Corn and soybean futures have at least a fighting chance of closing higher Tuesday, when traders return from Labor Day holidays. But soybeans in particular are vulnerable to a September swoon, confronting a minefield of USDA data as the 2023 marketing year begins.

In addition to another round of World Agricultural Supply and Demand Estimates due Sept.12, Grain Stocks and the Small Grains Summary at the end of the month could derail markets looking for bullish news.

Jitters from Wall Street could also come into play, following a monthly employment situation that kicked off the month Sept. 1. A higher jobless rate following weaker GDP gains in the second quarter and signs of easing inflation reported earlier fueled ideas the Federal Reserve could pause raising interest rates when the central bank updates its economic projections and monetary policy guidance at the end of its next two-day meeting Sept. 20.

Hopes for lower rates could put pressure on the dollar, which in turns tends to be bullish for commodities. But the greenback remains the safe haven of choice if investors dump stocks for bonds, which offer positive inflation-adjusted returns free from risk for the first time in years.

Another risk is the potential for a government shut-down if Congress fails to resolve budget battles by the end of the federal fiscal year Sept. 30. Unintended consequences from a prolonged stalemate abound, ratcheting risk fears higher.

Otherwise, expect grains to focus on fundamentals, in particular just how big, or small, 2023 crops may be.

Labor pains

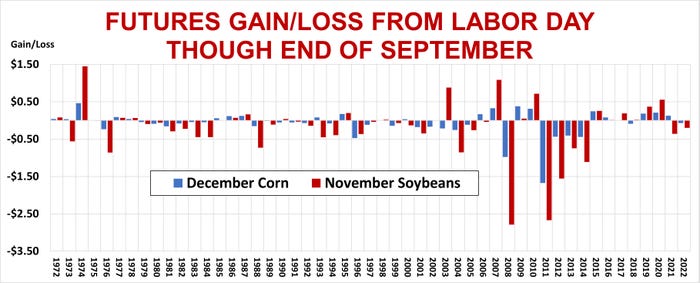

Over the past 50-plus years, December corn futures were evenly split the first session after Labor Day, but were lower 44% of the time by the end of September. November soybean futures ended higher 59% of the time the day after the holiday, but were lower 41% of the time by the end of the month.

One reason for soybeans performance may be fallout from the USDA reports. The agency tends to raise its estimate of soybean yields in September, compared to the first surveys in August. Corn yields changes tend to be more mixed by comparison.

Following yield cuts in August, which were put at 175.1 bushels per acre for corn and 50.9 bpa soybeans, models I use to forecast production are mixed about USDA’s direction.

Corn projections look mostly a little lower, though some are higher, too. But blistering heat during parts of August raised ideas USDA may trim its yield estimates Sept. 12 for soybeans, which endured the hot temperatures during their reproductive phase. Weather data for the month is still highly preliminary and unofficial, but readings in seven key states used in a popular weather model were warmer but only a little drier than average, suggesting fairly normal yields overall.

Estimates made from weekly Crop Progress ratings and the Vegetation Health Index are even more optimistic for soybeans, which could set up a bearish surprise for those leaning the wrong way.

Demand stable

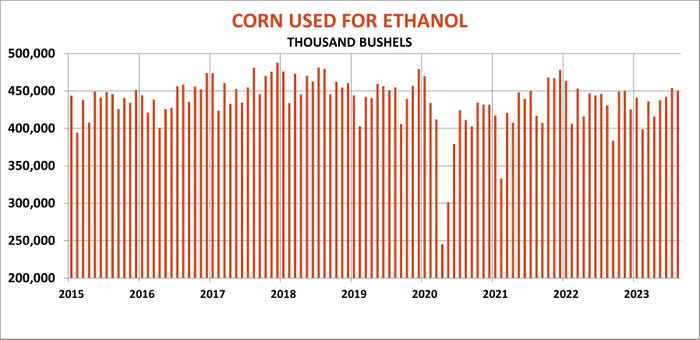

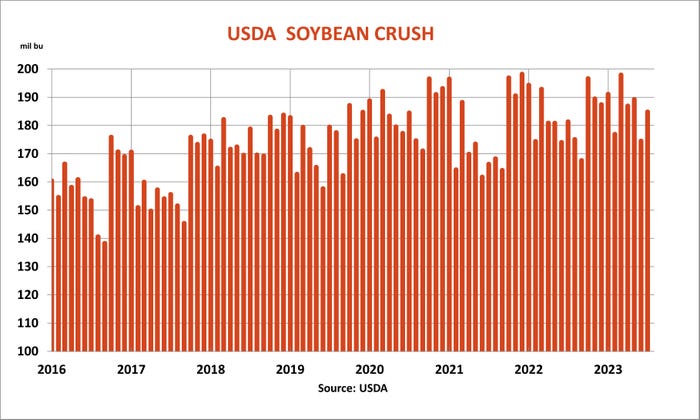

Data out to start the month on Friday suggests changes to demand estimates Sept. 12 may be modest, if any. Corn used by ethanol plants in July and soybean crush were in line with totals suggested by industry data released earlier. Both sectors enjoyed stronger margins, which rebounded sharply from low levels in June.

A little better exports and ethanol usage of corn could boost demand 50 million bushels or so. More changes in usage could appear following the Sept. 30 stocks reports, which feature estimates of corn and soybean inventories left over at the end of the 2022-2023 marketing year. Sept. 1 corn stocks should also indicate how much corn was assumed fed to livestock, while USDA could also make changes to its 2022 production estimates for either crop, which were last updated on a monthly basis way back in January.

Big changes to 2023 production in the small grains report due Sept. 30 could also influence markets. Otherwise, wheat likely will focus on forecasts for above normal temperatures and below normal precipitation with much of the winter wheat belt from central Kansas to Ohio already short moisture for seeding.

South American weather is also in play, with parts of Argentina and Brazil stressed, though the winter dry season there is due to end before planting begins in earnest.

Traders’ mood headed into the holiday was mixed. December corn stopped a couple ticks shy of $5 to start the week before turning lower, while November soybeans hit the skids after failing to hold a close over $14.

Large speculators trimmed bearish bets in corn while increasing their net long positions in soybeans, according to the latest Commitments data from the CFTC.

About the Author(s)

You May Also Like