USDA’s Feb. 8 World Agricultural Supply and Demand Estimates weren’t expected to help corn and soybean rally prospects much, and the latest report did even less. The government said it expects more of both crops will be left over at the end of the 2023-2024 marketing year Aug. 31, 2024, keeping futures near the lowest levels since 2020.

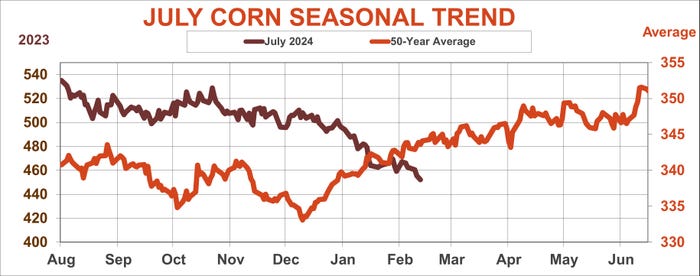

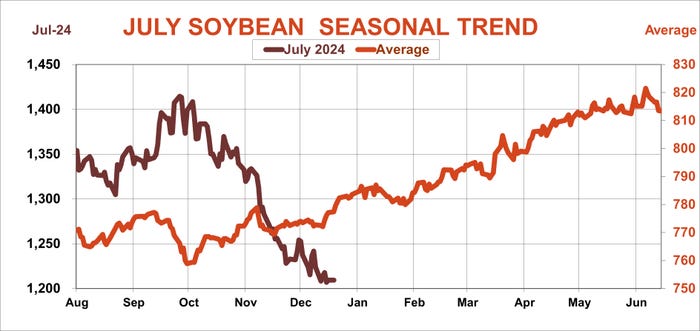

Optimists may point to seasonal price charts to put lipstick on these pigs. Over the past 50 years futures have indeed tended to move higher on average once these February numbers come out, trends that continue into June.

But average can be misleading. As the Harvard Business Review pointed out many years ago, averages “gum up” the math because they ignore the wide swings that often take place. Such variations often seem to be the rule, not the exception, in the commodity markets.

Sure, most years corn is indeed higher, though soybeans struggle to post gains half the time. But average doesn’t mean always, say when futures lose more than $1 a bushel. July corn already is down 75 cents from harvest in October, while beans are off $1.25.

Prices could still perform their seasonal pivot, and no broad market like corn and soybeans goes down forever. But the old crop story is getting long in the tooth. Getting a reboot won’t be easy. Taylor Swift announcing she’s a bull could help. Otherwise, game changers are tough to come by.

China truce?

China and the United States are trying to play nice, or what passes for nice, despite lots of angry rhetoric in many parts of Washington. I heard U.S. Trade Representative Katherine Tai speak last week here in Chicago, and she scrupulously avoided any of the China-bashing coming from both sides of the aisle. But she admitted fixing the relationship “is going to take a little while” – in other words, don’t get your hopes up.

USDA kept its forecast for total China soybean imports from all sources unchanged, but commitments out of the U.S. were down 28% year-on-year as of last week. Soybean export hopes could get a lift if Chinese traders return from celebrating the Year of The Dragon and announce big purchases, as sometimes happens after market breaks like the Lunar New Year.

A gesture like a big soybean purchase would offset at least a little bit of the talk that China has become more, not less, dependent on its export engine since the end of the trade war. The Communist Party’s attempt to make its economy more driven by domestic consumption ran into the tough reality of a local stock market debacle that wiped out much of the wealth those consumers were trying to build with investments.

USDA decreased its forecast for U.S. marketing year soybean exports by 30 million bushels, increasing leftover supplies by a like amount. Crush doesn’t seem likely to come to the rescue, either, despite hopes for a biodiesel boom.

USDA did only a minor tweak to its corn balance sheet, increasing ending stocks by 10 million bushels due to weaker industrial use. Year-to-date usage of corn by ethanol plants appears to be running even a little better than the 200-million-bushel increase USDA forecasts. But the U.S. Energy Department’s latest forecast remains lower, and dramatic changes don’t appear likely without a sea change in attitudes.

El Niño ending

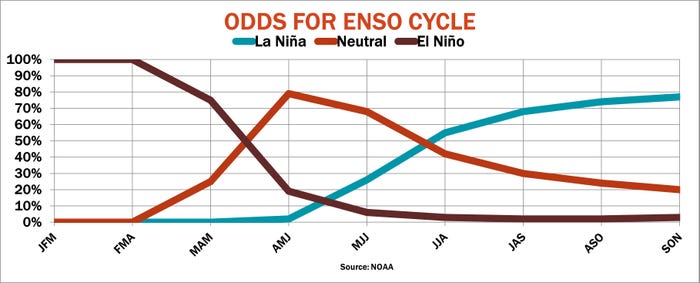

Another report out Feb. 8, a few hours before the WASDE, may provide the best hope for rallies, at least in the long run. U.S. weather forecasters said they expect the current El Nino warming of the equatorial Pacific to end quickly by spring, with a 55% chance of La Niña cooling developing by summer. While El Niño is associated with better U.S. corn and soybean yields, the opposite is true for La Niña summers, when yields tend to suffer.

And, when La Niña follows on the heels of El Niño in the same year, both corn and soybean yields are a more likely to be off than during the typical La Niña.

This trend is statistically significant as well, so it may not be just a chance roll of the dice. But the connection is still relatively week, so the odds could be even worse than some of the Taylor Swift prop bets were for the Super Bowl.

Yes, prices are due for a change. Betting on a weather rally in February is risky, but it may be the only game in town for speculators looking for a wager to place – assuming they still have their wallets after the Super Bowl.

About the Author(s)

You May Also Like