It’s earnings season on Wall Street, which provides the rest of us mere mortals a closer look at the broad macroeconomic trends at play in the fuel and fertilizer industries. Top global and domestic fertilizer companies Nutrien, CF Industries, and Mosaic have all released second quarter earnings results in recent days.

The overarching theme of these reports is that these companies are earning less revenue due to lower fertilizer costs. Low fuel expenses have helped to stop some of the bleeding, but those days are increasingly looking to be short-lived.

More Russian and Belarusian fertilizer supplies have returned to the market this summer. And even though Russia continues to flood the global market with its surplus oil reserves, production cuts and maintenance closures elsewhere in the world are helping to tighten the global energy balance sheet, making fuel more expensive as farmers prepare for fall harvest and application activities.

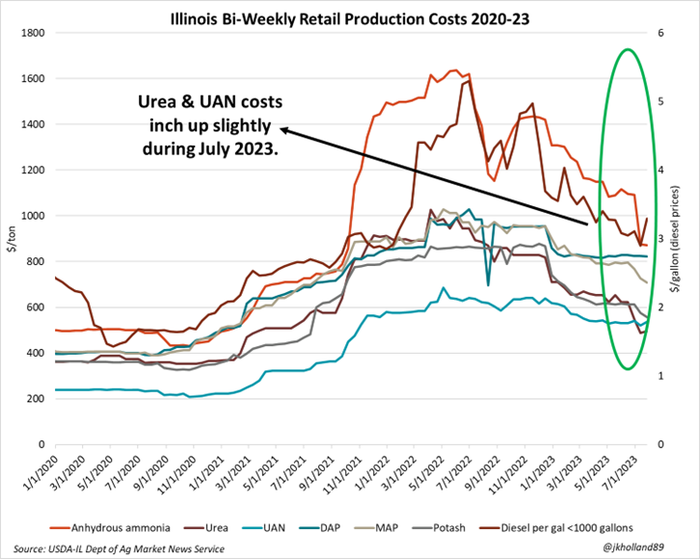

In Illinois, the basket of NPK and diesel retail offerings have fallen by 35% since reaching highs in late June 2022. For farmers, this means that the window to capitalize on reasonable fuel expenses, low Fall 2023 and Spring 2024 fertilizer costs, and current interest rate levels will only be open for a limited amount of time in the coming months.

Fertilizer companies cut back

Ahead of its second quarter earnings call on Thursday, Nutrien announced Wednesday afternoon that it would be putting an indefinite pause on current projects aimed at expanding its potash empire as well as its widely touted clean ammonia plant in Louisiana.

Despite the widespread push for green fertilizer production thanks in large part to the Inflation Reduction Act’s financial incentives to retrofit existing facilities to become greener, the low revenue and rising construction cost environment faced by the fertilizer industry is generating doubts about the timing and capacity for demand for clean ammonia – a risk no one wants to be saddled with at a moment when revenue streams are dwindling.

The world’s largest fertilizer producer cited low fertilizer prices for the indefinite pause on these big projects, estimating that capital expenditures for the year would be reduced (salvaged?) by a whopping $200 million. Belarus has resumed its potash shipments following Western banking sanctions enacted after Russia’s invasion of Ukraine last year, flooding the global market with fresh potash supplies.

Translation: Nutrien isn’t making enough revenue at current fertilizer price levels to finance these expansion projects.

The limited production capacity, surplus global stocks, and uncertain farmer demand will likely cause Nutrien to pare back its 2023 profit forecasts. After Nutrien made this announcement on Wednesday, its share price fell 2.6%. It now expects its earnings per share price to significantly drop from the prior forecast of $5.50-$7.50/share to $3.85-$5.60/share (ouch).

This isn’t the first sign the fertilizer industry has given the market that surplus stocks, low prices, and questionable usage rates are taking a bit out of fertilizer producers’ bottom lines. In July, Nutrien announced it would scale back production at a Saskatchewan potash mine as prices tumbled amid robust global supplies and sluggish farmer demand.

Following that announcement, the company projected lower fiscal year profits due to the lower prices but also a since-resolved strike by Canadian dock workers that slowed fertilizer export volumes.

Low prices cure record fertilizer revenues farmer profit squeeze

CF Industries cited low revenues as the driving force behind a nearly 55% decline in second quarter earnings per share estimates. But the huge drop in share price was still not as big as analysts had been expecting for CF Industries’ second quarter.

The fertilizer producer’s net sales from its ammonia division fell 53% from the prior year. Granular urea sales dropped 45%, net urea ammonium nitrate sales fell 44%, and ammonium nitrate (liquid UAN) sales tumbled 59% lower during that time.

