Since March 2022, The Federal Open Market Committee (FOMC) has enacted eleven interest rate hikes accounting for a 525-basis point (5.25%) increase (FRED, 2023). We discuss how increasing this rate impacts agricultural lending in 2023.

The Fed Funds rate indirectly impacts the cost of other market interest rates such as those for agricultural operating loans. The FOMC influences rates by managing available cash (money supply) in the financial sector.

In terms of supply and demand, if cash is limited then the cost to borrow available cash (interest) increases, and borrowing is deterred. The Fed utilizes these tools, in either direction, to slow down the economy in times of rising inflation or to reinvigorate economic activity in recessionary times.

According to the Kansas City Fed (2023), operating loan rates are typically higher than the effective federal funds rate.

A survey of lending terms to farmers for the tenth financial district showed that, on average, a producer is paying an 8.03% interest rate compared to 3.66% the previous year. Agricultural lending has become increasingly expensive, creating additional financial stress in the agricultural sector.

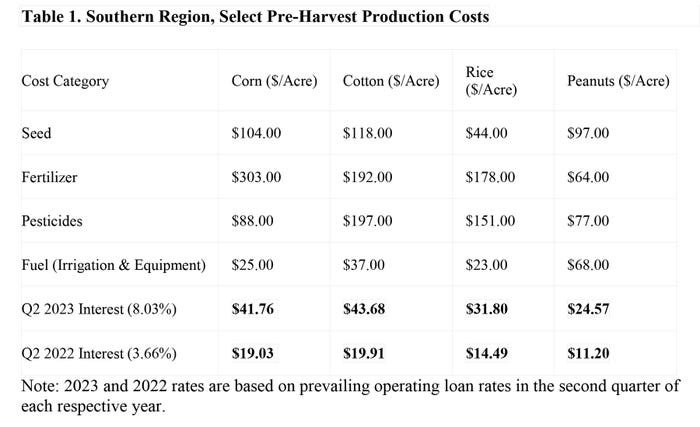

Table 1 is derived from budgets across the southern region. Included are estimates of primary pre-harvest expenses that might be included on an operating loan.

Cost of borrowing

Interest costs for Q2 2022 and 2023 (see Table 1) represent the cost of borrowing the capital needed to cover the listed production expenses at either 2022 or 2023 rates. Interest is estimated by totaling the select per acre production costs and multiplying it by the prevailing interest rate ($520*0.0803 = $41.76).

It’s worth noting that these expenses are only a subset of production costs. The impact on interest expenses will increase as individual operating loans include other costs of production. Additionally, higher interest rates are putting considerable pressure on the financing cost of equipment and land ownership.

Producers are now faced with paying over double the cost per acre in interest for 2023 than if they were to take out the exact same loan in 2022.

Keep an eye on decisions out of the September FOMC meeting as it may hint to the Fed’s future choices to raise rates through 2023.

If inflation continues to decrease and underlying economic activity slows, the need for further interest rate hikes may diminish.

Source: University of Arkansas System Division of Agriculture

About the Author(s)

You May Also Like