1 Min Read

Corn price post little movement following the latest round of USDA data.

Ethanol usage was raised +25 million bushels to 5.350 billion. Non-ethanol food, seed and industrial was raised +10 million bushels.

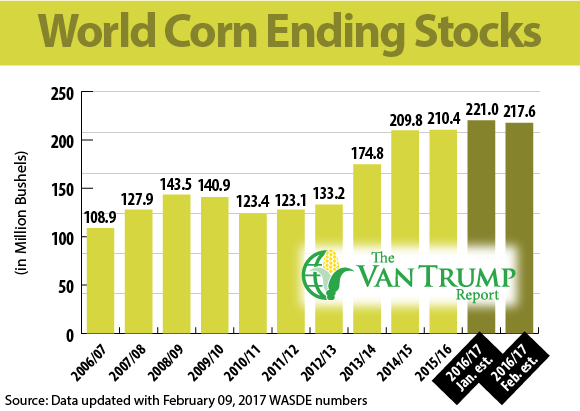

Corn ending stocks are lowered -35 million bushels from last month. The projected range for the season- average corn price received by producers was narrowed 10 cents on each end to $3.20 to $3.60 per bushel, with the midpoint unchanged at $3.40.

Production in both Argentina and Brazil was left "unchanged." Perhaps digested as somewhat bearish was the fact the USDA raised their corn export estimates for Ukraine and Canada.

About the Author(s)

Subscribe to receive top agriculture news

Be informed daily with these free e-newsletters

You May Also Like