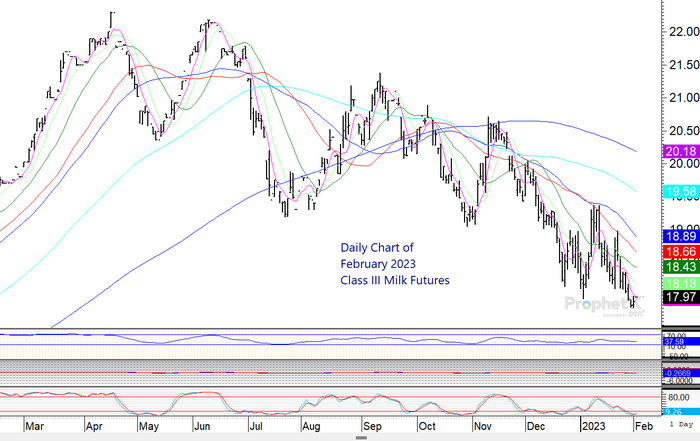

After weeks of steady selling pressure, Class III milk futures fell to multi-year lows after trading as high as the $22.00 price area in March of 2022. Now that the calendar year has flipped to 2023, will the down trend in milk prices continue? Or will there finally be a corrective price move higher?

The good news is, the market turned the corner on Wednesday in the first trading day of February. Not only did the nearby February 2023 Class III milk futures turn a notch higher, closing 6 ticks higher at $17.90, but each spot product was bid higher with butter up 2.50c, cheese up 1.375c, powder up 4.75c, and whey up 3.50c.

The demand tone was a noticeable change from recent sessions. Buyers may finally be supporting the market at these discounted levels.

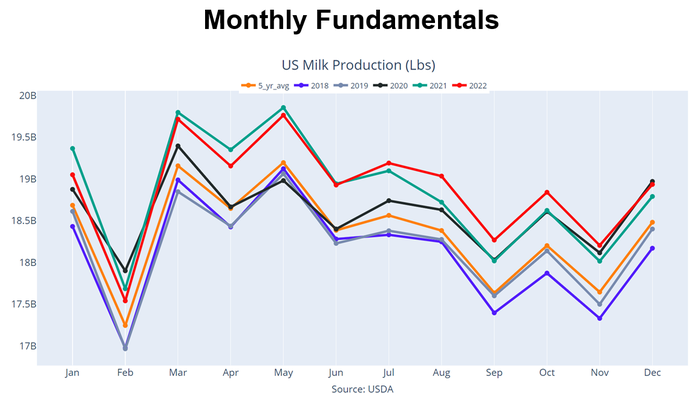

High U.S. production

Milk production has been plentiful for the latter part of 2022, which is what was pressuring prices lower. U.S. milk production in December totaled 18.90 billion pounds, up 0.80% from the same month last year. Production has now been up on a year over year basis for six months in a row.

Milk production per cow averaged 2,014 pounds, up 9 pounds from December of last year. Total milk cows on farms in the U.S. came in at 9.40 million head which is 27,000 more than the same month a year ago, but is down 8,000 head from last month.

Dairy demand

The reality of higher milk production is what is keeping milk prices on the defensive, while demand for dairy products has been firm.

The Western Regional Cheese Report stated demand is still steady from retail cheese purchasers. Food service cheese sales are strengthening, and mozzarella demand is still high, especially during the NFL playoffs.

Monthly Cheese in Cold Storage at the end of December 2022 totaled 1.445 billion pounds. This was up 1% from December 2021 and down 1% from the month prior. By comparison, the amount of cheese in storage in December 2021 was 1.441 billion pounds.

Export sales of cheese are strong, as are overall dairy products that are exported. United States dairy exports in November totaled 236,177 metric tons, which is another really strong month of exports. Large year-over-year increases from 2021 to 2022 were seen in butter (up 102%), cheese (up 13%), and whey (up 14%). Nonfat dry milk was the only product to see weaker exports from November ’21 to November ’22, as it fell 3%. Overall total dairy exports were strong, up 9% year-over-year.

Demand for dairy looks good, yet the abundant milk production is keeping any major rallies in check for now. However, recent bullish reversals on daily Class III milk charts may be signaling that a short-term low could be in place.

Reach Naomi Blohm: 800-334-9779 Twitter: @naomiblohmand [email protected]

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation

About the Author(s)

You May Also Like