USDA lays out tea leaves for the grain market this coming Thursday Oct. 12. What traders read into the World Agricultural Supply and Demand Estimates should focus on results of the next survey of U.S. corn and soybean production.

While prices are due for lows as harvest gathers steam, rally potential into the beginning of winter likely depends on whether crops are getting bigger or smaller, because the demand outlook so far doesn’t look like it’s going anywhere fast.

Evidence supports both higher or lower yields depending on the data used, so surprises could be bullish, bearish or neither. And, after a red-hot jobs report on Friday, noise from Wall Street and beyond could be almost as important as what USDA says about supply and demand. Financial fallout could not only impact grain prices in the short term, but also rock markets affecting farmers, from interest rates to fuel and fertilizer.

Some of the details of the upcoming WASDE report are already known, thanks to Sept. 1 grain stocks released at the end of last month. That update fixed supplies left over at the end of the 2022-2023 marketing year, cutting corn carryout by 6.3% while increasing soybean inventories 7.2%.

One month into the new marketing year, at least a little hard evidence is known about demand, if not enough to make conclusive trends. Demand forecasts could also be impacted by other markets, here in the U.S. and around the world, as volatile weather from the new El Nino add yet another variable to the mix.

So, here’s a look at what we know, and don’t know.

Interest rates jump

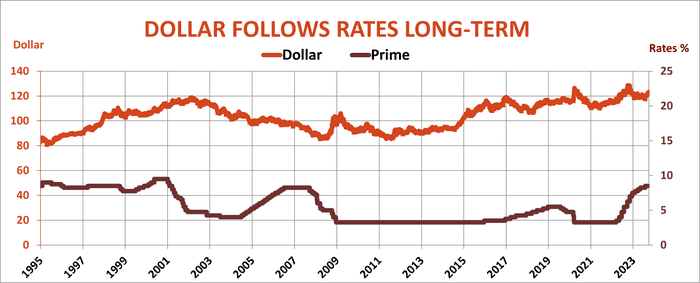

The biggest news from the first week of October – other than at least the lights being on at USDA at all – came from the Labor Department, which said the economy created twice as many jobs as expected in September. That roiled markets, because good news is rarely good news for those who trade paper for a living. While the surge in hiring doesn’t mean the Federal Reserve will start raising interest rates again at its next meeting in November, it supported the “higher for longer” narrative worrying investors. How long? Yields on the 30-year Treasury Bond hit 5% intraday for the first time since 2007, sparking concerns tight credit could indeed last through 2024, and perhaps longer.

U.S. stock indexes recovered quickly, once again fighting bears’ attempt to break below the key 200-day moving average. Still, the fallout continued to punish bond markets around the world that were already punching bags, because prices of those securities move the opposite way of yields. In addition to raising borrowing costs for governments, businesses and consumers, higher yields added further turmoil to currency markets. Investors tend to buy currencies of countries where they can earn a higher rate. Treasuries offered not only a safe return, but one that produced “real” net income because yields were above inflation expectations for the first time in years.

A stronger dollar doesn’t impact U.S. grain exports directly, and corn and soybean sales through the first four weeks of the 2023 crop season were mixed. Corn commitments beat last year by 20%, but soybeans were a third lower because costs out of Brazil in dollars were cheaper than the Gulf. U.S. shipments should become more competitive soon as South American supplies run out; how long they stay that way depends on whether Argentina recovers from historic drought and potential impacts from a dry start to planting in Brazil.

Export, biofuel impact

While not influencing commodity exports, a stronger dollar does tend to weaken prices of commodities denominated in the greenback. Exhibit A in that regard came from crude oil. After hitting $95 a barrel at the end of September as Saudi Arabi and Russia signaled they would maintain production cuts, the surging dollar and fears of a global economic downturn slashed crude below $82 briefly by the end of last week.

The downturn was good news for growers needing to refuel for harvest, because wholesale Midwest ULSD prices plunged to the lowest since July – at a time when ag use often swells costs.

Wholesale propane markets also headed south, bucking seasonal trends for higher prices ahead of winter.

