I’ve made no secret about being bearish on corn this fall, but prices continue to stubbornly persist between the $4.80 - $5.00/bushel range. The deeper I dive into the corn market, the more perplexed I am at trying to pin down just what exactly is supporting corn prices right now.

In recent morning reports, I’ve talked through this problem with myself at the reader’s amusement. This article is a deeper dive into that conversation so that we can truly nail down what is supporting corn prices and what we can expect from the corn market as fall progresses.

The dilemma

Figuring out corn demand/end usage has been a bit of a challenge for me as an analyst this fall, though I suspect it continues to play a role in supporting current price levels. Here’s my conundrum:

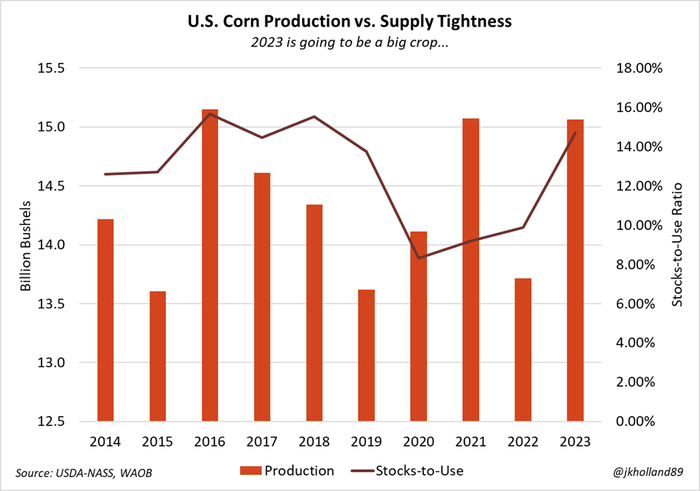

The U.S. is harvesting a big crop this year, regardless of how bad – or good, in many cases – yields were in your area. Production is going to be the third highest on record this year.

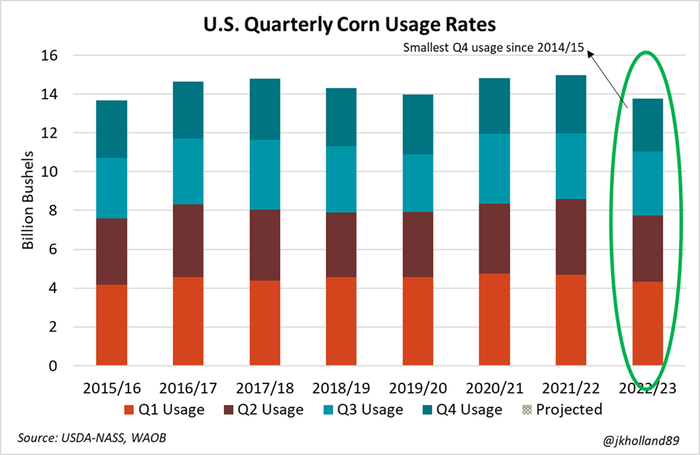

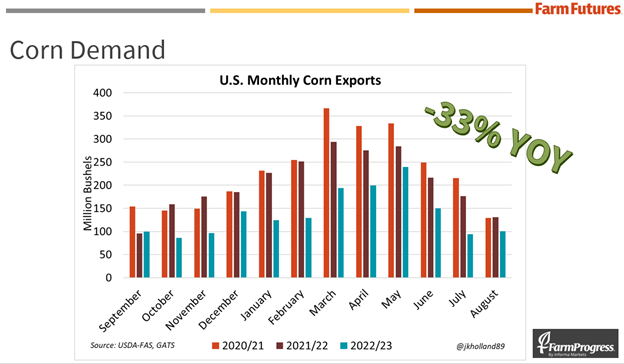

But we are coming off weak June-August 2023 usage rates. In fact, usage volumes for the last quarter of the 2022/23 marketing year were the lowest since the same time in 2014/15.

This year’s crop is similar in size to the 2021 crop. But the key difference between the two years is the lower usage rates this year compared to 2021/22 due to the limiting nature of last year’s (2022) small corn crop.

