Dry weather has again caused the Mississippi River levels to fall to near-record lows.

This is a problem for row crop producers and grain elevators in the Lower Mississippi River area, who rely on barges as the primary mode of transportation for grain. For example, during 2015-2019, approximately % of U.S. corn exports were moved by barge.

When the Mississippi River is low, barge traffic slows, causing barge freight prices to increase. Crop basis, defined as the difference between local cash prices and futures prices, is impacted by local market fundamentals, including the cost of transportation.

When barge rates increase, crop basis weakens (becomes more negative or less positive) at grain elevators near the Mississippi River.

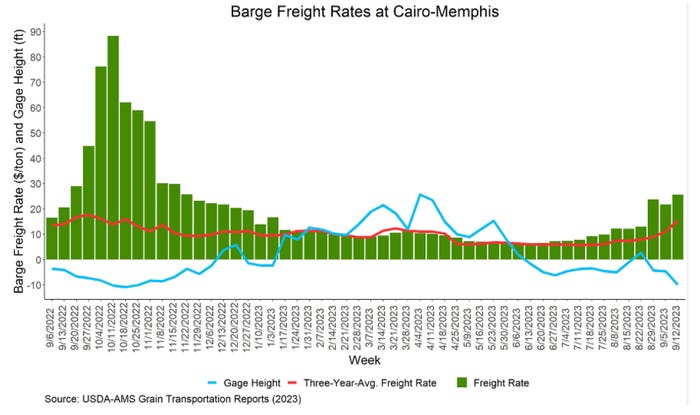

Figure 1 shows river barge freight rates for the 2022-23 marketing year compared to the three-year average.

3-year average

The three-year average indicates that we typically see small fluctuations in barge freight rates; thus, barge rates likely have a small effect on local commodity basis when river levels are sufficient. However, in 2022, the river level at Memphis hit a historic low of -10.81 feet, nearly stopping all barge traffic and sending barge freight rates to a record high of nearly $90/ton of grain.

As of September 5th, the river level declines have caused barge rates to increase to $30/ton. Although data is not included in the graph, the September 18th river level at Memphis is -9.56 feet.

Current weather forecasts look dry, and without sufficient rainfall, barge freight rates may increase similar to last year, causing another situation in which commodity basis drops.

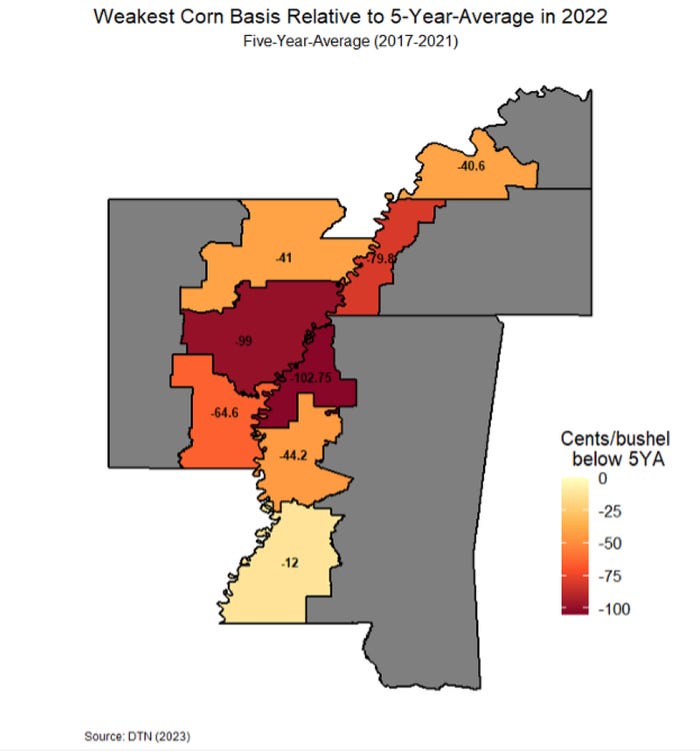

Figure 2 indicates the weakest corn basis in 2022 compared to the 5-year average for southern agricultural districts bordering the Mississippi River.

