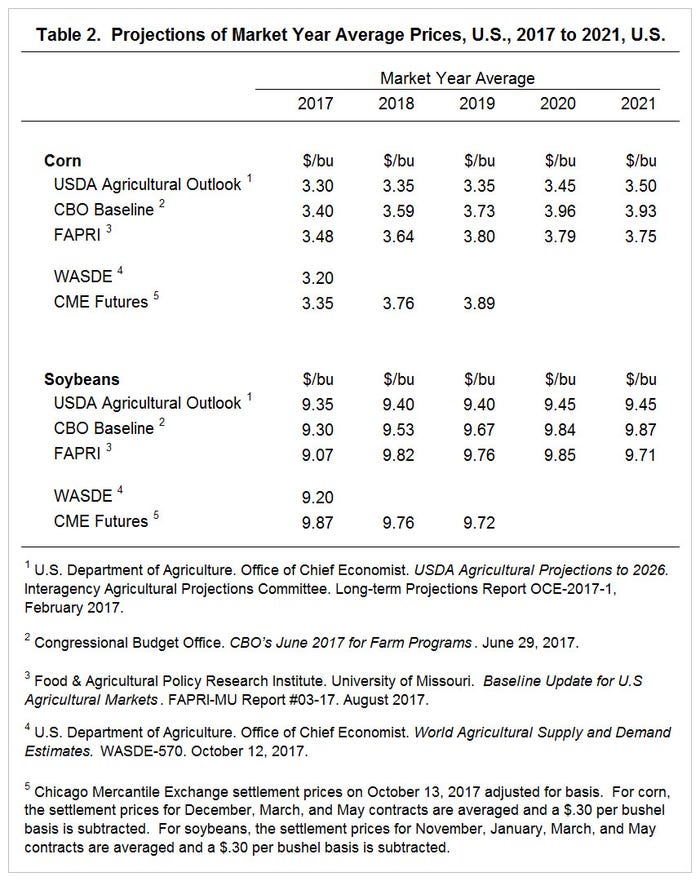

Will corn and soybean prices go up or down over the next five years, and will those price swings be dramatic or minimal? That ultimately depends on who you ask, but USDA, the Congressional Budget Office (CBO) and the Food and Agricultural Policy Research Institute (FAPRI) each have varying projections through 2021, with CME Futures adding its own estimates through 2019.

Two University of Illinois ag economists, Gary Schnitkey and Todd Hubbs, recently compared the numbers on the university’s farmdocdaily website. Although each forecast differs, it’s not by a large amount – especially for corn, the economists note.

“These corn price forecasts are quite consistent,” they write.

For example, for 2018, each source suggests corn prices in the mid-$3 range. USDA offers the lowest estimate, at $3.35 per bushel, with CME Futures delivering a more bullish projection of $3.76 per bushel.

Then, for 2019, corn price estimates inch ahead to the mid-to-high $3 range. Once again, USDA offers the lowest estimate, at $3.35 per bushel, and CME Futures comes in on the high end of the range, at $3.89 per bushel. Further out, corn price estimates range between $3.45 and $3.96 per bushel in 2020, and between $3.50 and $3.93 per bushel in 2021.

“Soybean price forecasts fall within relatively narrow ranges as well,” the economists note.

For 2018, that includes a range of guesses between $9.40 and $9.82 per bushel. For 2019, the range tightens slightly to $9.40 and $9.76 per bushel. Further out, soybean price estimates range between $9.45 and $9.85 per bushel in 2020, and between $9.45 and $9.87 in 2021.

“Making decisions with prices in these levels seem prudent,” the economists note. “For example, cash rental decisions should be made with the expectation of mid-$3 corn prices and mid-$9 soybean prices. Basing cash rents on higher prices could place farmers in financial stress.”

That’s not to say higher prices can’t occur, Schnitkey and Hubbs add. Any number of weather-driven production shortfalls could kick prices much higher than average. But on the other hand, there are plenty of potential wildcards – if the U.S. pulls out of NAFTA is one scenario that comes to mind – that could lower future grain prices.

“It does not seem reasonable to use price forecasts that are not in the mid-$3 range for corn and mid-$9 range for soybeans,” the economists conclude. “Obviously, corn and soybean prices will vary from these projected levels sometime in the future. The events leading to those changes are unpredictable at this point in time.”

About the Author(s)

You May Also Like