On Jan. 12, USDA released a series of reports revealing January production, stocks, and supply-demand.

For corn, December 1 corn stocks surpassed expectations, standing at 156 million bushels greater than the 12.01 billion bushels trade average. Notably, South America experienced changes, with Brazil exceeding the trade average by 0.5 million metric tons and Argentina estimating 200 thousand bushels higher than the trade average.

The U.S. corn yield saw a significant increase of 2.6 bushels per acre to 177.3, contributing 108 million to the production total. Despite a half-million reduction in harvested area, ending stocks rose by 31 million to 2.162 billion, surpassing the trade average by 68 million. Feed/residual use increased by 25 million, and FSI consumption (ethanol-driven) received a 50-mbu boost.

Chinese corn crop increased by close to 12 MMT, potentially impacting U.S. sales to China. Market analysts advise closely monitoring the South American corn crop and assessing the impact of lower corn prices on demand.

Soybean stocks increase

December 1 soybean stocks totaled 3.000 billion, surpassing the 2.976 bbu trade average by 24 million. Changes in South America revealed Brazil exceeding the trade average by 300 thousand, while Argentina's estimate rose 1.3 higher than the trade average. The U.S. ending stocks forecast increased by 35 million to 280 mbu, exceeding the trade average by 38. A notable 33 million bushel increase in crop size contributed to the higher ending stocks figure. First-quarter residual use of 146 million was 15 higher than trade estimates implied.

The Chinese balance sheet remained unchanged, and skepticism persists regarding the USDA's expected 10 MMT increase in foreign soybean meal use. Challenges in Chinese buying from the U.S. and sluggish demand from Southeast Asia are noted concerns. Despite the Brazil production cut, South American output remains 900 mbu greater than the previous year.

Wheat market stays flat

December 1 wheat stocks of 1.410 bbu slightly exceeded the average trade estimate of 1.391 bbu. U.S. all wheat ending stocks of 648 mbu were slightly below the average trade estimate of 659.

The first survey-based 2024 U.S. winter wheat seedings estimate was supportive, with acreage at 34.4 million, 1.3 million below the average trade estimate. Factors such as a late soybean harvest and a significantly based crop insurance price contributed to the decline. SRW seedings fell to 6.9 million, 100,000 below the average trade estimate, HRW seedings were 24.0 million, 1.2 million below the average estimate, and White seedings were 3.54 million, slightly below trade estimates.

Market attention is now focused on monitoring 2024 northern hemisphere weather trends, particularly improving moisture conditions in the U.S. Central and Southern Plains. The wheat market faces pressure from sharply lower corn prices, fueling selling interest.

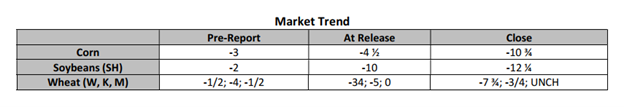

CBOT Grain Prices before, during and after the report release.

The future of grain markets

Market focus from mid-January into at least early March will shift to South American weather and

production prospects. There are indications that soybean output in Brazil may continue to decline, but

near ideal weather in Argentina may support an increase in crop estimates. Weather markets often

translate into increased uncertainty.

Seek an advisor who can help you turn uncertainty into opportunity by developing and implementing risk management strategies for 2023 and projected 2024 production.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like