Longtime internet users remember “WWW” as shorthand for world wide web. But in today’s nervous grain market, those letters stand for weather, war and worry.

All three elements are on full display heading into the final full week in July, when conditions typically make or break corn yields. While the fate of soybean production plays out more in August, prices for both crops showed signs of fatigue, at the least, and perhaps submission, at the worst.

Temperatures could hit 100 degrees this week in Iowa and other parts of the central Midwest. The forecast failed to keep December corn futures from retreating from the four-week high achieved on Wednesday, despite continued Russian attacks on Ukrainian grain facilities after the collapse of the export deal stopped shipments through the Black Sea.

That kicked off a season of worry for growers hearing the clock tick more loudly on the opportunity to make new crop sales at profitable levels.

The USDA estimates Ukraine could ship 767 million bushels of corn in the year ahead. Wiping those sales off the international grain trade completely boosts 2023 crop U.S. export potential by 300 million bushels. Assuming Ukraine’s sales fall to zero could add 75 cents to average cash prices, though some grain from the war-torn country would likely move by river and train even if Russia’s shipping blockade remains.

Weather, of course, could have the final say on where prices end up, another worry for growers facing FOMO – the fear of missing out on either profitable prices or a bigger rally, take your pick.

Yields hold on

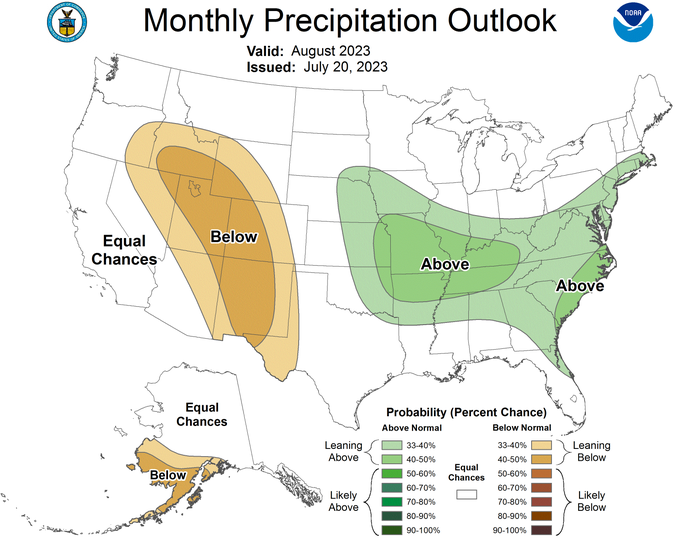

After one of the driest June’s on record, weather returned to more normal measurements in the first three week of July, with forecasts into the end of the month suggesting averages for month in key corn producing states will be cooler and a little wetter than normal – good conditions for a pollinating crop trying to recover. Given that outlook, yields could approach the 181.5 bushels per acre figure USDA used until its July update as “normal.”

Not all production forecasting tools are that sanguine. Weekly Crop Progress ratings for corn have improved over the past three weeks, but still point to below average yields around 174.5 bpa at best depending on the methodology used. The Vegetation Health Index for the crop gained more, pointing to yields around 176.8 to 179.3 bpa. USDA cut its yield forecast to 177.5 bpa in July, ahead of its first survey of farmers and their fields in August.

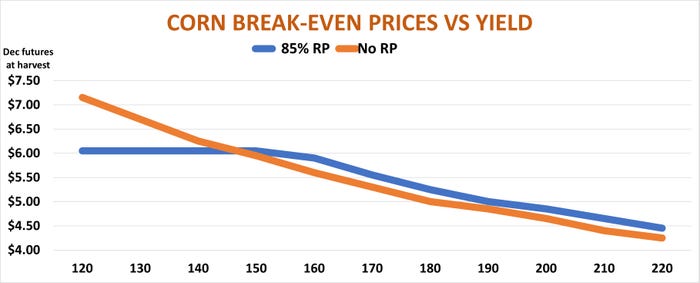

Smaller yields and Ukraine’s uncertain exports could turn around the bearish mood on corn charts, which showed signs of finally cracking after failing to hold a 50% rebound off June lows. December futures are still profitable for the producer achieving average yields and costs, based on a cash break-even price around $4.85. But profitability depends on prices, yields, and the risk management support chosen for the government farm program and crop insurance.

Corn on brink

Those who signed up for ARC and insured 85% of trend-adjusted yields with Revenue Protection need $5.25 December futures to break even, assuming basis of 35 under. Those who opted for only basic crop insurance protection have a $5 break-even due to savings on premiums. But RP coverage becomes more important as yields fall and prices needed for profitability rise.

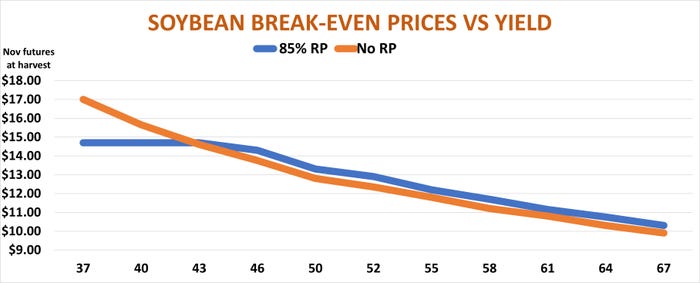

With November futures holding $14 on Friday, soybean growers have more leeway if they decide to wait to see how weather plays out during the rest of the growing season. USDA earlier this month held its yield at 52 bpa despite the dry June start, and most models support that reasoning.

Crop Progress ratings for soybeans recovered more slowly than corn in July but still translate to potential for 51.7 to 52.2 bpa. The Vegetation Health Index for beans is even more optimistic, giving the crop potential to hit 53 bpa or better, in line with forecasts for August weather in key states to be fairly average.

The cash break-even for the grower with average yields and costs is $11.70, or $12.45 futures assuming basis at 75 under. As with corn, those without RP protection save money on premiums, but that decision turns negative if yields fall much below the 85% insurance guarantee.

Soybean charts are in better shape than corn after making a new high for the year last week, with no obvious sell signals on view. Still, yields of 53 bpa could drive average cash prices to $12 or less so producers face a bird-in-hand vs. two-in-the-bush choice. Right now, time may be on their side, but it may be decision time soon given the volatile tone of late.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like