There has been a lot of recent concern regarding Mexico potentially banning genetically modified (GM) corn. The crux of the issue started in December 2020 when Mexico’s president, Andrés Manuel López Obrador, issued a presidential decree calling for GM corn for human consumption to be phased out by the end of January 2024.

Details of this decree and how it would be implemented are scarce. The United States has also engaged in negotiations with Mexico on this issue. The purpose of this article is not to debate the merit, or lack of merit, in Mexico’s decree to ban GM corn, it is to quantify the potential amount of corn trade that could be affected.

Mexico’s position revolves around the protection of native heirloom varieties and banning GM corn for human consumption. The Mexican President’s position on GM corn used for animal feed and industrial use has softened recently however, the phrase “destined for human consumption” is opaque and subject to interpretation. Any potential ban is destined to have a two-pronged result.

First, Mexico would pay more to secure the displaced U.S. corn (whether the replacement is U.S. non-GM or procured from another country), and second, U.S. corn would have to find an alternative market.

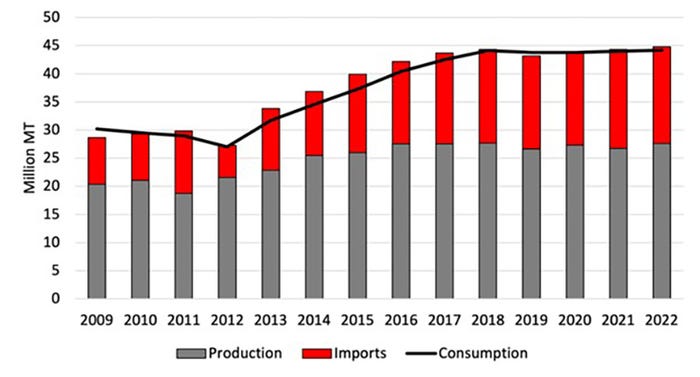

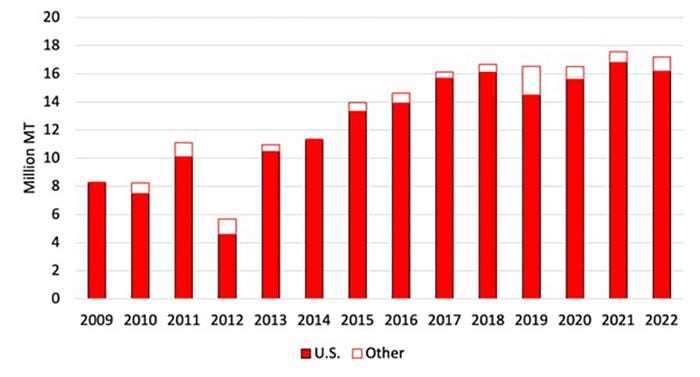

From 2009-2022, Mexico consumed an average of 12.5 million metric tons (MMT) of corn more than it produced (Figure 1). During this time interval, 94% of the corn imported to make up the deficit came from the U.S. (Figure 2).

Figure 1. Mexico Corn Production, Imports, and Consumption, 2009-2022

Data Source: USDA-PSD

Figure 2. Corn Exports to Mexico, 2009-2022

Data Source: USDA-PSD and USDA-GATS

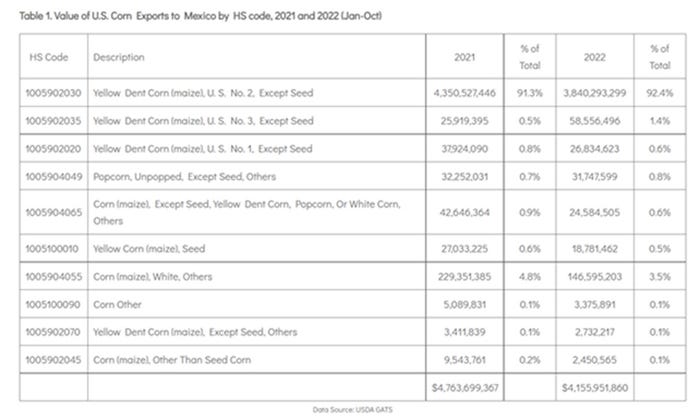

For the 2022-2023 marketing year, Mexico is projected to import 17.2 MMT of corn. Trade data can be examined by Harmonized System (HS) code. HS code is a standardized numerical method of classifying traded products.

Table 1 shows the value of U.S. corn exports to Mexico by HS code. Over 90% of corn exports to Mexico are Number 2 Yellow Corn. Available data did not provide an indication of intended use (food, feed, industrial etc.) for U.S. origin corn.

Annually, the U.S. exports approximately 15% of total corn production. The top five export markets for U.S. corn over the past five years have been Mexico, Japan, China, Columbia, and South Korea.

U.S. corn exports to Mexico represented 25% of all corn exports from 2009-2022. If access to Mexico’s market is restricted, then corn exporters would have to rely on alternative export markets or absorb the production domestically. Holding other factors constant, restriction of U.S. corn exports to Mexico would adversely affect domestic corn prices in the U.S.

Producers, Corn Growers Associations, and other stakeholders are rightfully concerned over attempts to restrict market access for U.S. corn exported to Mexico. The impact of any potential loss of access to Mexico’s corn market will be contingent on the details of the proposed restrictions.

Source: Southern Ag Today

About the Author(s)

You May Also Like