December 1, 2023

At a Glance

- A one-year extension of the 2018 Farm Bill offers some stability for farmer decision-making for 2024.

- The extension does not remove further debates coming about commodity, conservation, nutrition and other issues.

- Farmer decisions between ARC and PLC may not be as cut and dried as in previous years.

In November, Congress included a one-year extension of the 2018 Farm Bill as part of a broader funding bill to keep the government open through early 2024.

The extension resolved concerns about an expired farm bill that would go over the “dairy cliff” on Jan. 1. It also included a shift of funds from available sources to reestablish some small programs in the farm bill that technically expired in September with no continuing funding authority, meaning the full farm bill now remains intact until Sept. 30, 2024.

Passing an extension took the immediate pressure off Congress to resolve the ongoing debate over new farm bill legislation. The same debates over commodity programs, conservation programs, nutrition assistance and other issues remain, however, and could make prospects even more difficult for finishing a farm bill in 2024 in a year that will quickly shift attention to the upcoming general election.

Farmer decisions to be made

One thing that will not get pushed off very long is the commodity program decision that producers have faced every year between Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC). The farm bill extension keeps existing programs intact under current provisions, and that means a new decision in 2024. The normal deadline for making an ARC v. PLC enrollment decision is March 15.

Whether that deadline changes because of the lateness of the farm bill extension, producers will need to prepare for the enrollment decision at the same time they are making final crop insurance decisions around the same March 15 deadline.

The rules and provisions for the ARC v. PLC decision in 2024 will be the same as in previous years, but two important factors could affect producer decisions in 2024 and make the decision more significant.

First, the 2018 Farm Bill included an effective reference price provision based on the higher of the legislated reference price, or 85% of the five-year Olympic average price (with an upper limit of 115% of the legislated reference price).

After several years of higher prices, the effective reference price will actually go up in 2024 for several commodities — including corn, sorghum and soybeans. Higher effective reference prices for some commodities mean the comparable protection levels between ARC and PLC may look very similar.

Second, current price and, thus, revenue expectations for 2024 are lower relative to the 2022 and 2023 crop years. They are still mostly above ARC and PLC protection levels, suggesting no program payments in any cash flow projections (2024 program payments would be paid in October 2025).

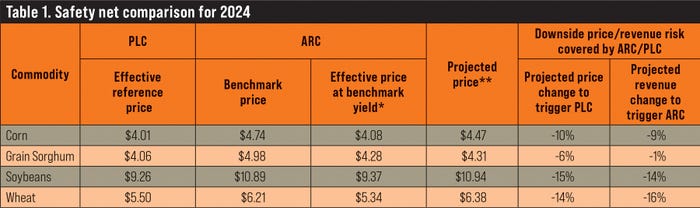

However, they are closer than in the past few years and offer a greater degree of downside risk protection. A table of program protection levels and downside risk protection offers insight for the 2024 ARC v. PLC decision.

Making comparisons

If you compare the effective reference price for PLC to the effective price protection in ARC assuming benchmark yields, the comparable protection between the two programs is much closer than in past years.

For corn in 2024, PLC would trigger if the national marketing year average price fell below $4.01 per bushel, while ARC would trigger below $4.08 per bushel (assuming benchmark yields).

Comparing ARC and PLC protection levels to projected prices released in September from the Food and Agricultural Policy Research Institute at the University of Missouri provides an assessment of potential risk and risk protection offered by the programs.

For corn, PLC would protect price losses of more than 10%, while ARC would protect revenue losses of more than 9% from current price projections and benchmark yield levels. ARC and PLC protection levels are similarly close for soybeans and wheat as well, while ARC appears to offer more immediate downside risk protection for sorghum than PLC does.

The analysis suggests the decision is much more balanced (and difficult) in 2024 than it was originally in 2014, when relatively strong ARC protection levels led to overwhelming ARC sign-up for corn and soybeans, or in 2019-20 when lower prices over time meant ARC protection was lower than PLC for most commodities and sign-up shifted toward PLC.

The sign-up in 2024 could be much more dependent not only on expected support, but also on producer preferences and related risk management decisions.

As suggested, the sign-up decision is about more than just expected protection levels. ARC and PLC protect different risks. ARC protects revenue losses, or the combination of price and yield below trigger levels based on 86% of benchmark levels. But it only protects the first 10% of revenue losses below trigger levels, or a band from 86% down to 76% before it is capped.

The presumption has been that producers are also using underlying crop insurance tools, so the ARC program covers shallow losses before crop insurance might kick in, although ARC and farm-level crop insurance do not trigger on exactly the same price and yield levels.

By comparison, PLC protects price risk below the effective reference price all the way down to marketing loan rates before loan program benefits would kick in, so PLC effectively covers full downside price risk. However, PLC makes payments based on the farm’s historic program yields, which might be around 80% of current yield expectations at best, so the downside protection is limited in PLC as well.

Complicated matter

To complicate the decision, a producers’ crop insurance choices and marketing decisions could affect their risk exposure and their preferences for price or revenue risk protection and, ultimately, PLC or ARC.

Furthermore, producers that are interested in the Supplemental Coverage Option (SCO) insurance policy that adds on top of their underlying crop insurance policy can only purchase SCO if they are not enrolled in ARC. SCO provides protection from 86% down to the producer’s underlying crop insurance coverage level, so the policy mimics ARC, at least in the 86% to 75% band of protection.

Putting farm programs and crop insurance together, the decision may not just be ARC v. PLC, but rather might be ARC v. PLC plus SCO, thus the details of SCO may be critical. Of course, SCO comes with a purchase cost, unlike ARC, but SCO is subsidized like other crop insurance policies, so premium costs relative to expected indemnity levels for SCO also matter in the comparison.

While a new farm bill may be delayed for another year, the existing ARC and PLC programs will offer a new and potentially challenging decision for producers in 2024. Comparing expectations for ARC and PLC and relative protection levels can help inform the decision, although producers need to consider their risks and their related crop insurance and marketing decisions, as well to assess which safety net really works best for their operation.

Lubben is the Extension policy specialist at the University of Nebraska-Lincoln.

Read more about:

Farm BillAbout the Author(s)

You May Also Like