I have had the opportunity over the last two months to travel around the U.S. meeting with industry participants, U.S. farmers, and global end-users of corn, soybeans, and wheat. The common theme that comes to mind is that “commodities prices are again a point of interest” but also poses the questions of, “how and why did that come to pass outside of just sheer fundamentals?” The quick thought and definition for reflation is the following: expansion in the level of output of an economy by government stimulus, using either fiscal or monetary policy. We have all witnessed inflation over the past six-months, whether at the grocery store or at the pump. When looking through a series of white papers recently, it appears that medium to long term expected inflation rates are on the rise in the U.S. as market participants start to price in the risk of higher U.S. consumer inflation. This is driven by a combination of the strong economic recovery plus the inflationary effects of bottlenecks in logistics and the supply of goods, specifically raw materials such as corn, soybeans, and wheat.

The U.S. Federal Reserve (the Fed) has been clear in its public pronouncements that it will not pull back its exceptionally easy monetary policy until U.S. core inflation has exceeded 2.5% for an extended period. Historically, rising U.S. inflation expectations have coincided with substantial rises in commodity prices. Thus far, the rally in new crop corn, soybeans, and wheat to date are up 35%, 26%, and 6.5% respectively. Lower inventories and rising demand are an invigorating recipe for commodities, in particular row crops. Jeff Currie of Goldman Sachs may say it best, “All major commodity bull markets and inflationary episodes have been invariably tied to redistribution, or populist, policies that have reduced income and wealth inequality.”

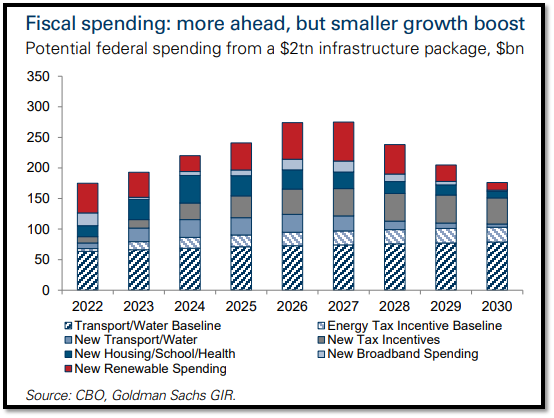

In an article by Goldman Sachs, they mentioned the following highlights that will influence fiscal spending:

The next round of fiscal spending, which we expect to be focused on infrastructure and total at least $2 Trillion and will likely be at least partially offset by tax increases.

Fed tapering/liftoff, which we continue to expect to begin in early 2022 and 1H24, respectively.

Overheating risk; they are not that worried about large overheating given ample economic slack and a fading fiscal impulse.

Virus/vaccines; while case growth has recently moved sideways to lower, 64.4% of the U.S. has one vaccination (in adults).

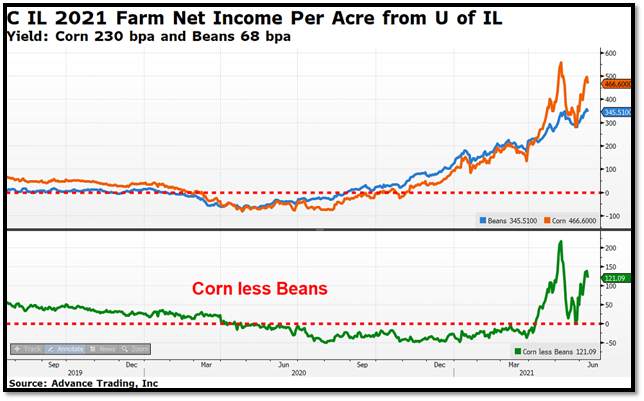

So, while this is generally outside of the fundamental review we do each week as it pertains to risk management, I think it is important to note that the vaccine rollout, weaker U.S. Dollar Index, excessive stimulus, speculative demand for hedges, tight supply chains, and influx of money for risk will continue to dominate flat price futures fluctuations in agricultural commodities. I do not know where prices are headed but I do know that intraday volatility will persist as we move through the summer. Whether you are looking to fundamentals or “outside the box” like longer-term reflation trade for a direction in price, it is still imperative that you surround your farming operation with a trusted advisor to help manage this risk. If you look at the graphic below from FarmDoc (University of Illinois), you can see the U.S. farmer has profitability that we have not witnessed in quite some time. There are ways for producers to establish floors to protect the price per bushel yet maintain flexibility for higher prices. Seek a trusted advisor with the heart of a teacher that can help show you the tools available to accomplish this.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

MarketsAbout the Author(s)

You May Also Like