June 22, 2018

Last month I wrote a column entitled “New crop cotton futures in the 80s.” As of this writing, that title is still accurate. But the intervening 30 days have been one wild ride!

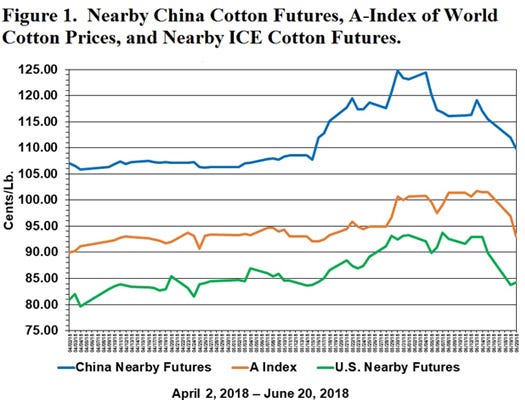

ICE (Intercontinental Exchange) futures surged into the 90s, consolidated there, and then plunged back to the mid-80s (Figure 1, green line). There have been many apparent influences on the market, which is to say influences on the hedge fund speculators holding long cotton futures positions.

The rise and fall of ICE cotton futures has mostly followed the Chinese cotton market (Figure 1, blue line). At mid-May, the initial rise in the Chinese cotton market was attributed to bad weather in Xinjiang Province, bullish state reserve auction policy, and speculative buying on rising expectations of more Chinese imports.

The week before the Memorial Day holiday saw another round of U.S. cotton futures chasing the Chinese cotton market higher. Fundamental news in the U.S. focused on hot, dry weather in the Southern Plains region as growers ran up against crop insurance planting deadlines.

The holiday-shortened week of May 29-June 2 saw more of the same, with limit up moves in Chinese cotton futures and ICE futures, which vaulted over 90 cents. The next two weeks saw prices slip and gyrate around 90 cents. The expansion in hedge fund net longs that lifted prices to these levels appeared to level off and shrink slightly by June 12.

A MAJOR IMPORTER

June 14 saw official Chinese announcements confirming an expansion of duty-favored import quota. By raising the allowed amount of 1 percent tariff cotton from the minimum 4.1 million bales to 7.8 million bales, it signaled a return of China as a major importer. However, that confirmation did not seem to matter to the market.

June 15 saw China again announce 25 percent tariffs on U.S. cotton, this time to be implemented within a couple of weeks. An earlier threat of Chinese tariffs on U.S. cotton, circa April 4, would have had a much later date of implementation. Whenever they are implemented, it means that U.S. cotton imports will be more expensive than cotton from competitors like Australia or Brazil.

In the long run, I would expect the impact of Chinese tariffs to be more of a reshuffling of U.S. cotton exports, rather than a reduction. Countries like Vietnam, Indonesia, Bangladesh, Pakistan, and India might import more U.S. cotton than they previously would have, spin it into yarn, and ship that yarn to China duty-free.

SCARED SPECULATORS

However, the short run effect of the June 15 China tariff announcement was to apparently scare a lot of hedge fund speculators out of their long positions in ICE futures. Hence, the sharp fall from the 90s back to the 80s.

It probably didn’t help the speculators that the drought-stricken Southern Plains region received several rounds of scattered showers during the first two weeks of June.

So now what? If you hedged some expected production when ICE futures were in the 90s, that was a reasonable move.

If you can hedge some expected production now that ICE futures are back in the mid-to-lower 80s, that is also a reasonable move. I define reasonable as hedging a price floor above your costs of production, while keeping the upside open.

For additional thoughts on these and other cotton marketing topics, please visit by weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like