November 6, 2023

As a young man, I had the opportunity to travel throughout China, which was just beginning to open back up in 1985. I saw people who yearned for a better life. The industriousness of their society made it happen.

In the span of a generation, many Chinese people lifted themselves out of poverty. In 2000, China’s middle class amounted to just 3% of its population. By 2018, this number had climbed to over half of the population, constituting nearly 707 million people.

In today’s globalized world, the economic health of one nation can have ripple effects across continents. China, as the world’s second-largest economy, plays a pivotal role in this global network. Its immense population, vast manufacturing base and growing middle class have made it a key trade partner for many countries, including the U.S. For Illinois farmers, this relationship is particularly significant. The state’s rich farmlands produce a bounty of crops, many of which find their way to Chinese markets.

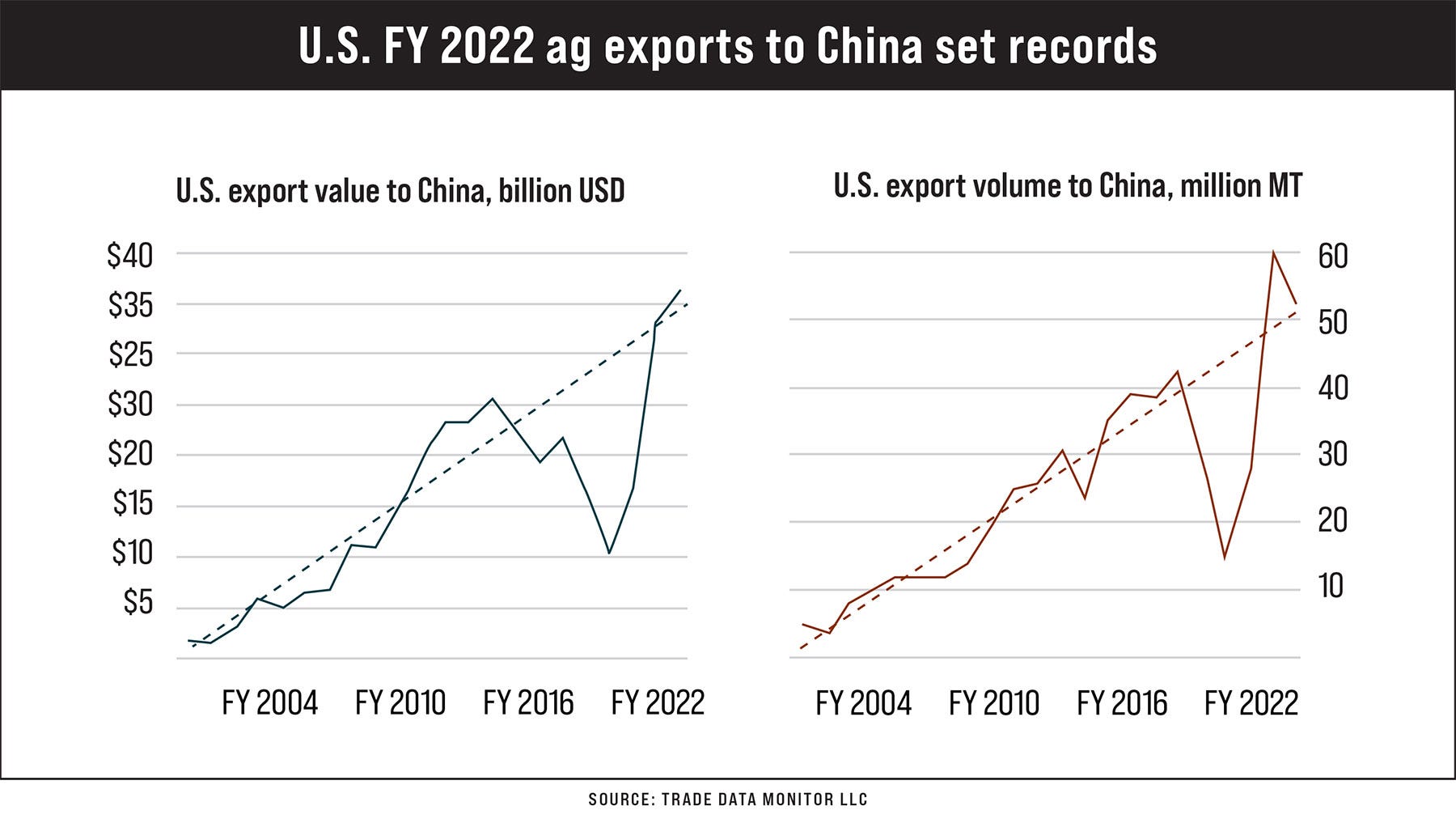

According to USDA, in 2022, U.S. agricultural exports to China reached $36.4 billion, marking a record high for the second year in a row, with China being the top export market. This growth, driven by higher agricultural prices and consistent demand, was achieved despite most products seeing reduced volumes.

Following a sharp decline in U.S. exports to China and the conclusion of the Phase 1 Agreement, U.S. exports have resumed their growth trend since China’s entry into the World Trade Organization. Over the past two years, the U.S. has seen record export values to China in products like soybeans, corn, beef, chicken meat, tree nuts, sorghum and cotton — all of which play a significant role in the U.S. agricultural economy.

Note: Volume is for all bulk grains, oilseeds and cotton. These products typically account for greater than two-thirds of U.S. export value to China.

