Last week I warned USDA’s Prospective Plantings are a jump ball, with history closely divided on whether 2024 corn and soybean acreage could be higher or lower than the agency’s most recent guess in February.

Round one of this perennial battle is now in the books, with a surprising corn estimate rocking December futures to their best gains since the failed rebound rally in July. But most of this game is still left to play, with farmers and traders watching spring and summer weather forecasts for clues on how the numbers will change in subsequent reports.

The government’s next significant data dump is an appetizer April 10 that interprets how March 1 grain inventories, also released last week, affect supply and demand for the rest of the 2023 marketing year. Then attention again returns to new crop with the May 10 World Agricultural Supply and Demand Estimates that lay out the acreage impact on USDA’s first monthly tables for new crop production, usage and prices.

The summer docket continues with updated acreage figures due June 28, followed by the first production estimates based on actual numbers from farmers and their fields Aug. 12. The hits just keep on coming through January, but most of the selling opportunities likely will be over before the first frost. Rallies could depend on the developing La Nina weather pattern sometimes associated with Midwest droughts, and these fears, or others, could lift prices into profitable territory.

Indeed, my model holds out hope futures return to test last summer’s highs. Alas, those forecasts likely will change just about as often as the weather does as we begin agriculture’s version of Hamlet. Here’s what the numbers are whispering – at least what I can hear of them.

Demand holds the profitability card

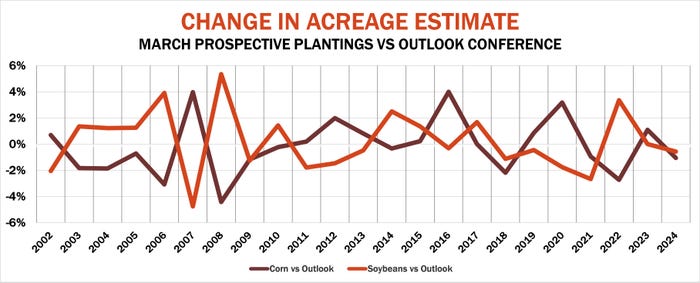

The headline number from March 28 was corn acreage. USDA said farmers want to put in just over 90 million acres of the feed grain, down 4.9% from 2023 and 1.1% lower than forecast in February at the annual outlook conference.

Soybean seedings were forecast at 86.5 million, up 3.5% from last year and just six tenths of 1% lower than the outlook projection, only 500,000 acres.

Grain stocks changed from a year ago but were close enough to my expectations and those from the trade to allow futures time for a pre-holiday focus on acreage. December corn jumped 15.5 cents to close at $4.7775, while November soybeans edged 2.75 cents higher.to settle at $11.8625. After basis, those prices are still well below the average full cost of production, though they are better than spring prices guaranteed by crop insurance.

Assuming weather is – as always – a wild card, rally prospects to reach profitability depend on more than the obvious supply suspects of actual yields and acreage, and final 2023 crop ending stocks, which are due out Sept. 30. Demand also matters when figuring price potential. As some other writer once said, “Aye, there’s the rub.”

Demand forecasts are a game of three-dimensional chess. Driving factors behind both domestic and foreign demand change, sometimes unpredictably. Here’s a taste for each market, along with impacts on the rally outlook.

Corn could make money

If U.S. farmers do indeed plant 90 million corn acres and harvest the average percentage for grain, production should be less than the big 2023 crop and the record achieved the year before. USDA likely will stick with its current projection of 181 bushels per acre in its May WASDE, which is based on normal weather and planting progress in key Midwest states.

My working yield is slightly lower at 179 bpa, which is the 20-year trend, and includes good, bad and in-between years. This would still produce a huge crop of 14.63 billion bushels, the fourth largest ever.

As for demand, my model suggests it will be close to levels projected for the 2023 crop marketing year ending Aug. 31, an estimate unphased by the grain stocks data out last week. The grind from ethanol plants and industrial users could be a little less – and feed usage a little more – than USDA estimated in February. I base my biofuel number on the latest estimates put out by the U.S. Energy Information Administration, which are updated every month.

The amount fed to livestock varies with the number of critters, feed prices, and availability of various rations. I use my projected corn price and work backwards, but this can obviously change a lot. Will inflation stay strong enough to discourage red meat consumption? What will happen globally to influence meat, poultry, egg and milk products exports? Will the international economy continue to recover or face yet another Black Swan event? Who knows is the best answer for these questions.

U.S. corn exports depend in part on how much we have to sell after domestic consumers take their share. Production overseas, especially by foreign competitors trying to keep or expand their market share, depend on all these factors, too. Like I said, three-dimensional chess.

But currently my model says U.S. sales abroad will continue to improve from the setback seen during the 2022-2023 marketing year. If that happens, carryout at the end of the 2024 marketing year runs around 2.23 billion bushels, higher, but by less than 100 million bushels from USDA’s current projection for 2023-2024. USDA’s February outlook estimate was 2.6 billion bushels, one reason for the rally March 28.

That outlook report put average cash prices for the 2024 crop at $4.50 a bushel, but those numbers were prepared during the fall and early winter when prices were higher. My model ranges between $4.15 and $4.31. This translates into potential futures selling ranges of $4.70 to $5.10 and $4.90 to $5.30. That would take December futures back to levels that lasted from September through the end of 2023, enough to be profitable if yields hold up.

Beans back in the teens

Similar forces drive my soybean model, but these are more concentrated than corn. Competition for exports focuses on South America, where weather and politics can vary widely. Demand from abroad is similarly somewhat single-minded, and China is as murky as ever. Will relations with the U.S. stay on the rails, or could another trade war boil over with a change in the White House?

U.S domestic demand hinges on crush, which is no longer solely controlled by livestock usage. New processing plants require more biofuel expansion, which in turn also swings with the winds in Washington.

Both exports and crush are price dependent, too, but costs for these consumers should get a break from all the acres farmers intend to plant.

My 20-year trend yield for soybeans is 52.2 bpa, only slightly higher than USDA is using. If achieved, the 4.46-billion-bushel crop would be just a few beans shy of the record from 2021. Total demand would be strong, but not a record, at 4.2 billion bushels, which would swell ending stocks on Aug. 31, 2025, to almost 460 million bushels.

Prices also will change with swings in market volatility – always a threat for soybeans, with average cash prices from $10.15 to $10.95, down from the $11.30 in USDA’s Outlook report.

If my take is close, this means November futures selling targets between $11.65 and $12.50 and $12.10 to $13.10. That latter range would be around the levels that lasted from September into January – and is more than a buck a bushel higher that Thursday’s close on the board.

So, rally hopes remain alive for corn and soybeans. The question now is: when?

About the Author(s)

You May Also Like