As a result, stocks-to-use (STU) ratios for the 2023/24 marketing year are forecast at 14.7%. The last time we saw STUs range between 13%-15% was between 2015-2019.

Average corn prices received by farmers during that time ranged between $3.36/bushel - $3.61/bushel. Dec23 prices are down to $4.78/bushel this morning.

So what exactly is keeping corn prices so close to $5/bushel right now? Brazil is currently planting its first corn crop of its growing season, though it isn’t large enough to generate significant price movement. That tells me that domestic demand must be keeping corn prices afloat, even though we are coming off a weak Q4 2022/23 in terms of usage.

This is the first year in several we have seen negative basis prices at harvest – a pattern that is typically the norm this time of year (more supplies = lower prices). But over the past couple weeks, other analysts and I have been hearing reports of improving corn basis prospects, particularly in the Plains and Western Corn Belt.

Since it’s going to be a big crop, the price support has to be coming from the end user side, though it is not clear to me which end user is propping up the corn complex. Livestock feed and ethanol corn consumption are expected to account for 34% and 32%, respectively, of 2023/24 beginning corn supplies. This year, corn exports make up 12% and food and other industrial usage accounts for 8%, with the remaining 13% left in ending stocks.

Ethanol – the dark horse?

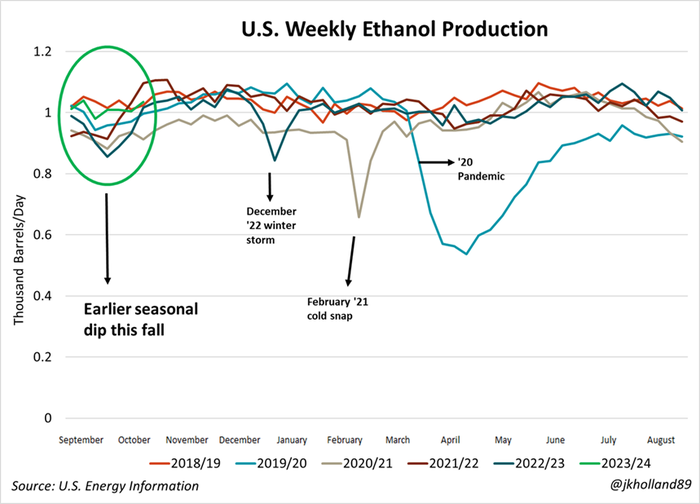

On Monday, cash bids at a couple ethanol plants across the Western and Central Corn Belt rose. Weekly ethanol production values rose for the third consecutive week through October 20, according to las Wednesday’s weekly Petroleum Inventory Status report from the U.S. Energy Information Administration.

Ethanol production margins remain profitable, even though blending support from the EPA as announced in June will remain fixed at 15 billion to 15.25 billion gallons per year between now and 2026 – relatively flat growth, especially compared to growing renewable diesel production.

But ethanol output remains below pre-pandemic levels as we put peak summer driving season into our review mirrors. And due to the fixed EPA blending mandate and growing consumer trend in purchasing electric vehicles, it seems unlikely that fuel consumption will return to the same levels before the pandemic, especially as gasoline costs are squeezing consumers’ pocketbooks.

So, is it coming from feed?