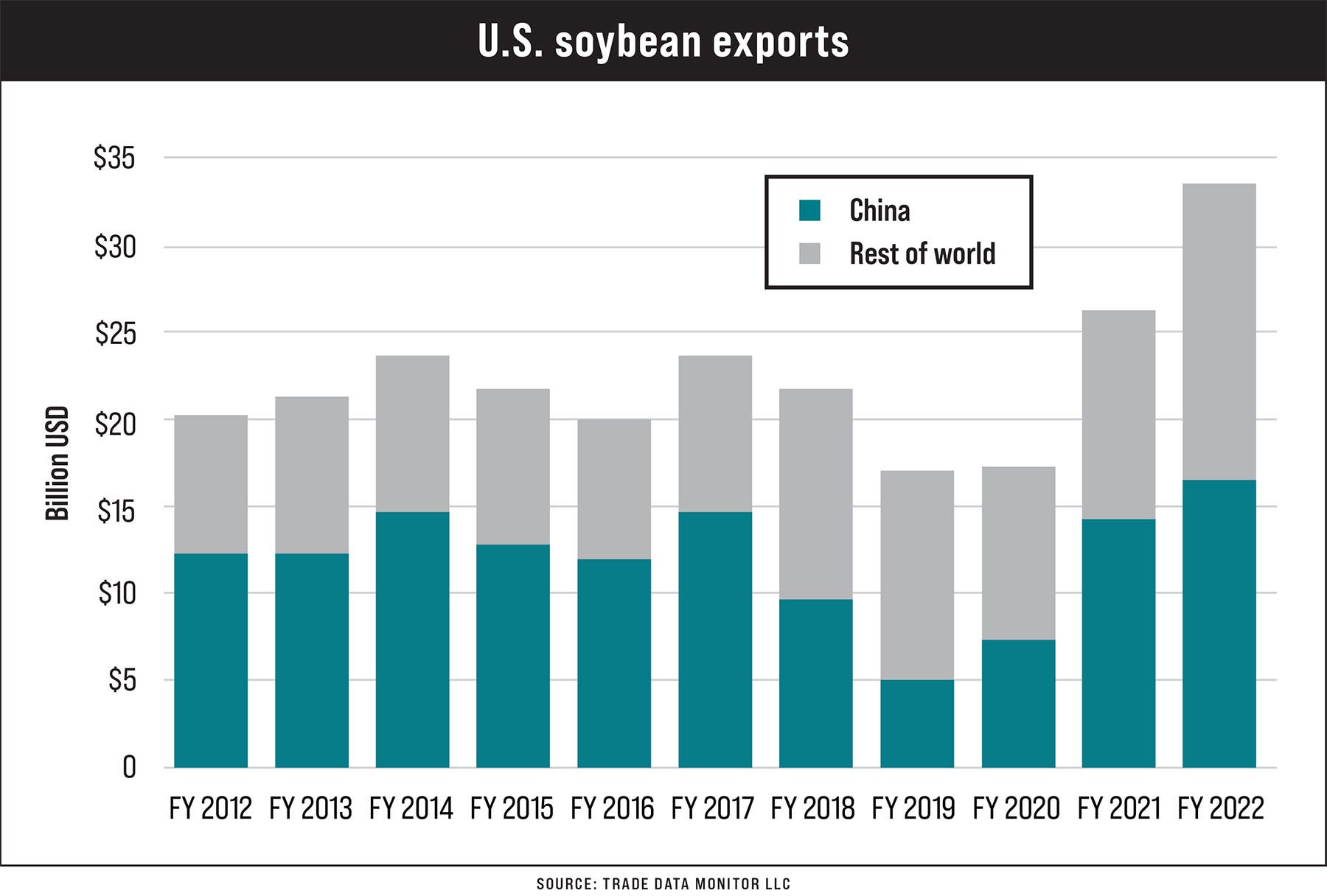

More relevant for Illinois, in 2022, soybeans made up almost 50% of U.S. agricultural exports to China, reaching an unprecedented $16.4 billion and exceeding the prior year’s record by over $2.2 billion. China stands as the biggest global importer of soybeans, representing close to 60% of worldwide trade and 50% of the value of U.S. soybean exports.

Recently, I’ve been seeing articles predicting China’s economic downfall. Trade wars, a draconian zero-tolerance COVID-19 policy, a real estate housing collapse and more all threaten to upend this economic powerhouse. A storm looks to be brewing on the horizon.

What could happen to farmland in Illinois if such a dominant economic player like China faces a downturn?

A look into the past

In the last century, U.S. farmland has had two periods of major correction. The first was after World War I, and the second was during the early ’80s. What led to these corrections?

Following World War I, a combination of economic, social and agricultural factors led to the deflation of farmland values. During the war, there was a surge in demand for agricultural products from Europe, which had devastated much of its own agricultural infrastructure. This increased demand led to higher prices for crops and, consequently, a boom in farmland values in the U.S. Farmers took on significant debts, often mortgaging their lands to expand production and capitalize on these high prices.

However, after the war, as European agriculture began to recover and the demand for U.S. ag exports decreased, crop prices plummeted. At the same time, advancements in farming technology and practices led to overproduction, further driving down prices. The combination of falling crop prices, high levels of farm debt and overproduction resulted in a sharp decline in the value of farmland. Many farmers found themselves unable to repay their loans, leading to widespread foreclosures and further depressing land values.

