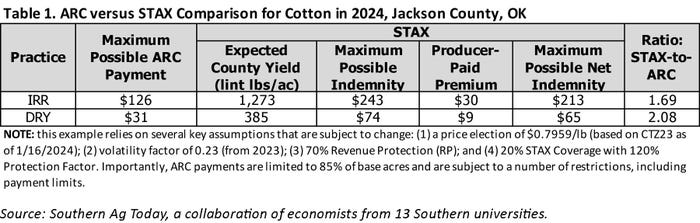

For cotton producers, we continue to recommend you first evaluate the Stacked Income Protection Plan (STAX) before making decisions about ARC/PLC. In the case of cotton, STAX cannot be purchased on any farm where the seed cotton base has been enrolled in ARC or PLC for that crop year. As discussed at the Red River Crops Conference in Altus, Okla., in a scenario where the crop is a total loss, the area-wide policies can provide considerably more coverage than ARC. For example, as noted in the example for Jackson County, Okla., in Table 1, STAX can provide more than twice as much support as ARC in a total loss scenario.

Hopefully, we have given you something to think about as you consider your signup decisions. We wish you luck and don’t hesitate to call for assistance.

Read more about:

Federal Crop Insurance ProgramAbout the Author(s)

You May Also Like