February 20, 2024

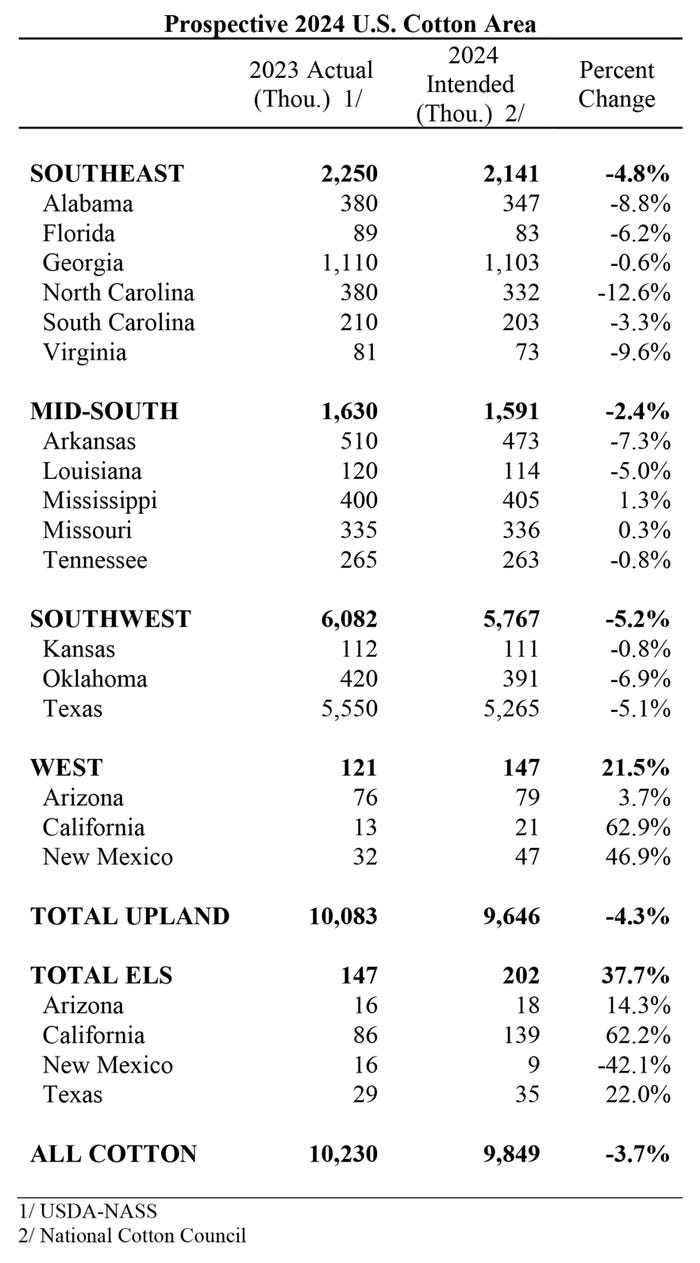

U.S. cotton producers intend to plant 9.8 million cotton acres this spring, down 3.7% from 2023, according to the National Cotton Council’s 43rd Annual Early Season Planting Intentions Survey.

Upland cotton intentions are 9.6 million acres, down 4.3% from 2023, while extra-long staple (ELS) intentions of 202,000 acres represent a 37.7% increase. The detailed survey results were announced today during the 2024 National Cotton Council Annual Meeting.

Dr. Jody Campiche, the NCC’s vice president, Economics & Policy Analysis, said, “Planted acreage is just one of the factors that will determine supplies of cotton and cottonseed. Ultimately, weather and agronomic conditions are among the factors that play a significant role in determining crop size.”

Using ten-year average abandonment rates along with a few state-level adjustments to account for current moisture conditions, Cotton Belt harvested area totals 8.1 million acres for 2024 with a U.S. abandonment rate of 17.9%.

Using the five-year average yield for the Southeast and the Midsouth and the 10-year average yield for the Southwest and the West generates a cotton crop of 14.6 million bales, with 14.0 million upland bales and 538,000 ELS bales.

Planting survey

The NCC questionnaire, mailed in mid-December 2023 to producers across the 17-state Cotton Belt, asked producers for the number of acres devoted to cotton and other crops in 2023 and the acres planned for the coming season. Survey responses were collected through mid-January.

Campiche noted, “History has shown that U.S. farmers respond to relative prices when making planting decisions. As compared to average futures prices during the first quarter of 2023, all commodity prices were lower during the survey period, but cotton had the smallest decline. As a result, the price ratios of cotton to corn and soybeans were higher than in 2023. Based on historical price relationships, this would generally suggest an increase in cotton acreage. However, the 2024 crop year could go against that relationship due to high production costs relative to current prices.”

Southeast

Southeast respondents indicate a 4.8% decline in cotton acreage to 2.1 million acres. In Alabama, the survey responses indicate an 8.8% decrease in cotton acreage. In Florida, respondents indicated 6.2% less cotton. Georgia growers expect to plant 0.6% less cotton, while the survey indicates a 12.6% decline in North Carolina’s cotton area. South Carolina growers expect to plant 3.3% less cotton, with Virginia growers reducing cotton acreage by 9.6%. According to the survey responses, the expected decline in cotton acres is due to an increase in corn, soybeans, and peanuts.

Midsouth

Midsouth growers intend to plant 1.6 million acres, a decline of 2.4% from the previous year. In Arkansas, acreage is expected to decline by 7.3%, while Louisiana growers expect to plant 5.0% less cotton. In Mississippi, cotton acreage is expected to increase by 1.3%. Missouri growers expect to plant 0.3% more cotton, while Tennessee acreage is expected to decline by 0.8%. Survey responses suggest an increase in soybeans and ‘other crops�’.

Southwest

Growers in the Southwest intend to plant 5.2% less cotton. Kansas growers expect to plant 0.8% less cotton, while Oklahoma producers expect to reduce cotton acreage by 6.9%. Texas acreage is expected to decline by 5.1%. Southwest respondents indicated an increase in corn, sorghum and wheat for 2024.

West

In the West, upland cotton acreage is expected to increase by 21.5%. Upland cotton acreage is expected to increase by 3.7% in Arizona, 62.9% in California, and 46.9% in New Mexico. According to the survey responses, the expected increase in upland cotton acres is due to a decrease in corn and ‘other crops’.

ELS acreage is expected to increase by 37.7% in 2024. Arizona growers expect to plant 14.3% more ELS cotton, while California growers expect to plant 62.2% more ELS cotton. More normal weather conditions are expected to play a role in the increased acreage as excessively wet conditions in 2023 prevented some acres from being planted. New Mexico ELS cotton acreage is expected to decline by 42.1%, while Texas growers expect to plant 22.0% more ELS cotton. Overall, U.S. cotton growers intend to plant 202,000 ELS acres in 2024.

NCC delegates were reminded the expectations are a snapshot of intentions based on market conditions at survey time with actual plantings influenced by changing market conditions and weather. Producers will continue to monitor changes in commodity prices and input costs before finalizing their 2024 acreage decisions.

Since the survey period, cotton prices have increased while corn and soybean prices have further declined. The change in the price ratios could result in higher cotton acreage than reported on the NCC survey.

Source: National Cotton Council of America

You May Also Like