If you were following farm bill developments over the past year, chances are you’ve heard a lot of chatter about the Inflation Reduction Act (IRA). The IRA—signed into law in August 2022—provided approximately $18 billion in new, additional funding for climate-smart agriculture delivered via the existing conservation programs authorized in Title 2 of the farm bill. But, what does that have to do with the farm bill reauthorization? As it turns out, quite a lot.

While the IRA infused $18 billion into the conservation programs, it was one-time funding. The IRA passed through Congress under a budget process known as reconciliation. While that process lowers the vote threshold in the Senate—allowing bills that might not otherwise pass to find their way through the process, typically in partisan fashion—it also requires that no spending extend beyond the 10-year budget window in the reconciliation agreement. For the IRA, that window closes in 2031. Contrast that with the farm bill, where the budget for conservation programs is assumed to continue in perpetuity.

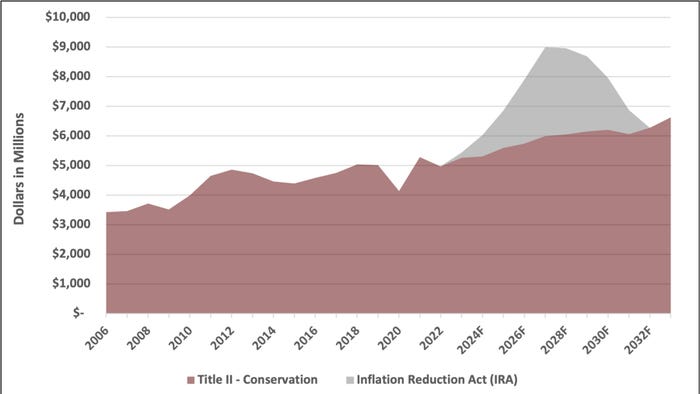

While the debate over the IRA has largely involved (1) quibbling over CBO’s projections of IRA spending and (2) speculating if USDA will be able to obligate the entire $18 billion by 2031, both of these arguments miss the bigger point. Absent creative thinking, the IRA funding will be a one-time flash in the pan—gone by 2031—as noted in Figure 1.

Figure 1. Historic Conservation Spending with Estimated Spending under Current Law

Sadly, like most debates in Washington, D.C., creativity often takes a backseat. The same is true of this debate. Much of the conversation has focused on the fringe options: (1) doing absolutely nothing, despite the caution above and (2) clawing back all of the IRA funding and using it to fund deficit reduction. We don’t see either of these as viable—or likely—options. In the remainder of this article, we explore the middle ground: options that deviate from the status quo but that could result in permanent increases to conservation funding.

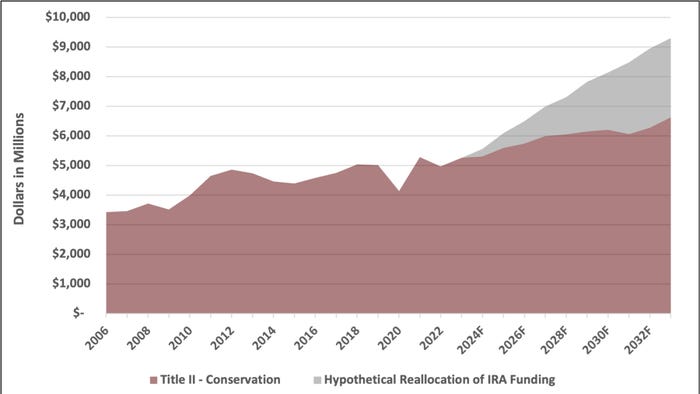

As noted above, the farm bill differs from the IRA in that the budget for conservation programs in Title II of the farm bill is assumed to continue in perpetuity. The options that follow all involve reallocating the IRA funding within the context of the farm bill. It is complicated to be sure—and would require navigating arcane budget rules—but it is possible and would ensure that elevated funding levels for conservation extend beyond the life of the IRA. To illustrate the point, the gray area from Figure 1 is simply reallocated (in a nearly linear fashion) in Figure 2. A few key observations from this hypothetical reallocation:

This option results in additional conservation funding beyond 2031, which is not an option under status quo;

By CBO’s estimates, the IRA will result in Title II outlays reaching a maximum of $9 billion in FY2027 (Figure 1), while the hypothetical reallocation option presented in Figure 2 would reach $9 billion by 2033; and

Perhaps most importantly when compared to status quo, this option would result in these elevated levels in perpetuity. In other words, rather than reaching $9 billion for a single year, it’s possible to build a Title II baseline at $9 billion per year in perpetuity.

Importantly, this example is hypothetical. The faster USDA obligates the IRA funding, the less there is available to build long-term baseline in a farm bill. In other words, the longer this drags on, the less opportunity there is to have a long-term impact. Regardless, while this option would trim IRA spending in the near term, it would result in permanent additional baseline to Title II of the farm bill going forward.

Figure 2. Historical Conservation Spending and Hypothetical Reallocation of IRA Dollars

Of course, Congress is under no obligation to follow the hypothetical allocation presented in Figure 2. The IRA was a one-time agreement strictly limited to $18 billion. If policymakers agree to a solution that allows for a permanent increase in Title II spending—particularly those who were opposed to the IRA in the first place—then it stands to reason that compromise may be required. For example, some of the gray area in Figure 2 could be allocated to fund other priorities in the farm bill. While some may be naturally opposed to this option, it could still result in long-term investments to Title II that dwarf the IRA funding.

Where does that leave us? Supporters of status quo (i.e., those demanding that the IRA not be brought into farm bill discussions) are guaranteeing that no more than $18 billion will be added to Title II programs for carrying out climate-smart agriculture (at least not in the near term, given the political environment that appears against more spending). While it would require some very difficult conversations about priorities and funding levels, to us this seems to present a win-win opportunity…but only if cooler heads can prevail.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

About the Author(s)

You May Also Like