When you take a micro look at the current corn balance sheet, it is hard not to be bullish after the September USDA revisions.

USDA said total corn production was lowered to an estimated 13.944 billion bushels. That is due to harvested acres being lowered by 1 million acres down to 80.8 million acres and the national corn yield being cut by 2.9 bushels from the agency’s August estimate (175.4 to 172.5 bushels per acre).

History tells us that 70% of the time, if you have a yield cut in August and in September, you have further cuts to the final yield. So, the odds are high that production will continue to fall. Total U.S. corn use was cut by 250 million bushels by lowering feed and residual by 100 million, exports by 100 million, and ethanol by 50 million.

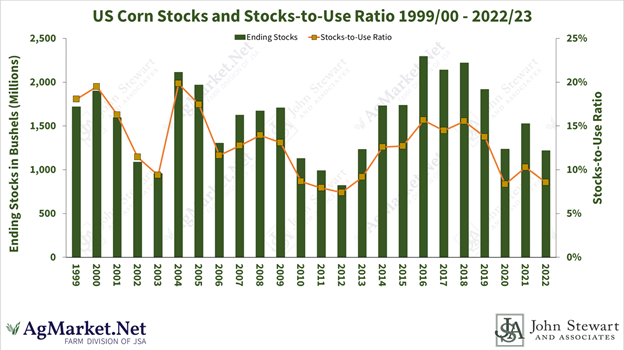

USDA has decreased demand for the 22/23 year by 290 million bushels since the first balance sheet was released in May, and has lowered demand year by year by 575 million bushels. With U.S. stock-to-use projected to come in at 8.5%, further demand revisions will be hard to come by without higher prices.

World corn ending stocks continue to fall, dropping to 304.53 MMT versus 306.68 MMT last month and 312.14 MMT last year. The drop in ending stocks came despite upward production revisions for China, Ukraine, and Canada. USDA is also assuming a record production bounce back for Brazil this upcoming production cycle, even though the third year of La Nina is forecasted to impact the South American continent into 2023. Argentina continues to struggle with drought as it attempts to plant this year's crop. The EU crop was lowered by 2 MT to 58 MMT, but the odds are high that further production cuts will be seen as harvest continues across the region.

World stock use, like U.S. domestic stocks, are at near record low levels. Any hint that production continues to be overstated or demand understated, the odds are high the market will have to move higher to ration demand.

Macro headwinds

Unfortunately, the macroeconomic picture provides headwinds which could cut the legs off of a potential bull market. The Fed is a major force working against the commodity markets. The Fed is trying to stuff the inflation genie back into the bottle. To do this, they have started to raise the Fed fund rates. It will keep raising rates until demand for goods is curtailed. This, in turn, drives down the price of commodities due to a lack of demand.

Earlier in the year funds liquidated long corn positions as the Fed started to raise rates. With the funds long back over 200,000 contracts, there is a real risk that they could liquate these longs like earlier this year as the fed continues to raise rates.

The U.S. Fed isn't the only central bank raising rates, as almost every central bank has started to raise rates to try to reverse the tide of inflation that has washed across the globe. The increased rates have a real threat of putting one or more countries into a recession, negatively impacting demand.

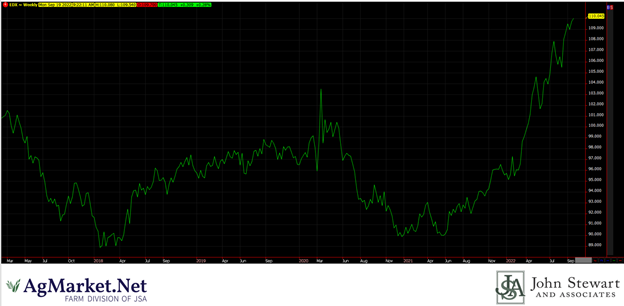

The increase in the Fed fund rates has helped drive the U.S. dollar to 20-year highs. Year-to-date, the dollar is up 22%. The increase in the dollar makes our commodities more expensive to importers. Without corn prices changing, the simple change in currency exchange makes U.S. grain 22% more costly for European countries, 27% more expensive for Japan, and 14% more costly for China. All the while, corn prices have gone up 40%, from $4.84 to $6.75.

With the Micro and Macro pictures giving mixed signals, producers must acknowledge that market volatility will likely increase. We encourage producers to implement ways to manage the increased pricing risk. Consider placing puts under unsold bushels (this includes next year’s crop as well) to hedge off the recession risk. While looking at re-ownership plays of sold bushels the market could see an explosive move higher if US production and or the South American production falters.

If you have questions, don't hesitate to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like