Risk avoidance

As the river levels were lowest during harvest season, producers without storage were forced to deliver and could not avoid basis risk.

Producers unlikely to avoid the risk included those taking the spot price, hedging through futures, or using hedge-to-arrive contracts where the basis is set near or at delivery.

At the minimum basis, hedging producers in southern agricultural districts bordering the Mississippi River, excluding southern Mississippi, could have experienced realized prices of $0.40-$1.03/bushel under their expected price, which is estimated when the hedge is set.

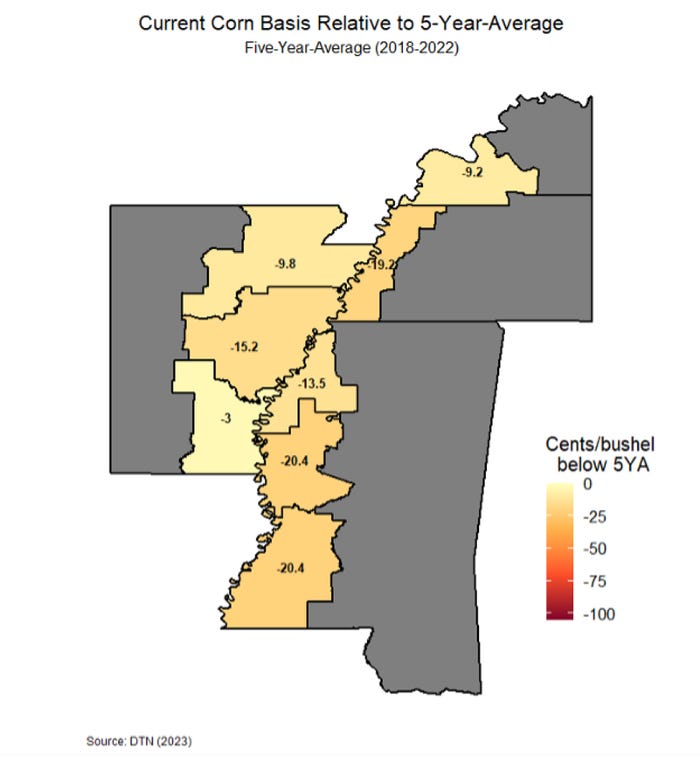

Figure 3 indicates that as river levels continue to drop and barge freight prices increase, the 2023 basis has started to widen again in the districts bordering the Mississippi.

The impacts vary drastically by region; however, as of September 12th, the average weekly basis is between 3 and 21 cents under the 5-year average which contains basis for marketing years 2017/2018 through 2021/2022.

Unexpected losses

If heavy rainfall does not cause river levels to improve, southern producers could again face unexpected losses due to the effects of falling river levels on barge freight rates and, thus, basis.

If the basis continues to drop, hedging producers will likely experience prices below their expected price, which could have huge implications on farm profitability and cash flow for Southern producers bordering the Mississippi River.

Producers have limited options for managing basis risk. Hedging or HTA contracts are typically used to minimize futures price risks; however, they leave the producer susceptible to basis risk, which is usually more stable than commodity futures prices.

However, last year and currently, lower river levels have caused unpredictable basis patterns.

If we continue to experience dry summers and low river levels, Southern producers bordering the Mississippi may need to rely on forward contracts, which lock in price and basis pre-delivery, or basis contracts, which lock basis in before river levels can decline.

Compared to hedging, a pitfall of these contracts is that they limit the flexibility of when and where grain is delivered.

Entering into a forward pricing contract also exposes a producer to production risk which may result in a fee from the elevator if agreed-upon bushels are not delivered in the specified window.

In the short term, if available, producers should consider utilizing on- or off-farm storage until basis improves.

Source: Southern Ag Today

About the Author(s)

You May Also Like