COTTON SPIN: Limit risk: Watch out for increasing supply

Growers should be poised and ready to quickly take advantage of new crop price rallies, especially if they are mostly driven by short-lived hedge fund buying and/or mill fixations on maturing old crop contracts. Forward contracting and/or various options strategies can be used to limit downside risk while retaining upside potential.

March 24, 2017

USDA’s March world old crop cotton supply and demand numbers involved mildly bearish adjustments.

World carry-in was increased due to an upward revision in Australian old crop of about 250,000 bales. World production was raised mostly due to the increase in the U.S. (discussed below). World consumption was barely changed after some offsetting reductions in Turkey and Central Asia, plus some increases in Indonesia and Bangladesh. The trade categories were adjusted by over 200,000 bales, reflecting small adjustments in a number of both importing and exporting countries.

After a small adjustment to the “loss” fudge factor category, the bottom line was a month-over-month increase in world ending stocks for 2016/17 of 0.58 million bales. Such a monthly adjustment would be neutral to slightly price-weakening, according to theory and history.

The 2016/17 U.S. cotton numbers were more bullish. A moderate 271,000 bale increase in U.S. production was more than offset by an unusually large upward adjustment in exports, from 12.7 million to 13.2 million bales. The latter had been expected for a while, but perhaps not this much all at once.

Likewise, the increase in production was expected in a month or two to jibe with the final ginnings report from USDA. After a small adjustment to the “loss” fudge factor category, the bottom line was a month-over-month 300,000 bale decrease in projected U.S. ending stocks, to 4.5 million bales. Such monthly adjustments would ordinarily have a small positive price response.

INCREASED PLANTINGS A CONCERN

Looking at the new crop outlook, I am concerned about the impact of a large number of planted acres.

Julius Caesar’s assassination was famously foretold with the warning: “Beware the Ides of March!” (March 15th). But I’m more worried about March 31, the date the USDA Prospective Plantings report is released, and it happens to coincide with the end of the month and the end of the quarter. What soothsayer wouldn’t be cautious about that?

Let’s assume that 12 million acres of all cotton will be planted. If we take USDA’s tentative (February) projections of 13 percent abandonment and 816 pounds per acre in yield, we get a large 17.7 million bales of production.

USDA assumed, and I agree, that a larger crop would lead to larger exportable surpluses. But, unless the 2017 crop has the same exceptional quality as its predecessor, then that half million to one million more bales of U.S. exports will probably happen at a lower price than today.

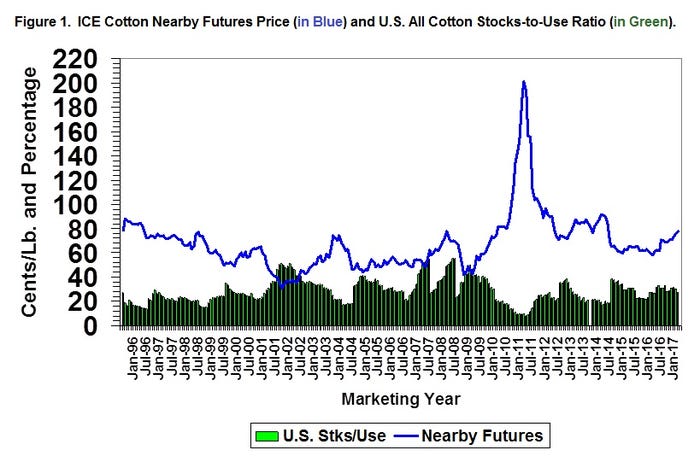

In historical terms, it seems very likely that 2017/18 cotton ending stocks-to-use will be at least three or four percentage points higher than the 31 percent level for the 2016/17 marketing year. As Figure 1 shows, an increase in ending stocks-to-use toward 40 percent is typically associated with price weakness.

WEAKNESS TOWARD FALL

It will take all summer for the market to figure out its expectations of the crop size. Unless it turns out to be surprisingly small, I would expect the typical price weakness to set in as we approach the fall harvest season.

Growers should be poised and ready to quickly take advantage of new crop price rallies, especially if they are mostly driven by short-lived hedge fund buying and/or mill fixations on maturing old crop contracts. Forward contracting and/or various options strategies can be used to limit downside risk while retaining upside potential.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/

Cotton

About the Author(s)

You May Also Like