The latest crop reports from Conab and the USDA provide valuable insights into the current state of global corn, soybean and wheat production.

Corn

First, Conab reduced the Brazil crop by 3.9 to 113.7 MMT, which was 3.2 MMT below the trade average.

Second season, or safrinha, production was decreased by 3.1 MMT to 88.1 and is now 13.9 MMT smaller than the 2022/23 crop. The harvested area, at 15.9 MMT, is 537 K lower than the January estimate and nearly 8% smaller than the previous year, as producers opted to plant less area in the face of low corn prices.

The USDA decreased its estimate for Brazilian production by 3 MMT from last month to 124.0, resulting in a rather wide disparity between Conab and the USDA, which will be closely monitored in the coming reports.

The USDA left Argentina production at 55.0 MMT.

There is still quite a bit of daylight between the Ukrainian attaché and the WASDE people, particularly as this export forecast is 29.2 MMT. The WASDE increased by 2.0 MMT this month to 23.0, leaving the U.S. export forecast at 2.1 bbu.

Changes to the U.S. balance sheet were minimal, with ending stocks up 10 to 2.172 bbu, reflecting a similar reduction in food use. This month’s stocks number was 23 million above the trade average. Otherwise, there were no changes to export demand at the global level, other than a ½ MMT cut to the EU forecast.

The China balance sheet was left untouched, but we did note they cancelled 2.7 mbu in this week’s export sales report. The market impact was 2 to 3 cents lower heading into mid-day.

Soybeans

The market received some early strength from Conab, which put the Brazil crop at 149.4 MMT, or 1 million below the trade average and down 5.9 from its January estimate. This month’s Conab estimate now has the crop 3.4 million below last year.

The USDA wasn't quite as aggressive, choosing to make a more modest 1 MMT reduction to 156.0. The trade was quite a bit lower with respect to this estimate at 153.7. The Argentine crop estimate came in at 50.0, unchanged from February and 800 K below the trade average.

Also, the WASDE people upped last year’s Brazil crop by 2 MMT, all of which went into ending stocks and helps explain the country’s fairly aggressive January export program.

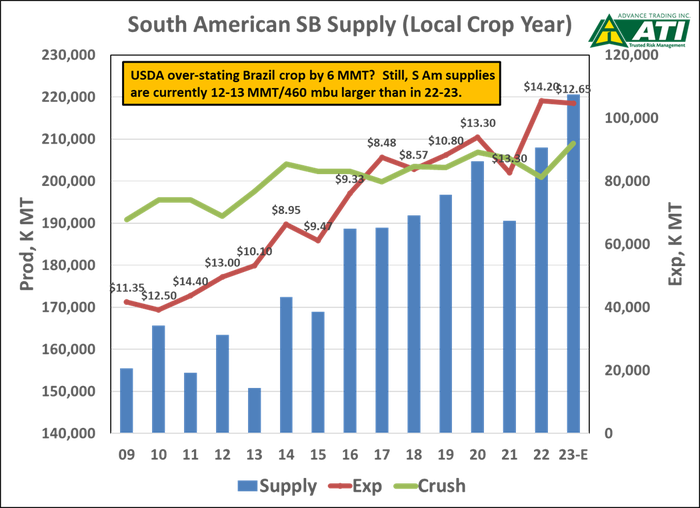

Keep in mind that the current USDA numbers for Argentina and Brazil work out to a 260.6 MMT supply, 22 million or 810 MBU more than a year ago. U.S. ending stocks were raised by 35 million this month to 315, or 30 million more than the trade average and exceeding the high end of the range by 5. There were no changes with respect to the products other than to reduce soybean oil prices by 3 cents to $0.51 per pound. Expected producer soybean prices were a nickel lower this month at $12.65.

The market’s focus will continue on the South American outlook and perhaps a little more on export demand.

Please note, there is no change in the USDA’s 102 MMT Chinese soybean import forecast from last month.

Wheat

World estimates were bearish, underscoring strong export competition through the remainder of the 2023/24 crop year. U.S. all-wheat ending stocks were 0.658 bbu compared to the average trade guess of 0.647 on the heels of a 10 mbu decrease in food use.

Notable changes to world estimates included a larger crop forecast for Argentina (+0.4 MMT) and increases in exports for Ukraine (+1.0 MMT), Argentina (+0.5 MMT), and Australia (+0.5 MMT).

Projected imports by China were also lowered by 0.5 MMT to 12.0.

World export competition remains fierce, with the U.S. being the residual supplier. With weather trends favorable at the moment for most northern hemisphere production regions, upside potential for all classes continues to be limited.

Market is recovering

As we enter the current week, it appears that the market has largely recovered from the impact of the recent reports. Our attention is now directed towards the weather conditions in Argentina, which are anticipated to influence the prices of corn and beans in the coming period.

A substantial rainfall in Argentina has brought relief after a three-week dry spell, proving beneficial for corn acres undergoing pollination and bean acres in the process of setting and filling pods. Once again, there arises the question of whether USDA is downplaying the actual status of Argentine crops.

Answers at this week’s Ag Outlook Forum?

Another crucial USDA event to monitor is the upcoming USDA Ag Outlook Forum scheduled for Feb. 15-16. This forum serves as a benchmark, providing forecasts for acreage in the 2024/25 season. Although not survey-based, it represents the USDA's most informed economic estimation as we approach the planting season. The Trade will closely observe the carryout numbers once the dust settles, with a prevailing inclination that these figures will experience an increase in the current year.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

ArgentinaAbout the Author(s)

You May Also Like