The AgMarket.net team anticipated that the USDA would revise the U.S. corn crop higher in the November WASDE report, but we were surprised by how aggressive the upward revision was. The average U.S. yield was raised 1.9 bushels to 174.9 bushels, the fourth-highest national yield on record, but it is still below trend. Almost all the primary corn-growing state yields were increased from last month, except for Nebraska and Kansas, which were revised slightly lower. Record-high yields are estimated in seven states, including Indiana, Ohio, New York, South Carolina, Georgia, Tennessee and Alabama.

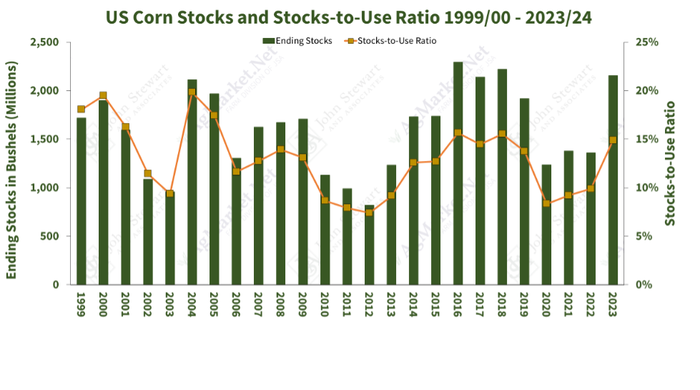

The USDA revised the demand side of the U.S. balance sheet to offset some of the production increase. Exports increased to 2.075 billion bushels, up from 2.025 last month, which was also a surprise. Most in the trade expected unchanged or smaller export demand due to disappointing sales outside of Mexico, which is frontloading sales this marketing year, leading to better sales optics. Ethanol demand increased to 5.325 billion bushels, up 25 million from last month, while the feed and residual use also bumped up 50 million bushels. The net effect of these adjustments is that the projected ending stocks will come in at 2.156 billion bushels – 45 million bushels above last month's estimates and will end up at the highest levels in five years if it comes to fruition. We would argue that the odds are high that the demand portion of the balance sheet is more than likely overstated, which could result in higher ending stocks in upcoming reports.

Producers storing unsold bushels should realize there is a downward price risk due to this large projected carryout. After many years of a bull market, this marketing year feels like we have transitioned into a bear market.

Marketing risks

The market currently pays you roughly $0.15 to store corn from December to March.

It's paying you $0.23 to store it in May and $0.32 to store the corn until July, which is undoubtedly attractive compared to selling the grain right out of the field at a time that is traditionally one of the worst times of the year to sell. If a producer does nothing to lock in this carry, they, unfortunately, could find themselves with a costly storage bill and corn prices not where they were hopping when they put the corn in the bin if there is no surprise uptick in demand or reduction in the world supplies.

The reason is that in bear markets, the spot futures price tends to fall to where their previous front-month contract went off the board. The September 2023 futures contract went off the board in September at $4.62 1/2, with a contract low of $4.55 ¾ scored on the same day. Without any significant surprises to either side of the supply or demand balance sheet, December's corn price will work down to the same price levels. As the December corn contract goes into delivery or sooner.

The pattern of the spot price falling to where the previous spot price went off the board could continue into the summer. This means you could end up with the same futures price in the July contract during its delivery period as where the September contract settled if you did not lock in that carry, but that's not the only risk.

In addition to the potential of seeing the carry disappear, there is the cost of storage grain due to the high-interest rate period we are currently in. The current interest cost of storing grain on the farm is estimated at 3 1/2 cents a month, So the interest on storing grain into next summer will easily cost you $0.24 in interest cost.

The only way to stop the interest cost of storing grain on the farm is not to store it. Producers should consider the storage cost in determining how long they plan to keep the grain on the farm. Historically, if you hold grain off the market, the basis will improve as the market tries to entice you to bring it to market. The question you must ask yourself this year is whether the basis improvement will be enough to offset the storage cost. If you don't believe the basis will improve enough to offset the storage cost, consider moving the grain and maintaining ownership on paper via futures or options strategies.

To mitigate the risk of giving up the carry, consider selling futures for the delivery you anticipate moving the grain to market. Use May futures to lock in the carry for a May delivery period. If you'd like to give yourself some flexibility, consider using put options as a way to lock in the carry but keep some upward potential available.

If you have questions or would like specific recommendations for your operations, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like