October 11, 2022

A grant to develop and deliver business and asset protection information to Hispanic farmers and ranchers has been awarded to the Texas A&M AgriLife Extension Service in partnership with the Southern Risk Management Education Center, SRMEC.

The project, implemented in conjunction with the Farm Tax and Asset Protection Program, FTAP, will develop and deliver educational materials and training to producers so they may better understand the important relationships between federal income taxes and USDA farm programs.

The new Farm Tax and Asset Protection Program for Hispanic Farmers and Ranchersproject is part of the USDA-Farm Service Agency’s $10 million investment toward the new Taxpayer Education and Asset Protection Initiative. That investment is part of a larger $14.5 million USDA outreach and education effort for farmers and ranchers, including those new to farming or historically underserved by USDA programs.

About the new project

The project will leverage resources of the National Farm Income Tax Extension Committee and Regional Farm Management Committees. It uses curriculum developed by AgriLife Extension in collaboration with the National Farm Income Tax Extension Committee and University of Arkansas Law School.

“The target clientele will be Hispanic farmer and rancher communities in the states with the highest rates of Hispanic operators,” said Pancho Abello, AgriLife Extension economist in Texas A&M’s Department of Agricultural Economics at the Texas A&M AgriLife Research and Extension Center in Vernon and primary investigator for the grant.

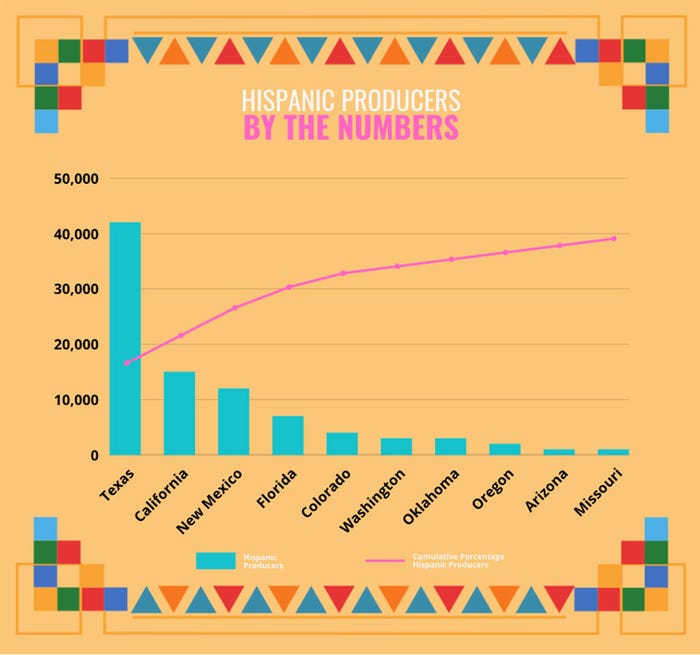

Educational workshops and outreach events developed through the project will be held in Texas, California, New Mexico and Florida. According to the most recent USDA census, these states represent more than two-thirds of the total Hispanic producer population in the U.S.

“AgriLife Extension’s role will be to help develop educational materials and provide training to the target audience, particularly to Hispanic farmers and ranchers in Texas and beyond,” Abello said. “Texas A&M was federally designated as a Hispanic Serving Institution in 2022, and this project aligns with both the Texas A&M land-grant mission and HSI objectives.”

Along with Abello, other AgriLife Extension economists involved in the project will be Luis Ribera, professor and AgriLife Extension economist who is director of the Center for North American Studies at Texas A&M; Samuel Zapata, associate professor in the Department of Agricultural Economics at Texas A&M’s Higher Education Center at McAllen; and Yuri Calil, an assistant professor in the Texas A&M AgriLife Research and Extension Center at Corpus Christi.

What is the purpose of the project?

The purpose of the project is to develop and deliver taxpayer education to producers to help them better understand the important relationships between federal income taxes and USDA farm programs.

See, NSP outgoing chair discusses season's challenges, two-year term

“We will focus on addressing the immediate needs of producers by delivering agricultural tax and asset protection workshops, training and information to farmers and ranchers,” Ribera said. “The project will also develop an infrastructure to support rural taxpayer education and tax preparation for limited resource, beginning and historically underserved agricultural producers.”

The USDA noted that an overarching objective of the program will be to support farmers and ranchers eligible for debt forgiveness and related USDA Farm Service Agency program payments.

Hispanic agricultural producers participating in the program will engage with tax professionals, attorneys, AgriLife Extension professionals, land-grant Extension educators, community-based organizations, Hispanic agricultural stakeholders and Hispanic farmers and ranchers across all states and territories.

Project team members will work with the tax committee and law school on the development of curriculum resources, including modules, recorded webinars, videos and supplemental print materials.

“Participating members will also guide trainings suitable for delivery to and by the project team, educators and farm advocates,” Calil said.

The main objectives of all training and educational activities will be to:

— Equip farmers and ranchers to understand the tax consequences of government payments.

— Teach participants about strategic options to engage in estate, asset protection, tax and business planning.

— Build relationships with Hispanic farmers and Extension educators.

How will the information be delivered?

Workshop locations will be defined within each state in the regions with the highest concentration of Hispanic-origin producers. Tentative locations include the Lower Rio Grande Valley, Laredo and El Paso in Texas; Las Cruces and the New Mexico-Colorado border in New Mexico; South Florida; and Central California.

“Educational materials for farmers and ranchers will also be available on the FTAP portal and will be promoted through the program’s educators so resources can be disseminated effectively,” Ribera said. “Producers will be able to access modules, recorded webinars, videos, supplemental print materials and farm advocate resources.”

He said program training and materials will enhance producers’ ability to understand and navigate the business decisions about tax and asset protection for their operations.

Source: Texas A&M AgriLife

About the Author(s)

You May Also Like