January 8, 2024

This time of year, markets are increasingly looking towards 2024 production outlooks for price direction. USDA will not publish its forecasts for 2024 supply and usage estimates until May 2024, so we are in a bit of a holding period until that data hits the market. Plus, at press time in early January, USDA had not yet published its 2024 U.S. winter wheat acreage forecasts.

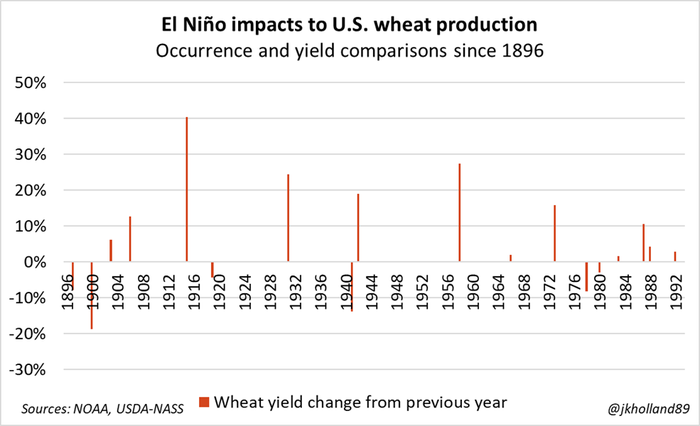

But as an El Niño winter settles in across the Northern Hemisphere, we don’t have to look far for clues as to how 2024 global wheat production will shake out. While some countries, like Australia and the block of Southeast Asia, may face production troubles, there is fresh opportunity for most major wheat producers in the Northern Hemisphere.

For Europe, which is the world’s second-largest wheat exporter, El Niño winters typically result in colder and drier winters in the north, and wet and warmer winters in the South. France’s planted wheat area has already taken a hit on the changing weather pattern. Last fall, excess rains prevented planting activities, shaving expected French wheat area down 11% from last year to 10.4 million acres.

El Niño favors higher than average precipitation in several key wheat growing regions in Russia. Central and Southern Russia has received above normal winter precipitation already this winter, which bodes favorably for wheat yields at harvest this summer. While January brought below average temperatures to key Russian growing regions, the plentiful snowpack will likely insulate dormant wheat crops and keep them in good condition until spring emerges.

Ukraine will remain a bit of a wild card in the New Year with both its El Niño forecasts, which will further exacerbate volatile price activity as its export volumes also remain up in the air. December 2023 Ukrainian wheat export volumes rose by nearly two-thirds from the previous month, but sluggish holiday shipping volumes and international demand left Ukrainian wheat exports falling flat early in 2024.

The wild card

Another country worth keeping an eye on as the El Niño winter progresses? India.

The world’s second largest wheat consumer and third largest wheat producer helped to provide meaningful export supplies to global buyers after Russia’s unprovoked invasion of Ukraine two years ago. Export volumes slowed last year as the government sought to rein in inflation, despite a record harvest during a turbulent growing season.

India’s Ministry of Agriculture and Farmers Welfare (MAFW) reported planted acres are expected to increase this year to 79 million acres. Yield forecasts were holding steady during early January, but El Niño dried up India’s monsoon season last fall and could threaten yields if heat torches the crop in the coming months.

Even with the large wheat crop harvested last year, India’s wheat imports still rose to their highest level since the 2017/18 marketing year. More drought devastation to India’s wheat in the coming months could turn this exporting lifeline into a larger buyer on the global wheat market.

U.S. crop conditions

Early in the 2024 calendar year, top hard red winter wheat-growing regions in the Southern Plains enjoyed higher rainfall volumes than at the same point over the past two years. Ratings improved for winter wheat crops in top producer Kansas, as well as Texas, Oklahoma, and South Dakota.

But dry soil continues to plague the entire Heartland. Through early February, 32% of U.S. winter wheat acres were rated in drought condition. And perhaps more notably, 25% of spring wheat acres were located within a drought area at that time.

An El Niño winter favors moisture in the Southern Plains, which we have already seen materialize in recent months. But more moisture will be needed further north to give spring wheat acres a fighting chance against competitive soybean earnings this year.

Read more about:

WeatherYou May Also Like