Whether they decorate graves, cheer a parade, or just get together with family and friends, Memorial Day marks the unofficial beginning of summer for most folks. For traders with a farm background it’s a chance to drive back home and find out what’s really happening out in the field.

These first-hand reports after a three-day holiday lull are one reason futures often seem to make moves when business reopens. The pace of planting and emergence along with how the first shoots look sets the tone for June as much as hot dogs, baseball and soda pop. As a result, Memorial Day is one of the key moments for marketers ahead of growing season weather volatility.

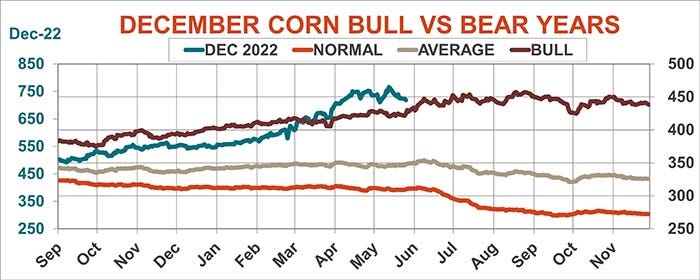

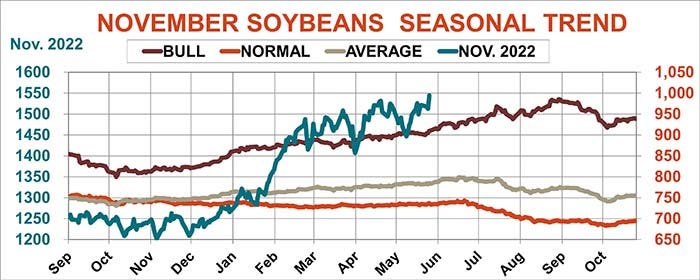

So what should growers expect in 2022, at least based on historical trends? Seasonal trend charts for December corn and November soybeans provide initial clues.

Though November soybeans made new highs ahead of the holiday this year, both new crop contracts in normal years tend to be flat for most of May before rally potential picks up in early June. This is one reason my study of seasonal preharvest hedging strategies includes one alternative for purchasing call options at the end of May ahead of sales in late June for corn and mid-July for soybeans. Combining the call and sale provides similar protection to buying a put option, and using different windows for the two trades improves overall performance though it also increases risk.

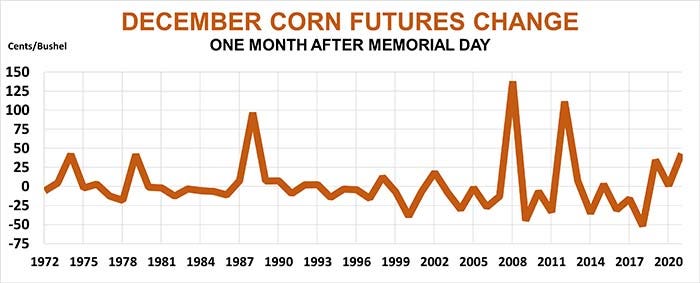

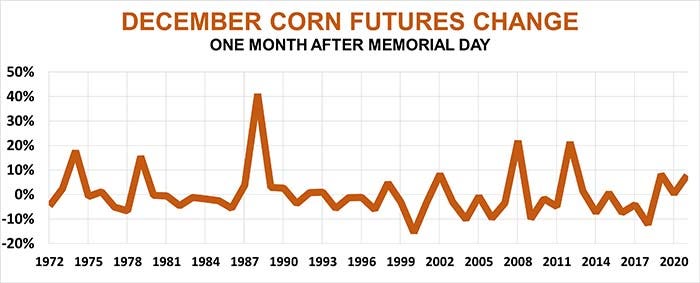

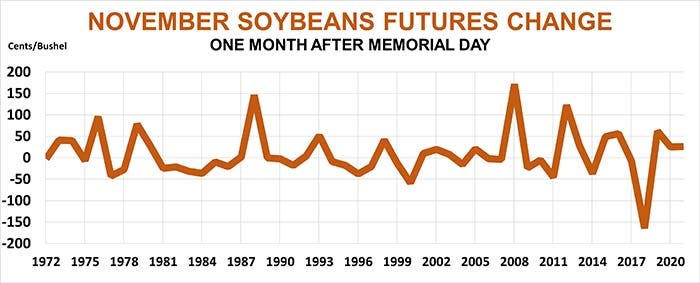

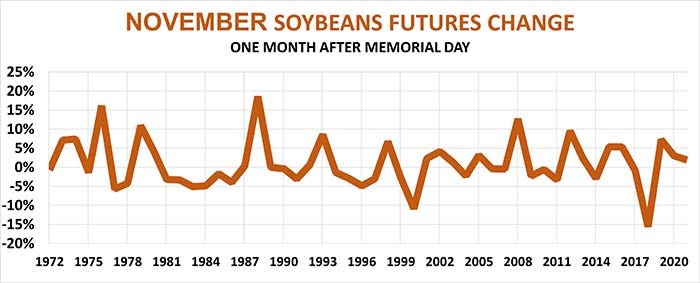

Buying calls could pay off if prices rally enough. Indeed, some post-Memorial Day rallies were impressive. In 2008 and 20012 corn jumped more than 20% in the month after the holiday, posting gains of $1.3775 and $1.115 respectively. The granddaddy of all these moves came in 1988 when futures surged 96.75 cents, a 41% gain. Soybean surges those years were similarly strong.

Such gains are the exception, not the rule. On average over the past 50 years, corn futures rose 2 cents while soybeans gained 8 cents in the month after the holiday. But years with big gains skew those averages. Medians – the levels in the middle when the changes are sorted – are in the red.

Only 19 of the 50 years showed gains in corn, with 31 years of losses. Results for soybeans were a little closer, but years with losses outnumbered gains by 28 to 22.

And some of the downturns were huge.

Big yields and the U.S.-China trade war sent prices tumbling in 2018, when corn plunged 51.75 cents and soybeans dropped $1.645. Record-fast planting in key states and fears of large surpluses sent prices down in 2000, even before the dot-com bust and 9/11 pressured Wall Street and other markets south the following year.

Weather appears to be the driving force behind post-Memorial Day price changes in corn. Another factor also comes into play for soybeans: expected leftover stocks at the end of the coming marketing year. Fear of tightening stocks is associated with years of bigger moves, while forecasts for an increasing surplus held back gains.

Moves on the day after Memorial Day can also provide a tip-off about things to come, with gains following gains and losses following losses. But the impact of the Tuesday trade mostly fades after the first week.

The direction of these moves in the first week of trading after the holiday can be misleading, too. Both corn and soybeans gained on Memorial Day Tuesday 21 times in the past 50 years. Corn prices were still higher a week or month later in only 11 of those years. Soybeans again did only slightly better, ending higher 13 times.

Farmers’ ability to seed fields by prevent plant deadlines will be one metric watched closely by the trade, along with first condition ratings once half the crops have emerged. USDA’s updated acreage and grain states estimates due June 30 could sway bulls and bears before weather forecasts begin peering into the corn pollination window – coinciding with the next market holiday over Independence Day.

While Memorial Day is a time for reflection on the ultimate sacrifice made by our veterans, July 4 is a much different occasion. Fireworks befit both the mood and, at least some years, the market.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like