When USDA released its first monthly forecast for 2023 crop supply and demand May 12, corn and soybeans faced a bearish outlook of big production and bulging surpluses. But those prospects are anything but certain as the agency updates its World Agricultural Supply And Demand Estimates on Wednesday.

One of the driest starts to the growing season on record in the Midwest, coupled with major adjustments to planted acreage released at the end of June, could reset the table for a market headed into the heart of summer.

The July 12 WASDE reveals how USDA interprets new data for both old and new crop balance sheets. While these July reports normally aren’t known for changes, the numbers this time could be scrambled in myriad ways.

With less than two months left in the 2022-2023 marketing year, wholesale changes to old crop forecasts aren’t likely. Still, expect some tweaks to the tables based on June 1 Grain Stocks and other demand data.

The new crop outlook is another story altogether. Not only will the July WASDE incorporate updated acreage estimates that showed a major shift from soybeans to corn, but USDA could slash the yields used in the report after June rainfall appeared to fall far short of normal. Then, look for the agency to adjust its supply and demand forecasts to reflect the changes in the production outlook.

Old crop appetizer

While new crop is the main course for the July 12 data dump, USDA’s old crop estimates should whet the appetite a little.

The agency’s June 1 inventory number for corn was well below trade estimates, though it came in right on my projection. This suggests March-May feed usage was greater than expected. So, unless fourth quarter feed demand is less than normal, USDA could raise its forecast for the entire marketing year. That would offset what I expect will be weaker than projected exports and usage by ethanol plants.

Of course, USDA’s feed category includes residual usage, a hard-to-decipher number used to adjust statistical errors in previous reports. So it’s hard to guess with any accuracy what USDA’s economists will come up with for old crop carryout. That was estimated in June at 1.452 billion bushels, but could come in as low as 1.311 billion or as high as 1.5 billion.

Residual usage could also play a role in the old crop soybean supply and demand tables. Fourth quarter residual usage on average is a negative number, a concept only government accounting could conceptualize. The stocks data appeared to factor in a larger than expected third quarter total for seed and residual, especially with fewer acres sown than expected. USDA may just chalk this up to statistical error, though it could be a hint the 2022 crop was a little smaller than estimated in January.

Otherwise, significant rationing of export demand in the last quarter of the marketing year is needed to keep carryout at the 230 million bushels forecast in June. Cancellation of existing sales should start showing up in daily and weekly export reports soon, as happened a year ago, or old crop carryout could be lower.

Not a lot of old crop bushels are still in play, but they still count, forming the “beginning stocks” in the new crop balance sheet. And USDA’s 2023-2024 marketing year guesses are where the real uncertainty exists.

Lower yields?

USDA normally bases its July new crop production estimates for corn and soybeans based on updated acreage reported at the end of June, using what it calls a weather adjusted yield. Most years, when weather is normal, this yield is the same figured used by the agency since its initial new crop outlook put out in November, nearly a year before harvest.

The model used by USDA for corn factors in planting speed along with July rainfall and temperature in eight key states. Seven states are used in the soybean model, which includes July and August weather due to the crop’s later reproductive period.

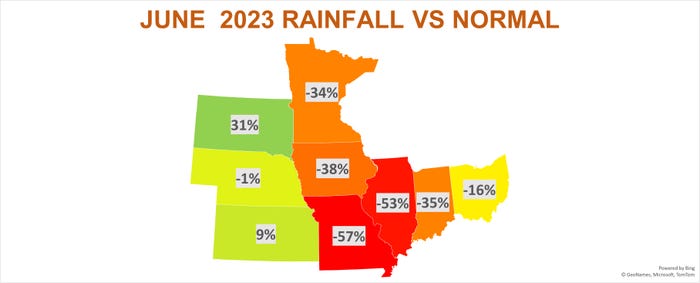

Both models also have a variable for June moisture stress, reflecting experience from the big droughts of 1988 and 2012. This measure kicks in when June rainfall in the key states is among the bottom 10% historically.

Satellite maps and daily weather station data appeared to qualify the average for the 10% threshold, which would cut the yield down to 173.5 bushels per acre.

Such an adjustment would more than offset the 2.1 million acre increase in corn plantings from March intentions. While lower production would likely cut usage, 2023 crop ending stocks would fall to around 1.94 billion. That’s still a lot, but less than the 2.257 billion USDA printed in June. Under that scenario, December corn might not have a lot more downside after trading down to $4.855 last week.

But preliminary figures from the Midwest Regional Climate Center came in higher than the other methods, likely due to heavy rains late in the month. This data differed enough for the month to fall in the normal range, which would keep USDA’s corn yield at 181.5 bpa. Coupled with the higher acres from the June 30 report, record production could swell carryout to 2.5 billion bushels, sending the average cash price to $3.50 or less.

The corn model includes Kansas and South Dakota, along with Illinois, Iowa, Indiana, Ohio, Minnesota and Nebraska. The soybean version drops Kansas and South Dakota but adds Missouri, which received less than half the rainfall of the other two states. This substitution qualified June as one of the 10% driest for soybeans, dropping the yield from the 52 bpa used in June to 50.7 bpa. Even with significant rationing of exports and crush demand, 2023 crop carryout could be cut by more than 150 million bushels, falling below 200 million, compared to the 350 million USDA published in June. Average cash prices could run around $13.80 - $1.70 more than the government predicted last month, leaving the upside open for rallies.

If USDA makes no change to its soybean yield forecast, lower acreage could keep carryout from increasing much beyond the 230 million the government forecast for 2022 crop ending stocks, still helping to support prices.

Reality check

It’s an uncertain outlook, to be sure, and bullish or bearish arguments can be made for both crops on both acreage and yield.

Indeed, a note attached to the beginning of the June 30 plantings report raised a few eyebrows, noting that 2.49 million acres of corn and 8.22 million soybean acres were left to be planted when the survey was conducted. These totals were less than noted in the June 2022 report, but still could trigger changes. So, the increase in corn ground may not have been as big as reported, while the loss in soybean acreage from March intentions could also be in play.

Other evidence also supports prospects for lower yields. Just 51% of corn and 50% of soybeans were rated in good or excellent condition last week, the lowest since 2012 for the period. Vegetation Health Index maps also are below normal. Those conditions likely will improve after recent rains, but currently point to potential for yields at or below the 173.5 and 50.7 bpa levels.

Weather models into the end of August don’t look especially threatening, with a little heat perhaps but mostly normal to above normal precipitation. Neither the American nor European models suggest anything close to a crop failure.

USDA’s July 12 reports won’t be the final say on any of these questions. But the updated outlook likely will anchor how the market trades headed into the agency’s first survey of yields from farmers and their fields due out Aug. 11.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like