August 4, 2015

I have several Columbia brand shirts. I like the style. They are comfortable. They never need to be ironed. Five years ago, I owned none. Now these are my favorite shirts. These shirts are 100 percent polyester. They were made in Indonesia.

Very often at grower meetings and other conferences, I am asked about the impact of manmade fibers (MMF) on the demand for cotton and, ultimately, the price farmers receive for cotton. My answer most often has been something like “Manmade fibers are not a threat to cotton as long as the consumer prefers cotton. Manufacturers cannot go against what consumers want”.

That’s a very subjective and cautious answer—“as long as the consumer prefers cotton.” In the present environment where cotton and MMF are competitively priced (polyester has actually been cheaper than cotton), manufacturers could and certainly have substituted MMF for cotton to save money but that business model ultimately does not work unless the consumer is willing to purchase the final product.

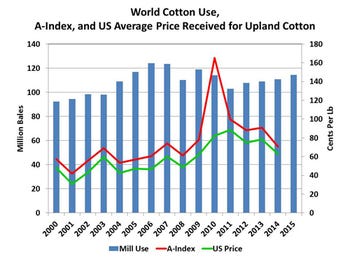

The World demand (Use) of cotton peaked at 124 million bales in 2006-07 and just slightly less than that in 2007-08. From 2000 to 2006, Use increased at a rate of 5.1% per year. Use declined sharply in 2008-09 due to global economic slowdown, recovered the following year, but then declined to a low of only 103 million bales by 2011-12—the lowest level since 2003. During this time, the World price of cotton (A-Index) and US prices have been high.

World demand has begun to recover—currently forecast at 114.4 million bales for the 2015 crop year and averaging 2.7% growth per year since 2011. This is welcome news. World cotton production exceeded demand (Use) for 5 consecutive years from 2010 to 2014. This is what created the massive stocks problem we now have.

The 2015-16 crop year is expected to be the first time since 2009 that demand will exceed production. Stocks are a function of both production and use. The significant decline in cotton’s use/demand since 2006 has been as much a cause for our “stocks problem” as anything.

So, what can be done?

Do the math—unless demand improves significantly, especially when you consider the improvements made in yields in recent years, we’ll simply need less cotton planted to meet demand and provide a reasonable carryover. Cotton Incorporated says that in the apparel market alone, the equivalent of 3 million bales per year has been lost to synthetic fibers. That’s a concern.

Cotton prices last season and again this year have sent the signal that less acreage is needed. Price is a double-edged sword—a certain portion of the demand equation depends on the price of cotton being competitive with MMF, yet price must be high enough to provide the needed level of net return to cotton producers.

A portion of demand growth is realized automatically due to population growth. Growth in market share and the more difficult part of growing demand, depends on uses and new uses for cotton, on relative prices and the substitutes for cotton, and consumer demand and preferences. The cotton industry must continue to promote cotton, stress the consumers preference for cotton, find new uses and technologies that expand the market for cotton. “Non-wovens” such as disposable diapers, upholstery, insulation, etc. represent a potential growth market.

Synthetic or manmade fibers are desired in the spinning process due to their consistency of length and quality. Cotton breeders and producers can help rival synthetic fibers by emphasizing quality characteristics like length, length uniformity, and strength.

I also have several 100% cotton Columbia shirts. They were made in India.

You May Also Like