USDA as expected made only minor tweaks to its forecasts for corn and soybeans in the June 9 World Agricultural Supply and Demand report. But these monthly numbers didn’t address the elephant in the room: weather.

A very dry start to the growing season in June had bulls hoping the fledgling rally would have wings – 45% of the corn crop was affected by drought, with 39% of soybean ground suffering. Forecasts into the end of the month show rain returning, though July still looks warm overall, with below normal rainfall possible in the western half of the growing region and above normal precipitation in the east. So, much could depend on whether forecast storms ease conditions over the next two weeks as predicted.

Wildfires spreading haze over North America are another wild card in the equation because there’s at least some research indicating the smoke could make it harder for clouds to seed rainfall.

Most of the focus right now is on corn, which always faces peril in the crucial July pollination window. Here’s a look at the potential scenarios that could trigger December futures rallies – or a collapse into harvest.

Bulls run

Dry weather in June gets traders excited thanks in part to the model USDA uses to forecast yields ahead of its first survey of farmers and their field in August. After the 2012 drought, the agency revised its methodology to include affects from abnormally dry June conditions. Yields plugged into corn price forecasts starting in November the year before harvest now factor in June rainfall, mid-May planting progress and July temperatures and precipitation in eight key states: Illinois, Iowa, Indiana, Kansas, Minnesota, Nebraska, Ohio and South Dakota.

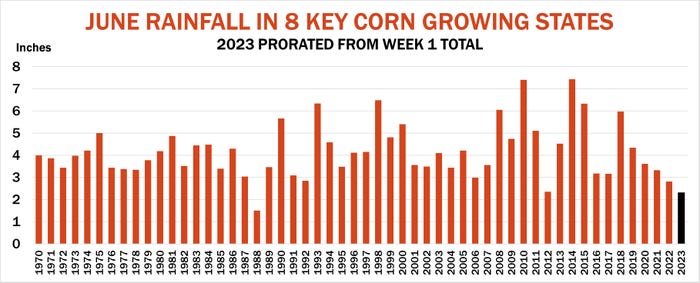

When weighted by expected harvested acres, farmers in those areas planted some 72% of their corn by May 15, in line with long-term averages. So the next numbers on deck are June rain, but not just total precipitation. The 1988 and 2012 droughts taught economists to look at only years when June rains were in the bottom 10% of years historically. In other words, it’s got to be not merely dry, but really, really dry.

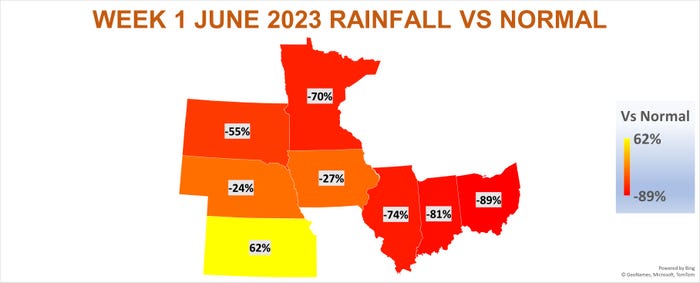

The first week of June in the eight states fits that bill according to early data from both weather stations and satellite imagery. If the pattern set in the first week continues, Minnesota and Ohio would see their driest June on record, while Indiana and Illinois would be the second driest and South Dakota seventh. Only Kansas, which until recently suffered from long-term drought, could find some relief with above average precipitation for the month.

June 2023 overall would come in the fourth driest since 1930, with fractionally less rainfall than even in 2012.

Adverse conditions in June don’t necessarily doom the crop. But according to USDA’s model, they would put production on the back foot.

USDA’s model forecasts a yield with normal weather at 181.5 bushels per acre currently. An abnormally dry June would drop that figure to 177 bpa. That wouldn’t be a disaster, but it could produce rally targets in new crop futures from $5.55 to $6.15. For reference, December futures peaked last week at $5.48.

So far, models aren’t calling for searing temperatures, but enough to trim yields a bit. The warm July currently in some forecasts would cut another 2.5 bpa off yields, taking the average to 173.5 bpa. That could produce more serious rallies, raising rally targets to $6.40 to $7.20.

Sad trombones

Dry Midwest weather and all the wildfires up north spurred lots of talk about El Niño. National Weather Service forecasters issued an advisory last week saying “El Niño conditions are present and are expected to gradually strengthen into the Northern Hemisphere winter 2023-24.”

While this warming of the equatorial Pacific was present during years with poor crops, including 2002, 1991 and 1983, on average the phenomenon is associated with higher yields. But if rains return in the second half of June, normal July weather could confirm USDA’s current yield estimate, triggering sharply lower prices.

USDA last week kept its forecast for 2023 crop average cash prices at $4.80, but the market could go significantly lower, even if cheap grain stimulates demand. A test of $4 might not be out of the question, especially if crop ratings improve and traders begin to fear even better yields.

Most of any increase in usage spurred by lower prices would accrue in livestock feeding, lowering production costs and giving consumers some much-needed relief at the meat counter, especially for beef. The outlook for the other two legs of demand aren’t as encouraging.

USDA sees a 1% increase in corn used to make ethanol in the 2023 marketing year, but that could be optimistic. The U.S. Energy Information Administration last week forecast flat ethanol production and gasoline blending. Lower corn feedstock costs could encourage plants to grind more if their margins improve, but not enough to eat into the huge potential piles of corn in storage.

More bushels could also help exports recover from their disappointing showing this year. The government last week cut its forecast of old crop sales by another 50 million bushels, with competition from Brazil keeping a lid on expectations. Still, without production problems elsewhere around the world, it’s hard to hope for a big surge in sales.

So, as usual, it appears markets – just like farmers – will keep their focus on weather, unless another surprises lurks in the weeds ahead.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Knorr writes from Chicago, Ill. Email him at [email protected].

Read more about:

WeatherAbout the Author(s)

You May Also Like