Given the uncertainty on weather associated with the spring planting season, the potential for increased price volatility is high following the March 28 USDA Grain Stocks and Prospective Plantings reports. The potential for significant (and unpredictable) price swings historically with those released – and more surprises were seen this year with numbers that were bullish for corn and generally neutral for soybeans.

The Grain Stocks report is only released four times during the year: January, March, June and September. Not only does the March report provide a point of reference to the trade estimates, but it also enables a comparison of usage trends within a crop year.

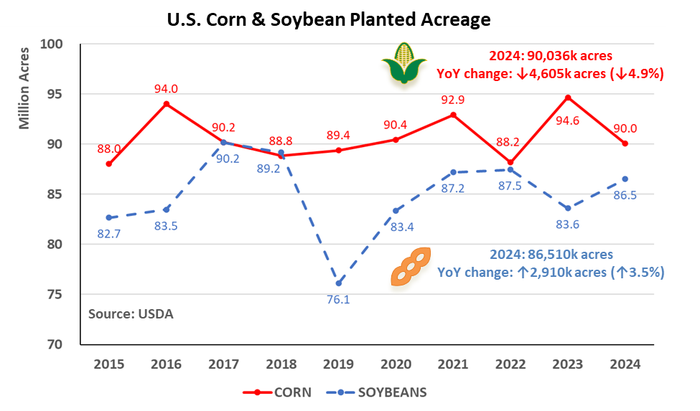

The USDA at the Agricultural Outlook Forum pegged 2024 corn plantings at 91 million acres, or 3.8% below the 2023 total of 94.6 million. For soybeans, the USDA estimated 2024 plantings at 87.5 million acres, which is up 4.7% from a year ago.

Corn: Ending stocks flat

Starting with corn, the USDA pegged March 1 stocks at 8.347 billion bushels, which was almost 100 million bushels below the average trade estimate of 8.445. Early ideas are that higher-than-expected feed/residual use during the winter months was linked in part to disappointing soybean meal use.

Looking ahead, the USDA may elect to increase its estimate of 2023/24 feed/residual use by 100-125 million bushels in the April 11 supply and demand report. All else being equal, that could reduce the ending stocks estimate by a like amount to 2.050 or 2.075 bbu.

The Prospective Plantings report pegged 2024 acreage at 90 million, which was almost 1.8 million below the average trade estimate of 91.8 and right at the bottom end of the trade range of 90.0 to 93.8. It’s important to note, however, that utilizing the trend yield from the USDA Outlook Forum of 181 bushels per acre, production would be 14.881 bbu. After incorporating the aforementioned reduction in beginning stocks and utilizing usage estimates from the Outlook Forum, ending stocks for 2024/25 would still be near 2.275 bbu.

Soybeans: Look for high ending stocks

Turning to beans, the Grain Stocks report pegged March 1 inventories at 1.845 bbu—just 10 mbu above the average trade estimate of 1.835. Last week’s report confirmed that the current forecasted crop size for 2023 of 4.165 bbu is accurate. However, there are still two more stocks reports upcoming at the end of June and September that will shed more light on the final production estimate.

Turning to the Prospective Plantings report, the USDA estimated 2024 bean acreage at 86.5 million acres. While that was 2.9 million acres higher than last year, it was right in line with the average trade estimate. Utilizing the USDA trend yield from the Ag Outlook Forum of 52.0 bpa, production for 2024 would be 4.452 bbu. Incorporating the current USDA ending stocks projection for 2023/24 of 0.315 bbu and adding in a small number of imports, total supply for 2024/25 would be 4.782 bbu.

Usage for 2024/25 from the Ag Outlook Forum was 4.400 bbu. Under these assumptions, ending stocks for 2024/25 would rise to 0.382 bbu, which would be an increase of more than 21% from the current year.

Corn running with the bulls

A bullish reaction to the reports was seen for corn, while beans were nearly unchanged.

Given the uncertainty on weather associated with the spring planting season, the potential for increased price volatility is high. It remains critical to maintain close contact with your advisor and execute risk management strategies to defend your balance sheet.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like