Glimmers of hope from livestock

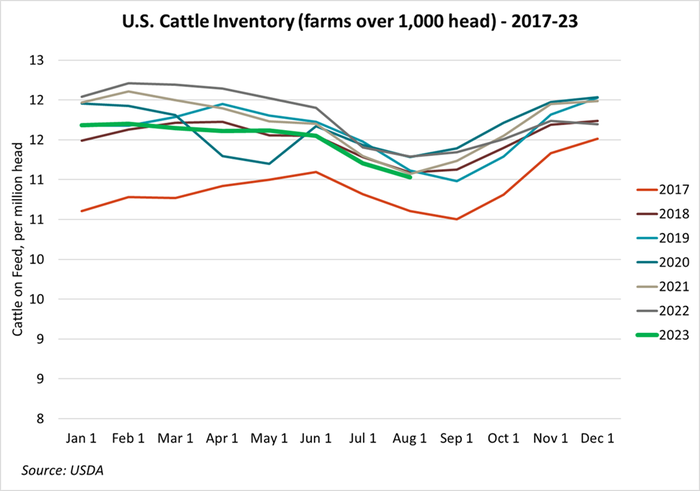

Heifer numbers were higher on October 1 relative to July. That’s not to say the cattle herd is expanding – it still faces questionable pasture conditions and high feed costs (and an aging operator demographic) that will continue to constrain expansion prospects, especially as meat packers are desperate for headcounts.

In fact, cow inventories (breeding stock) as of July 1 were the lowest for that time of year since USDA began tracking in 1971. But farmers reported holding back more heifers (young breeding stock) this fall compared to the same time a year ago, which suggests that wider corn availability this year might give a minor boost to the breeding herd.

Strong live cattle prices and persistently high corn costs aren’t encouraging the beef herd to expand anytime soon. Beef cow inventories were down 3% annually as of July 1 and the calf crop is expected to be 2% smaller this year. Milk cow inventories have stayed unchanged, though with lackluster milk prices over the past several months, our family’s dairy farm isn’t thinking twice about culling low performers at current cull prices – and we certainly aren’t alone in that train of thinking. Again, those packers are hurting for any bovine with a pulse.

But with corn crops on the Eastern Plains performing slightly better than expected, perhaps we are seeing some corn price support coming from cattle feeders on the Plains, scooping up affordable feed supplies ahead of winter.

As my dad pointed out as I talked through this conundrum with him last week, it’s a lot more palatable for cattle feeders to pay $4.80/bushel for this winter’s corn supplies than it was to pay $8/bushel last year (he told me the story of a fellow dairyman he talked to earlier this summer who paid $3.50/bushel over futures to have corn shipped into his Idaho dairy last year).

Livestock feed will be the largest end user of the 2023/24 corn crop. But prior to the pandemic craziness, livestock feed and residual usage made up 37% of annual corn consumption while ethanol barely used up 31%. At different points last year, ethanol consumption of corn was forecast higher than livestock and residual. And while that reality didn’t materialize, it reflects the reduced corn consumption volumes a smaller cattle herd inflicts across the ag commodity space.

*Some* export optimism

There’s no nice way to say it – 2022/23 was a dismal year for U.S. corn exports. In fact, it was the smallest annual U.S. corn export volume recorded since the devastating 2012/13 drought year.

A smaller 2022 crop wasn’t the only reason for the lackluster volume. A stronger dollar, high global prices in the aftermath of Russia��’s invasion of Ukraine, and increased competition from Brazilian supplies also deterred foreign interest in U.S. corn.

But with the U.S. on track to harvest a much larger crop this year, that story could change. With the extra supplies harvested this fall, USDA expects that 2023/24 corn exports will rise nearly 22% higher from last year to 2.205 billion bushels.

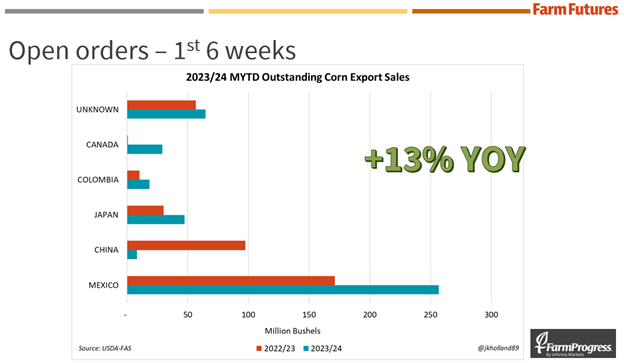

And there are already positive signs pointing to upcoming corn export prospects. Physical shipments through the first seven weeks of the 2023/24 marketing year are already 46% higher than the same time a year ago. Outstanding orders placed and accumulated (though not yet shipped) during that time are 21% higher than a year ago.

