All eight meetings on monetary policy each year at the Federal Reserve are a big deal to the markets. But last week’s session was a really, really big deal. Prices of everything from stocks to soybeans and corn to crude oil jumped sharply higher in the wake of the central bank’s decision to leave its benchmark short-term interest rate unchanged after raising it 5% since March 2021.

Parsing the logic behind any day’s price swings isn’t easy, and action ahead of the Juneteenth holiday was fuzzy, to say the least. While the central bank hit the “pause” button, both markets and most Fed officials appear convinced more increases are coming.

Higher borrowing costs aren’t usually good for businesses, farmers included. Besides raising interest payments on loans, higher rates also increase the cost of storing grain after harvest instead of paying down debt. Nonetheless, nearby corn and soybean futures jumped to eight-week highs and the S&P 500 Index rallied to its best level since April 2022 after officially entering bull market territory earlier in the month.

Higher for longer

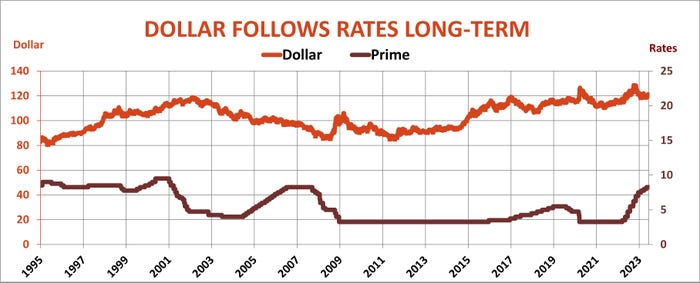

Currency gyrations also defied their usual rational. The dollar normally gains strength when rates rise, luring investors to Treasuries looking for a safe return on their investments. But the greenback fell to its lowest level in a month, even though traders expect the Fed to begin raising rates again at its next meeting toward the end of July.

The day after the Fed’s decision, the European Central Bank plowed ahead with its tightening cycle, which began later than in the U.S., with officials there saying more increases would follow. Inflation remains elevated on the continent, and it’s still a problem in the U.S. too.

Though the Consumer Price Index, released the day the Fed meeting started June 14, dropped from 5% to 4.1%, the decline was largely due to a sharp decrease in gasoline prices. The so-called “core” CPI excluding more volatile food and energy components fell only .2% to 5.3%, suggesting lingering price gains.

Indeed, projections by individual Fed officials participating in the policy meeting – the so-called “dots” – showed core inflation falling to 3.9% at the end of 2023 and 2.6% at the end of 2024, remaining at 2.2% in 2025, higher than its long-term target of 2% for overall price increases.

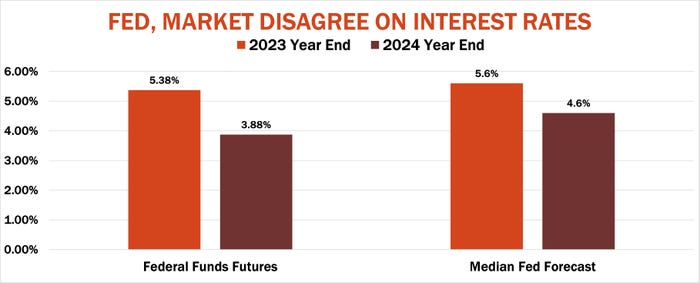

So, it appears interest rates must be higher for longer to tamp down inflation. Just how long, however, is a matter of opinion. The median projection by Fed participants put the “terminal” rate at 5.6%, suggesting another half of 1% tightening, with rates dropping 1% in 2024 and another 1.2% in 2025. Betting on Federal Funds futures is much more dovish. But even if the market is right, farmers can expect operating loan rates to stay around 8% or higher into next year.

Drought worries

Trying to correlate the dollar with anything from day to day is difficult. Some days the greenback rallies on safe haven buying despite weaker interest rates. Other days it falls because traders are in a “risk on” mode and ready to party – making bets on stocks, commodities, and just about anything else. Cheaper funding for these positions encourages more to go on the books because borrowed money fuels much of that trade.

So, it wasn’t surprising to see the dollar regain some of its footing by Friday, encouraged by rising interest rates.

Since the beginning of May, corn, soybeans and wheat have had the strongest relationship with the dollar of any commodities except gold. In this case, the correlation is negative – a weaker dollar brings higher gains.

But the grain market kept on rallying Friday because the dollar is only one factor affecting prices.

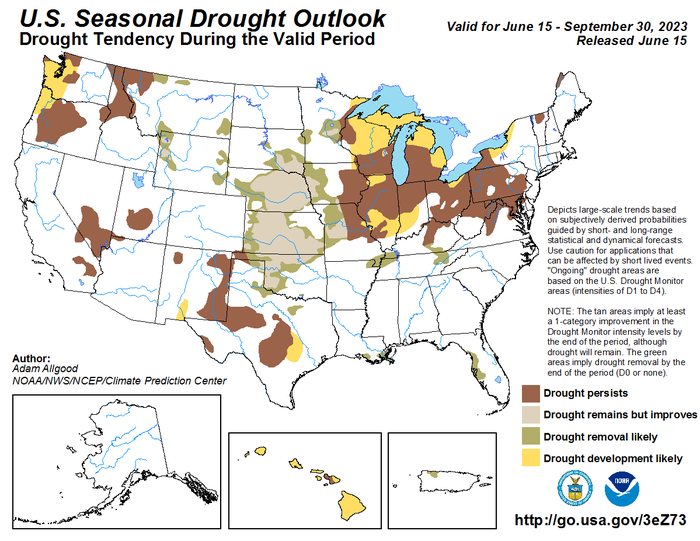

The big motivation for last week’s gains came, as it usually does this time of year, from weather. The Drought Monitor released by U.S. forecasters grabbed headlines by showing 89% of the Midwest was abnormally dry, the worst since 2012.

Despite better rains last week, most of the growing region outside the far eastern and western parts of the growing region saw below average precipitation in the first half of June. But forecasts for July and the July-September period don’t look excessively hot, with most areas receiving normal to above normal precipitation too. The latest Drought Outlook also calls for western areas to continue to improve with only a few spots in the east getting worse. And it contained a bit of a footnote for those few who cared to dig deeper in the report. While some of the regional forecasts were given moderate to high confidence ratings, certainty in the outlook for the Midwest was low.

Potash plunge

In the meantime, growers should continue to beat the drums on input buying they’ll need this fall. More good news on the fertilizer front came from potash. China negotiated a surprise deal with Canadian exporters at a price that was too good to refuse – around $278 a short ton. India, another huge importer, paid more than $380 in April for its latest deal.

The decline should continue to pressure potash costs, which dropped internationally to the lowest level since May 2021, when U.S. growers were paying around $420 a ton. Dealers are starting to adjust prices, but most growers still must pay $600 or more for immediate delivery.

The news wasn’t perhaps as friendly in the nitrogen complex, after a jump in European prices for natural gas. Still, some growers in Iowa paid as little as $580 for ammonia recently in Iowa, reflecting lower settlement for June contracts at the Gulf.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like