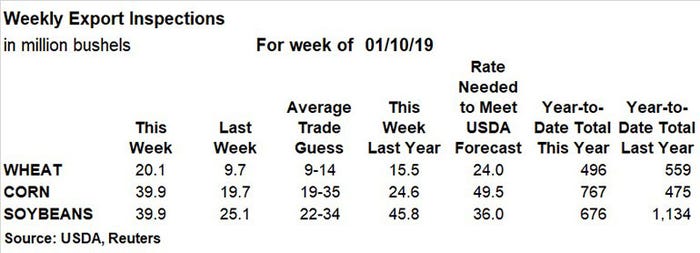

Corn, soybean and wheat export inspections moved moderately higher from a week ago, but a bullish round of data wasn’t enough to move grain prices higher this morning, according to Farm Futures senior grain market analyst Bryce Knorr.

“Better than expected export inspections all around didn’t give the market much of a boost, with only corn holding on to minor gains this morning,” he says. “Year-to-date totals for soybeans and wheat remain well behind levels suggested by USDA’s December forecast, though soybeans did beat the rate needed every week through August to reach the government’s projection.”

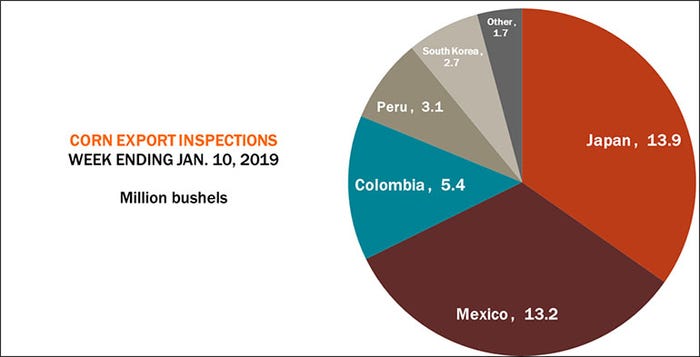

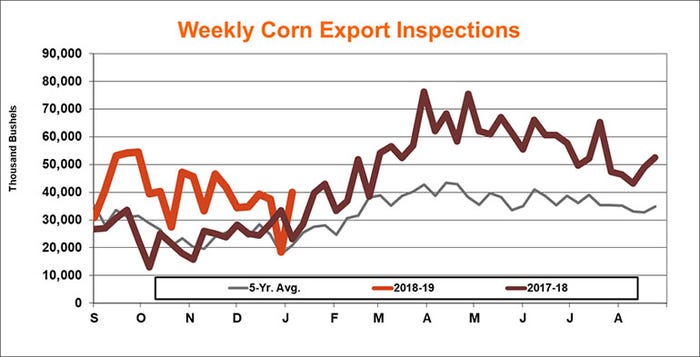

Corn export inspections topped 39.9 million bushels for the week ending January 10, which doubled the prior week’s total of 19.7 million bushels and bested trade estimates that ranged between 19 million and 35 million bushels. The weekly rate needed to match USDA forecasts still moved higher, however, to 49.5 million bushels. Cumulative totals for the 2018/19 marketing year reached 767 million bushels, remaining 615 ahead of last year’s pace.

Japan was the No. 1 destination for U.S. corn export inspections last week, with 13.9 million bushels. Other top destinations included Mexico (13.2 million), Colombia (5.4 million), Peru (3.1 million) and South Korea (2.7 million).

