Farmers harvesting smaller than expected crops this fall have at least one silver lining. Tighter supplies should bring stronger than normal corn and soybean basis at harvest. That’s a good problem to have, but also complicates storage decisions for growers planning to hold crops into winter, and perhaps beyond.

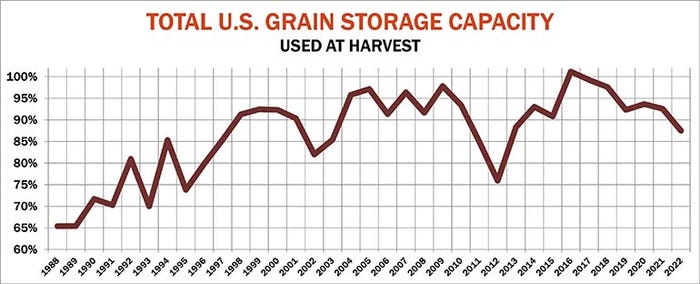

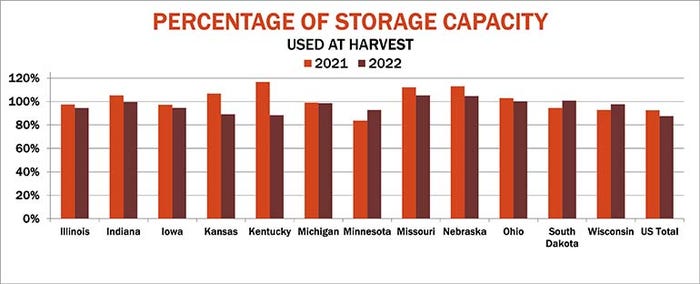

Based on Sept. 1 grain stocks and September production estimates, just 87% of the nation’s grain storage capacity may be filled this fall, the least since drought ravaged yields in 2012. Only states in the upper Midwest could see more bins filled this fall than a year ago, when dry conditions in the north nipped yields. But even these states overall could be at less than 100% of capacity.

Fears of empty bins could limit storage fees at commercial facilities as merchandisers scramble for grain to move. And it’s already spurring stronger than average harvest basis levels in many areas. That’s good news for farmers selling off the combine, even if they’re not lifting futures hedges made at higher prices.

Harvest basis is typically stronger in years with smaller crops and tight supplies. That doesn’t make it impossible to benefit from storage. Holding 1995 crop corn and soybeans into the following summer netted more than a dollar a bushel each after operating costs, despite below normal yields.

Different strokes

Still, storage capacity alone doesn’t explain everything in the basis market as October begins. Other factors come into play, including freight charges for rail, trucks and barges, leftover old crop inventories as well as projections for supply and demand when the new marketing year ends Aug. 31.

These influence soybean basis in particular, sometimes in ways opposite from corn.

Soybeans usually move first ahead of corn in the fall to meet international demand before South American harvests swamp global supplies. But because the U.S. share of soybean exports is larger than its position in feed grains, soybean basis is more sensitive to tight U.S. supplies.

Transportation costs, which are the highest in years due to expensive fuel, labor shortages and low water levels on the Mississippi River, affect bids for both crops, but in different ways some years. Higher charges tend to be a brake on fall corn basis, which is especially sensitive to fees for rail cars that move crops into position for exporters to Asia and Mexico, as well as to livestock intensive U.S. markets in the Southeast that always run a grain deficit.

In years with plentiful supplies, shippers shift more of those costs to local cash markets, weakening basis to convince farmers to hold corn off the market until it’s needed. But when demand is strong and supplies are tight, end users are forced to absorb higher freight costs, which appears to be happening this year.

By contrast, higher shipping costs are associated with stronger than normal harvest soybean basis, because buyers wanting beans have little choice than to shop in the U.S. as South American supplies run out.

Limited carry

These factors impact another aspect of the harvest market, especially for those interested in hedging crop inventory by selling futures. This includes not only farmers but merchandisers, who sell futures to protect their holdings from falling prices and to benefit from strengthening basis.

Carry, in this case the difference between deferred contracts and those for nearby delivery, can be a carrot or stick. Large carries motivate hedgers to hold crops; like basis, carry acts as an incentive for storage. Lack of carry can trigger sales unless basis appreciation by itself offers enough profit potential.

Forecasts for new crop supply and demand at the end of the marketing year appear to be the driving force behind carry in the soybean market as well as basis. Forecasts for tight ending stockpiles tend to strengthen basis and decrease carry.

Taking all these factors into account explains nearly all the variance in corn and soybean basis and carry seen in recent years. This multiple regression model suggests basis could be even stronger than recent readings indicate as crops are brought in. But it also forecasts larger carries than are currently present, making October markets only slightly stronger than forecast overall when carry and basis are combined.

A year for futures?

So what does this analysis mean for storage prospects? Here are some key takeaways to consider.

Tight carries and strong basis increase potential for gains from corn stored on-farm into summer, or from futures contracts purchased to replace cash crops sold at harvest. But lack of carry and strong basis decrease potential from storage hedges, and also hint futures could do a little better than cash markets after storage costs are figured.

The same forces are at work for soybeans. While spreads are widening, they’re still well below full carry. Small carries and stronger than average basis also make long-term soybean storage hedges risky this year. This potential lack of basis appreciation also could give buying futures and selling cash at harvest an edge over holding cash soybeans on farm unhedged. For those wary of trading futures, a deferred basis contract could accomplish a similar end.

These are national averages, and ground piles with large storage fees and weak basis could still be present in some areas. Weaker than expected demand or larger crop estimates could also shift market dynamics in a world where risk more and more seems like a four-letter word. Last week’s grain stocks tally proved how rapidly events can change.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like