Last week’s quarterly stocks and prospective planting report had some mixed messages. If you happened to read last month’s blog, the framework laid out in that article jives with this report’s data. Old crop corn and soybean stocks were less than anticipated by the trade; planting intentions would be considered bearish for corn and ever so slightly positive for soybeans.

Regardless of what the report said, the price action post-report is what really matters. Let’s think back over the last week and try to determine what the market is telling us.

I fielded several calls last Sunday night looking to lift $6 new crop corn and $14 new crop soybean hedges because of tight old crop stocks. The sentiment driving this is that 92 million acres of corn will be the highest number we see, and the fact OPEC+ cut oil production. While this week did start with a rather strong tone, heading into the three-day Easter weekend corn, soybeans and wheat all made new weekly lows.

With all of the bullish sentiment early this week, new crop corn was unable to trade above last week’s high made two sessions before the report. Instead, December corn finished this week settling below the report day low and within a dime of last month’s low.

Key technical to watch

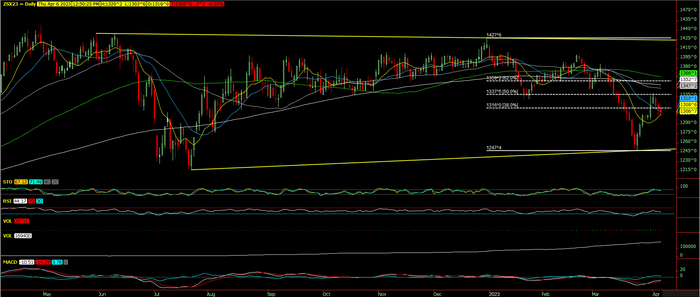

I cannot impress upon you enough how important it is technically for December corn to maintain prices above $5.40. I don’t make the rules for technical analysis, I simply try to follow them. December corn is in what is called a ‘descending triangle formation,’ and the downside objective of this pattern is $4.0075.

While November soybeans were able to hold last week’s report day low, it is important to note that the recent recovery rally failed at the 50% retracement level of the break from the $14.2775 high made the last trading day of 2022, to the $12.475 low made a week before the stocks and acreage report. A breach of the report day’s $12.98 low will likely lead to additional technical selling and a potential retest of that $12.50 zone.

Even the two wheat varieties that have an actual fundamental ‘right here and right now’ story, Hard Red Winter and Hard Red Spring, made highs early in the week that failed miserably. New crop HRW and HRS finished the week 38 cents and 39 cents off Monday’s respective highs. Extremely poor HRW crop conditions and record low HRS acres have not been enough to stem the selling.

Looking ahead

Enough of what was bearish this week; the next strong fundamental input will be the 6-10- and 8-14-day forecasts for the corn belt coming out of the holiday weekend. The current temperature outlook for most growing regions will be above to well-above normal for both timeframes. However, current modeling suggests that only the Eastern corn belt will have the required normal to below-normal precipitation to accommodate an aggressive planting pace.

What could be even more impactful is the above normal precipitation in the modeling for the Northern Plains. The current snowpack combined with rain on top of a quick melting event will create a flood scenario in the Red River Valley which will keep producers out of the field for the next several weeks. This conversation will inevitably lead to analysts reducing expectations of corn acres in flood areas and assumptions those acres could end up being planted to soybeans, should timing dictate.

Commodity indices and individual agricultural commodities have well-established down trends, and the saying “The trend is your friend” should be a nagging reminder of what to do on rallies.

There are plenty of ways to protect your downside while leaving flexibility to benefit from rallies. Feel free to contact me directly at 815-665-0463 or anyone on the AgMarket.Net team at 844-4AGMRKT for assistance. We are here to help.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like