Although nearly 29 million bushels of 2023/24 corn has already been shipped to China this fall, new orders have been thin. China’s outstanding U.S. corn purchases through the first seven weeks of 2023/24 only total 8 million bushels – that’s nearly 92% lower than this time last year.

But other traditional top buyers of U.S. corn are already lining up for freshly harvested supplies. So far, the U.S. has already shipped Mexico over 84 million bushels – a 75% increase from last year. Mexico also has 59% more corn export orders sent to U.S. sources than a year ago, suggesting higher shipping volumes will follow, pending no GMO restrictions are enforced.

It’s not just Mexico looking to buy more this year. Japan and Columbia’s orders for U.S. corn exports are also notably higher this fall. After purchasing little U.S. corn last year, drought and wildfire this summer across the Canadian Prairies will require our neighbor to the north to order more U.S. corn in the coming months, especially as cooler weather closes in on North America.

With lower prices and volumes well below 2020/21 records, it seems likely 2023/24 corn export volumes are not going to be able to stage another record-setting run. Projected corn export volumes this year are comparable to those last seen in 2018/19 during the trade war. And the U.S. is increasingly becoming a secondary global corn supplier, filling in as a seller of last resort when Brazilian corn stocks are delayed in shipping channels as the cheaper Brazilian crop has taken over as the world’s largest corn export volume since 2022/23.

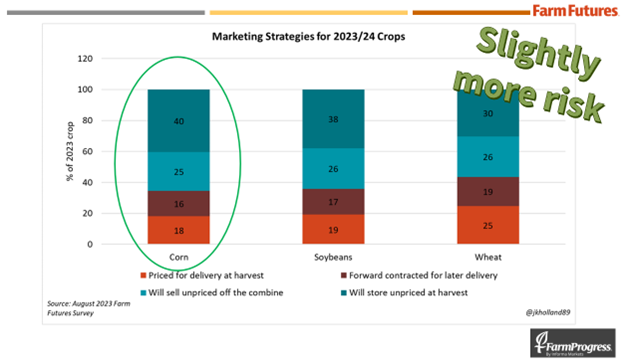

In the August 2023 Farm Futures grower survey, corn producers indicated they would store an average of 40% of their crop unharvested this fall – slightly higher from last year’s intentions. The futures spread currently favors storing crops this fall. Hopefully the improving corn export outlook will give corn prices the shot of support needed to remain profitable for farmers in the current supply environment.

Watching the fertilizer market

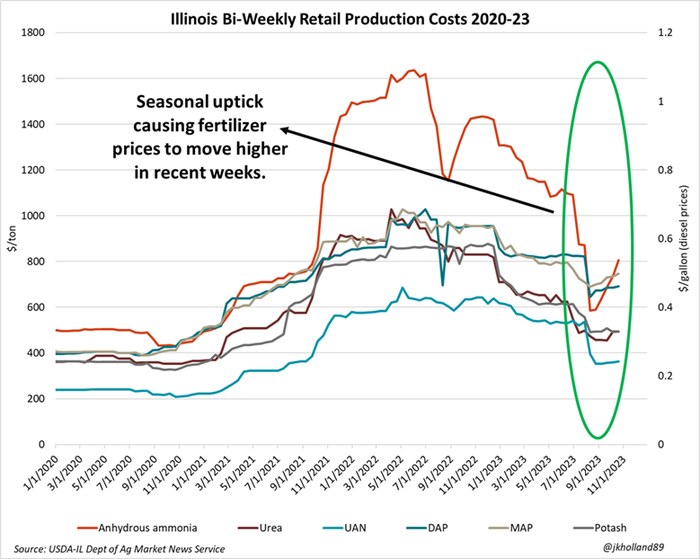

Fertilizer prices tumbled lower through the beginning of this fall, providing some profit margin relief to farmers feeling the pocketbook pinch of higher input costs due in large part to the ongoing Russian-Ukrainian conflict.

Nitrogen costs have experienced the biggest decline over the past year, with anhydrous ammonia and liquid UAN down 43% on the year to $805.91/ton and $363.20/ton, respectively, in Illinois as of October 19. Urea prices have fallen 41% lower during that time to $493/ton.