The Russian Grain Embargo of the 1980s was another significant event that contributed to a drop in farmland values in the U.S. Prior to the embargo, the Soviet Union was a major importer of U.S. grain, especially wheat and corn. The U.S.-Soviet grain trade had bolstered U.S. agricultural exports, leading to increased profitability for farmers and subsequently higher farmland values. However, in response to the Soviet Union’s invasion of Afghanistan in 1979, President Jimmy Carter imposed an embargo on grain exports to the USSR in 1980. This sudden halt in trade led to an oversupply of grain in the U.S. market, causing grain prices to plummet.

As a result, U.S. farmers faced declining revenues, making it challenging to service their debts, many of which had been taken on during the preceding years of prosperity. The combination of falling grain prices, reduced export opportunities and high levels of farm debt led to a significant drop in farmland values. The financial strain on the agricultural sector was exacerbated by high interest rates and a tightening of credit, leading to widespread farm bankruptcies and further depressing land values.

What about now?

In both cases, there was a significant run-up in demand for grain by a localized economy — the first being a war-torn Europe, and the second, the Soviet Union. Also in both cases, there was a corresponding increase in the level of debt taken on by farmers to expand their production.

While there has been a significant increase in demand from a localized economy, namely China, there are enough farmers and lenders around who remember the last farm crisis and are more cautious using debt to leverage expansion. Generally speaking, farmers today are not in the precarious position of high leverage and are better able to weather economic storms looming on the horizon.

The most recent news from China is a strong quarter of growth, which will hopefully continue. I’m rooting for the Chinese people to weather through their economic struggle, because in this interconnected world we live in, what’s good for the Chinese people is good for American farmers.

About the Author(s)

You May Also Like