USDA’s supply and demand balance sheet for U.S. corn has a feature not seen in the corn market since the beginning of the 2019 growing season: carryover from the previous crop exceeding 2 billion bushels. That level of beginning stocks has a significant price-moderating effect. In inflation-adjusted 2023 dollars, the season average farm price has not been higher than $4.33 per bushel in the three years since 2006 during which beginning stocks exceeded 2 billion bushels.

Figure 1. Corn beginning stocks and that season’s average real cash farm price ($2023)

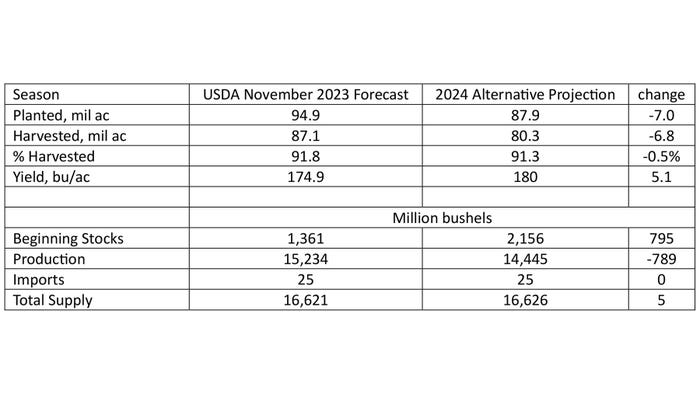

With a 2024 average yield of 180 bushels per acre (trend line estimate), planted acres could decline from about 95 million in 2023 to just over 87 million in 2024, and the total supply of corn from one season to the next would be little changed.

Table 1. 2023 U.S. corn supply forecast and 2024 alternative projection

Of course, supply is only one side of the balance sheet. Lower corn prices could stimulate increased corn use. But planted acreage above 87 million would also significantly augment the corn supply. In the recently released long-term projections, USDA projects planted corn acreage in 2024 at 91.0 million, a yield of 181.0 bushels per acre, and ending stocks (beginning stocks for the 2025 growing season) of 2.616 billion bushels, the most since 1988 (USDA, 2023).

We are just closing the bin door on the final bushels of the 2023 corn crop, but it is not too early to evaluate pricing opportunities for the 2024 corn crop given projections (what might happen) and forecasts (what we expect to happen) around acres, yield, and use.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

About the Author(s)

You May Also Like