December 21, 2023

by Austin Weaver

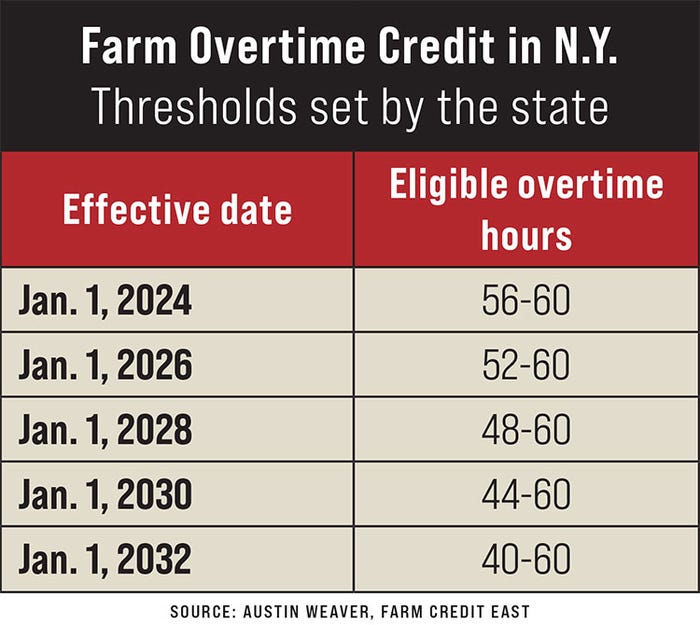

With 2024 around the corner, New York state farmers need to start thinking about the Farm Overtime Credit that will provide a refund for hours worked between the thresholds set by the state and 60 hours.

The table below outlines eligible hours, which for 2024 will be four hours:

Here are important details farmers need to know:

Only eligible farmers, generally those individuals or entities with two-thirds gross income from farming, are eligible for the credit.

The credit equals 118% of the additional cost of the eligible overtime paid to eligible farm employees.

In 2024, hours between 56 and 60 will count toward the refundable credit.

Only fiscal year filers are eligible for the credit in 2023, provided they paid eligible overtime after Jan. 1.

General executive officers are not eligible for the credit.

Licensed farm wineries and cideries whose sale of wine or cider accounts for more than 50% of farm income may only claim the credit for employees employed directly on agricultural property (for example, production employees, not retail staff).

Eligible farmers can request an advance payment for the portion of the credit on the overtime paid from Jan. 1 to July 31 by applying to New York State Department of Agriculture & Markets by Sept. 30. More information can be found via the ag department’s website. Once this takes place, the farmer will receive a certificate of the advanced payment that they can use to request their share of the advance payment from New York State Department of Tax and Finance by Nov. 1.

Here is a practical example of how to use the tax credit to your advantage:

In 2024, an eligible farm employee worked 59 hours a week. The rate was $15 an hour, $22.50 overtime. The calculation for that week would be 118% multiplied by three hours (56 to 59 hours) multiplied by $7.50, which is the additional cost of the overtime wage. The overtime during this period would be $26.55.

Assuming this was the only employee on the farm, and they worked 50 weeks during the year with three hours of overtime each week, the annual overtime credit would be $1,327.50. In this example, the farmer then chose to forgo the advanced payment and chose to receive the credit when he files his 2024 income tax return. To the extent that he has other credits that offset New York state income tax, such as the investment tax credit, he will receive the $1,327.50 overtime credit as a full refund.

Other important notes

Keep in mind that in 2024, this tax credit will be considered federal taxable income to the farmer.

To be an “eligible farmer” for the tax credit, it means that you must derive two-thirds of your gross income from farming. New York state has a lot of calculation worksheets available to help people in determining their eligibility.

The farm’s entity structure will also affect how the credit is allocated, and to whom the funds “belong.” Pass-through entities will flow the credit out along with all the items of income-expense, so it will be received at the personal level. Like all other business credits received, they become a component of personal taxable income for the tax year it is received.

A C corporation, on the other hand, would receive the credit at the entity level since the entity itself is a taxpaying entity.

More information on the tax credit is available on the New York State Department of Taxation and Finance website.

Weaver is a Farm Credit East tax specialist from Burrville, N.Y.

Source: Farm Credit East

You May Also Like