Even with lower prices, NPK and fuel costs are still high relative to historical prices, with seasonal forces pushing prices back up slightly over the past month or so. And we aren’t out of the era of higher price risk, either.

Planting season is underway in South America, with 2.2 million more acres of corn expected to be harvested this year in Brazil (56.6M ac.) and Argentina (17.5M ac.). Producers in that part of the world are expected to apply more nutrients to make up for missed 2022 applications that were not made due to high prices, scarcity following Russia’s invasion of Ukraine, and inclement weather.

Again, nitrogen prices have fallen more rapidly than phosphate and potash counterparts, reflecting some global production and shipping constraints facing the P and K markets. Phosphate producers in North Africa have slowed shipping paces to capture higher returns. And potash producers are increasingly scaling back expansion plans as lower prices received by farmers struggle to cover new capital expenses.

All fertilizer producers around the world are grappling with energy market uncertainty that is taking the biggest bite out of profit margins that have been shrinking over the past year as revenues from lower-priced product sales drift lower. Natural gas costs (natty gas comprises 70% of final anhydrous ammonia production) rallied last week on concerns about the ongoing Israel-Hamas tensions in the Middle East.

But markets are adjusting to the ongoing conflict. Plus, extended forecasts are pointing to a warmer winter for the Northern Hemisphere, which would reduce the volumes of natural gas used for heating. Stocks in Europe and the U.S. are plentiful, which could help send prices lower as spring application approaches.

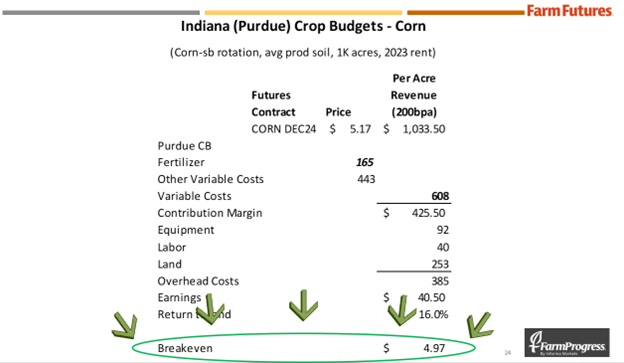

Earlier this fall, my redneck math calculated corn break evens between $4.80-$5.00/bushel. Is it possible that input costs are the key driver of corn prices staying so close to $5/bushel when supplies are ballooning? Maybe.

I currently project 2024 corn earnings at $40.50/acre (not including key tax items like depreciation). Soybean earnings for 2024 are forecasted at $37.50/acre – not much difference between the two.

The market needs to provide price incentive for farmers to continue planting corn, so it can only fall so far below break-even pricing for so long before correcting. And quite frankly, we don’t seem to be in that kind of situation just yet.

So I think it’s reasonable to deduce that corn markets are gleaning some price support from historically high fertilizer prices.

What’s next?

Exports may be helping to prop up prices at current levels, but higher corn end usage rates from livestock and ethanol will need to be reported during the winter months to maintain current price levels, as well as to help 2024 corn acres compete with 2024 soybean acres.

In the August 2023 Farm Futures grower survey, farmers indicated they would be taking slightly more risk in pricing 2023 corn crops relative to strategies used a year ago. More growers are either selling unpriced off the combine this fall or simply storing their crops unpriced. Fewer growers reported pricing out corn for delivery at harvest this year relative to last.

But even though slightly more risk may be used, the same end goal is in clear sight. Farmers expect to have 57% of their 2023 crop sold as of December 31, up just 1% from the previous year. That means that farmers are going to continue trucking their corn to end users at the same rates as last year, though they may be calling around for more bids than last year.

Markets will be closely eyeing next week’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA, with the expectation of further cuts to corn yields, which would have a muted to slightly bullish impact on prices. I have spoken with many farmers who reported average or above average crops, so I’m hesitant to think USDA will trim corn yields next week, which would keep bearish risks alive in the corn market.

About the Author(s)

You May Also Like