Lower natural gas costs are helping to somewhat offset the lower prices companies are earning from cheaper fertilizer sales. This dynamic could keep fertilizer prices fairly moderated (relative to 2022 highs) for farmers for at least the remainder of 2023.

“The global nitrogen supply-demand balance will continue to be positive owing to robust demand from agricultural and forward energy curves displaying an elevated cost curve,” CF Industries says in the outlook portion of its earnings release. “Energy price differences between major producers in North America and minor producers in Europe and Asia continue to be significantly higher than historical levels.”

“These stronger differentials are expected to last for a considerable amount of time, based on forward energy curves,” Zacks Investment Research firm notes of this outlook. “There will continue to be considerable margin opportunities for low-cost North American producers on the back of the global nitrogen cost curve.”

Farmer demand shows signs of life

Meanwhile, Mosaic’s CEO announced yesterday that the company expects its Colonsay, Saskatchewan potash mine to keep running “for the foreseeable future” even though Mosaic missed its second quarter earnings projections amid the low-priced fertilizer environment.

The company had restarted the previously idled Colonsay plant in July to help offset summer maintenance closures at Mosaic’s larger Esterhazy mine, also in Saskatchewan. This move suggests that even though long-term expansion signals may be calming in the fertilizer industry, it still remains profitable for these companies to produce enough volume to keep the global fertilizer balance sheet in a liquid position.

While Mosaic was forced to cut its phosphate prices by 36% from last year to $585/metric tonne, the company was buoyed by strong North American and Brazilian usage and is optimistic losses will be offset this quarter by lower raw material (energy) costs. Analysts noted that farmers held off additional fertilizer purchases in the first quarter, though the current low-cost environment could help boost sales in this (the third) quarter.

Mosaic also cited higher Russian and Belarusian potash exports as reasons for higher global stocks and thus lower fertilizer prices (and revenues). Norwegian fertilizer producer Yara also posted lower-than-expected earnings results amid low fertilizer prices and surplus global supplies.

To be sure, it was inevitable that all of these companies would see massive annual earnings declines after reaping unusually high revenues from last year’s operating environment, which battled the constraints of banking sanctions on Russia and Belarus that further constricted global fertilizer supplies (sort of…).

The energy market wrinkle

Even with Russia continuing to flood the market with their oil supplies, production cuts from OPEC and improving global macroeconomic sentiments are helping to tighten global oil stocks and push energy prices higher.

Brent crude oil prices rose 13% higher in July as a result and is trading near $85.50/barrel this morning. A 16% rise in U.S. crude oil (West Texas Intermediate) during that time has been keeping gasoline and diesel prices high this summer.

There are several implications to unpack here. First, for farmers looking to lock in fuel pricing ahead of fall harvest and fertilizer application activities, the price tag may not be optimal for at least another month.

“The Standard Chartered team says oil demand will outstrip supply by 2.8 million barrels a day this month, further boosting oil prices,” writes Anna Hirtenstein for the Wall Street Journal. “It says the daily deficit is likely to top two million barrels through to year-end, barring seasonal disruptions in October caused by refinery maintenance.”

Second, higher energy prices could reverse the easing inflation trends observed by the economy in recent months and could convince the Federal Reserve to slow interest rate hikes.

“It’ll likely slow the disinflationary trends we’ve seen,” Richard Bronze, head of geopolitics at consulting firm Energy Aspects, told the WSJ. “This will be a challenge for central banks.”

If farmers are looking to lock in fuel prices to avoid that headache during harvest, between now and the Federal Reserve’s next interest rate hike (likely after the Sept. 19-20 FOMC meeting) may offer the cheapest financing costs for pricey fuel.

Farmer success strategies

Fertilizer companies are scrambling to move these cheaper fertilizer supplies out of inventory, so I think farmers will be in a great bargaining position as fall prices are released this month. And I think this will be a very prudent move for farmers to make – corn prices are also falling on the heels of a larger than expected crop.

Recent weather forecasts indicate this crop could only improve and therefore corn prices are more likely to fall, holding all other factors unchanged. If that remains to be the case, farmers would be wise to not only lock in 2024 fertilizer prices at their current low levels, but also to forward price some of their future 2024 crops to adequately finance the aforementioned inputs.

The 2022 pricing environment – and even the early part of 2023 – was largely unfavorable for fertilizer buyers. And even though fertilizer prices remain historically high, they are still cheap relative to last year’s highs and plenty affordable at current crop price levels.

"The macro environment is bearish, Corn Belt forecasts are favorable, and (price) seasonals are bearish," Peak Trading Research said in a note as reported by Reuters on Thursday morning.

The onus is now on farmers to capture those profits.

Read more about:

FertilizerAbout the Author(s)

You May Also Like