July 25, 2017

The Kansas City Federal Reserve released its second quarter Ag Finance Databook earlier this month.

Among the findings:

The pace of farm lending at commercial banks was steady in second quarter 2017.

The volume of non-real estate farm loans originating in the second quarter increased less than 4%. Declines in farm income have likely slowed the volume.

Farm loan volumes at commercial banks with sizable farm loan portfolio rose about 7% from last year, while volume of new farm loans in banks with smaller farm loan portfolio declined from year earlier.

Interest rates on loans for operating expenses, farm machinery and other livestock have increased 25 to 50 basis points from a year ago.

Lenders have lengthened maturity periods for non-real estate farm loans. Maturities have increased to 35 months, up from 23 months from 2007 to 2014. The increase is likely designed to improve cash flow for borrowers.

Delinquency rates for both farm real estate and non-real estate farm loans edged to about 2% for the first time since 2013 and 2012, respectively. However, delinquency rates have remained near their 10-year averages and less than the average rate for all bank loans.

Borrowers' demand for financing has remained strong. Demand for farm loan renewals and extensions remained elevated in each Federal Reserve district for the ninth consecutive quarter.

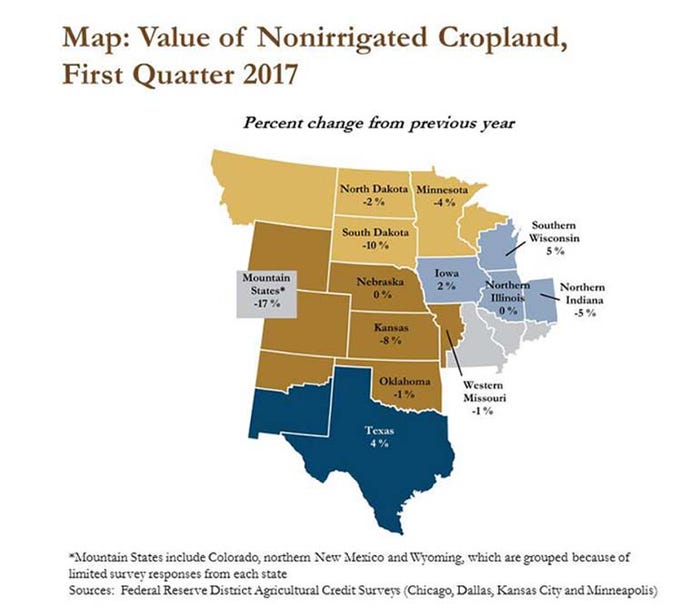

Farmland values have continued to decline. The largest declines have been in the Mountain states, South Dakota and Kansas, where there is a greater reliance on wheat and cattle. Bankers in southern Wisconsin, Texas and Iowa reported slight increases.

Source: Federal Reserve Bank of Kansas City

You May Also Like