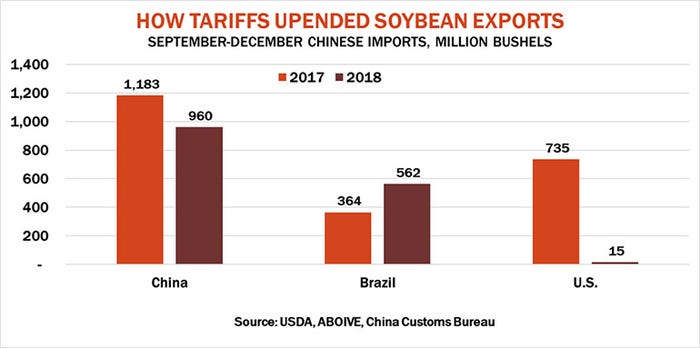

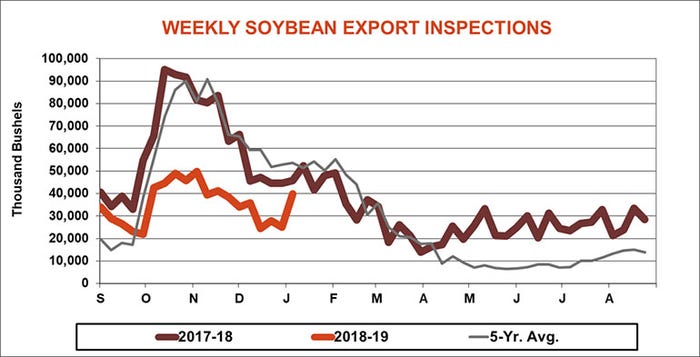

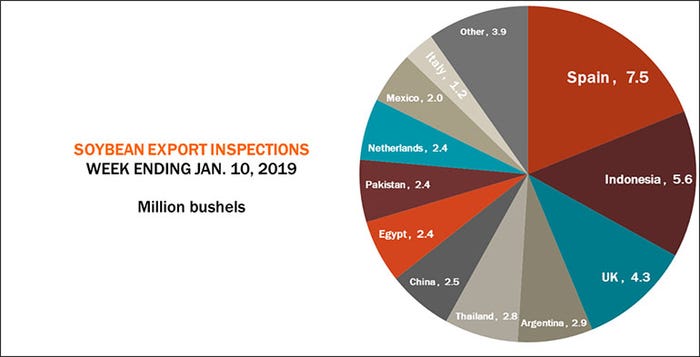

Soybean export inspections last week also tallied 39.9 million bushels, moving moderately ahead of last week’s total of 25.1 million bushels and staying ahead of average trade estimates that ranged between 22 million and 34 million bushels. Totals also stayed ahead of the weekly rate needed to match USDA forecasts, which eased slightly to 36.0 million bushels. Cumulative totals for the 2018/19 marketing year continue to lag 40% below last year’s pace, however, reaching 676 million bushels.

“China shipped out another 2.5 million bushels of soybeans, this load out of the Gulf,” Knorr notes. “That gives the buying a lot of time to redirect the vessel if trade negotiations hit a snag. The latest data from China showed total soybean imports in December down 40% from 2017 levels. Total imports in the first quarter of the marketing were down 19% from last year’s levels.”

Spain was the top destination for U.S. soybean export inspections last week, accounting for 7.5 million bushels. Other leading destinations included Indonesia (5.6 million), the United Kingdom (4.3 million), Argentina (2.9 million), Thailand (2.8 million) and China (2.5 million).

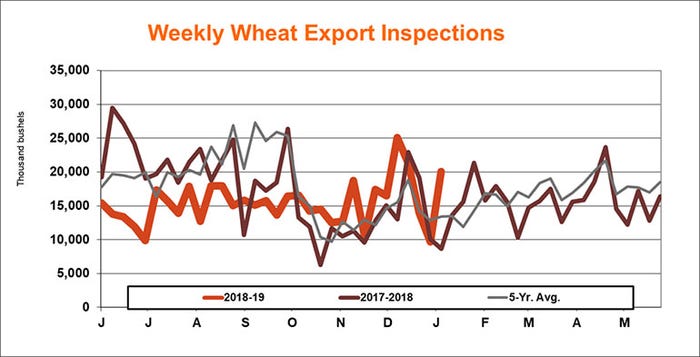

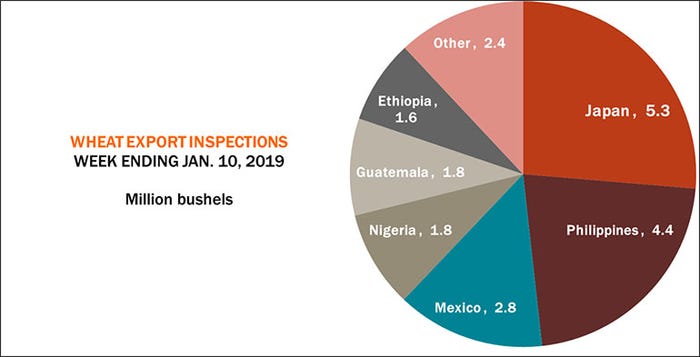

Wheat export inspections rebounded significantly last week, doubling the prior week’s total of 9.7 million bushels to reach 20.1 million bushels. That total also exceeded average trade estimates that ranged between 9 million and 14 million bushels. The weekly rate needed to meet USDA forecasts still moved higher, however, reaching 24.0 million bushels, as cumulative totals for 2018/19 is still 11% lower year-over-year after reaching 496 million bushels.

Japan was the leading destination for U.S. wheat export inspections last week, with 5.3 million bushels. Other top destinations included the Philippines (4.4 million), Mexico (2.8 million), Nigeria (1.8 million) and Guatemala (1.8 million).

About the Author(s)

You May Also Like