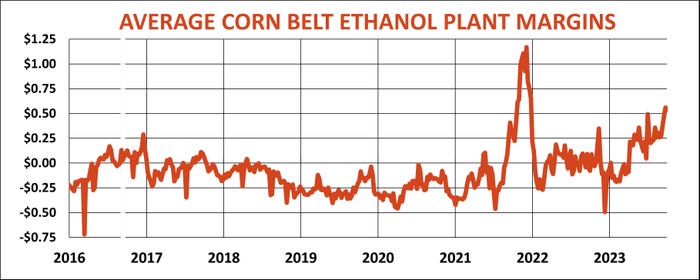

Lower energy markets aren’t all good news for farmers, of course, because some their corn and soybeans wind up converted to biofuels. That could act as a damper on demand, just as it appeared ethanol plants and soybean processors were ready to extend their buying habits.

Weekly ethanol production in September jumped 41% year on year, buoyed by processing margins that rose to the best levels since December 2021. While forecasts by the Energy Department still call for lower ethanol output and blending in 2023-2024, higher gasoline prices made the biofuel much more competitive, increasing potential for blending – at least until gasoline futures tumbled more than 25%, clouding the outlook even more.

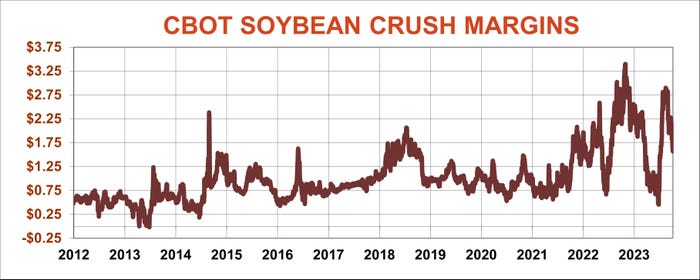

Soybeans also benefited from their biodiesel connection, especially as El Nino concerns threatened palm oil production in Malaysia and Indonesia. Nonetheless, U.S. crush margins also suffered, falling 45% from August highs.

Ammonia jumps higher

Uncertainty over exports and biofuels means the other big category of corn usage could be key. Demand from livestock feeders appeared to be stronger than expected over the summer as the old crop marketing year ended. USDA projects lower red meat and poultry production but higher output of eggs and milk this year as the industry continues to heal from pandemic supply chain shocks.

In the end, demand follows supply, all things considered, so yield cutbacks could sway overall usage until more is known about how consumers – from shoppers at the grocery store to importers buying boatloads – tighten their belts.

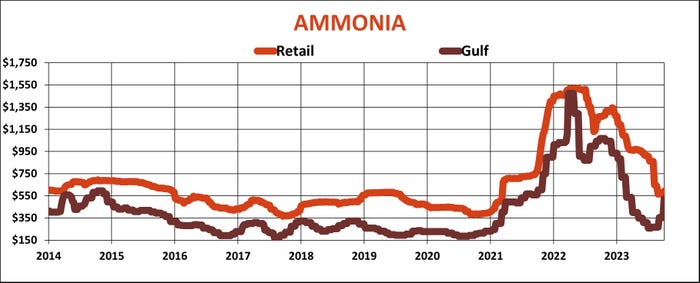

The market isn’t focused on next year’s crops yet, but farmers booking fertilizer certainly are. News about nutrients focused on the usual suspects: India’s next big tender for urea, whether China’s government will continue to restrict exports, the future of production in Europe given uncertain natural gas feedstocks, to name a few.

The biggest development in the U.S. came with settlement of October swaps at the Gulf for ammonia. Tight supplies and good demand pulled costs up $168 a short ton to $521.50, the highest since the market collapse last winter. Low water levels on the Mississippi River are making shipping anything more expensive, and time is running out too, with load outs from the Gulf to the Twin Cities shutting down for the season. Prices were already moving higher at dealer locations, and expenses for phosphates also gained after weaker imports, with only potash showing a lackluster mood.

The onset of colder temperatures should also spur demand for fall applications, affecting spot availability locally. January is often a good time to book spring supplies, but swaps for most markets are fairly steady through the winter, so some forward pricing may also be an option.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like